In a dynamic financial landscape, the municipal bond market has demonstrated resilience despite fluctuations in U.S. Treasury yields and the introduction of new tariffs. While municipal yields saw slight adjustments, the overall market remained stable. Analysts noted that issuance levels are manageable, even with last-minute additions to the calendar. The market's performance reflects broader economic trends, including inflationary pressures and potential state budget challenges. Despite these uncertainties, demand for municipal bonds is expected to remain strong, driven by attractive yields and supportive inflows into various investment vehicles.

Market Dynamics and Key Developments

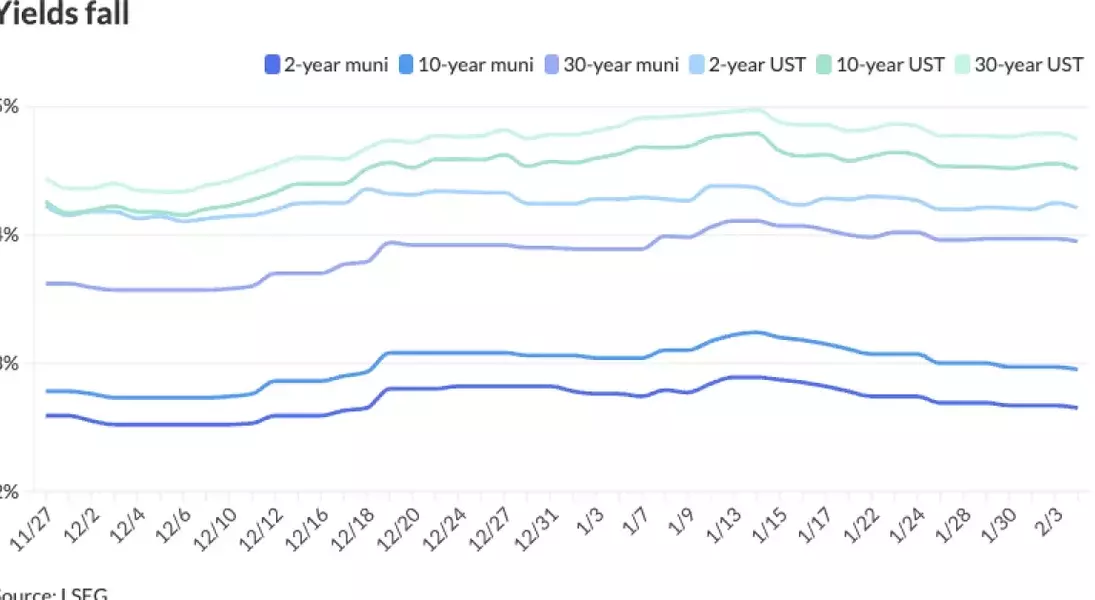

Amidst the changing tides of economic policy, the municipal bond market has shown remarkable stability. In the heart of autumn, as leaves painted the ground in hues of gold and crimson, U.S. Treasury yields experienced a modest decline, while equity markets showed signs of recovery. Municipal yields adjusted slightly, with variations across different maturity curves. According to data from Municipal Market Data, the two-year municipal yield ratio stood at 63%, while the 30-year ratio was at 83%. Similar figures were reported by ICE Data Services, highlighting the nuanced shifts within the market.

Notably, this week's issuance schedule remains manageable, despite some late additions. For instance, the San Joaquin Valley Clean Energy Authority successfully priced green clean energy project revenue bonds on Monday. Looking ahead, analysts anticipate that issuance will remain elevated throughout the year due to long-delayed projects and rising costs. Joshua Perry, a partner at Brown Advisory, emphasized that tax exemption concerns and the phasing out of federal stimulus could accelerate delayed issuances, particularly in the first half of 2025.

In the primary market, significant transactions included BofA Securities pricing $520.39 million of LCRA Transmission Services Corp. Project transmission contract refunding revenue bonds. Additionally, J.P. Morgan managed the pricing of $233.43 million of PSF-insured unlimited tax school building bonds for the Round Rock Independent School District in Texas. Meanwhile, BofA Securities also priced $130.22 million of hospital revenue bonds for the Kentucky Bond Development Corp., showcasing the diversity of issuers in the market.

The impact of tariffs on the market has been mixed. President Trump's announcement of tariffs on Canadian, Mexican, and Chinese goods led to initial market volatility. However, the delay of tariffs on Canada and Mexico provided temporary relief, while the 10% tariff on Chinese goods went into effect. Chris Low, chief economist at FHN Financial, observed that while U.S. stocks plummeted initially, the impact on USTs was more muted. Matt Fabian from Municipal Market Analytics noted that investor demand for munis could increase in response to policy turmoil, particularly if tariffs lead to higher prices and slower growth.

Perspective and Outlook

From a journalistic standpoint, the municipal bond market's resilience amidst economic uncertainty is both intriguing and reassuring. The ability of the market to absorb record issuance and maintain strong demand underscores its importance as a safe-haven asset. Investors seeking stability and attractive yields will likely continue to favor munis, especially given the current economic climate. Moreover, the ongoing policy debates surrounding tariffs and infrastructure funding highlight the need for adaptive strategies in managing investment portfolios. As we move forward, it will be crucial to monitor how these developments shape the future of the municipal bond market.