Navigating the Unpredictable: Decoding the Seasonal Patterns in Stocks, Bonds, and Commodities

As the markets brace for the final quarter of 2024, investors are left wondering whether the impressive 20% year-to-date gains in stocks will continue. However, a closer look at historical seasonal trends suggests that the path forward may not be as straightforward as it seems. From the potential impact of the upcoming presidential election to the nuanced performance of various asset classes, this comprehensive analysis aims to provide a clearer picture of what lies ahead.Uncovering the Seasonal Insights: A Roadmap for Navigating the Markets

Stocks: Riding the Seasonal Wave or Facing Headwinds?

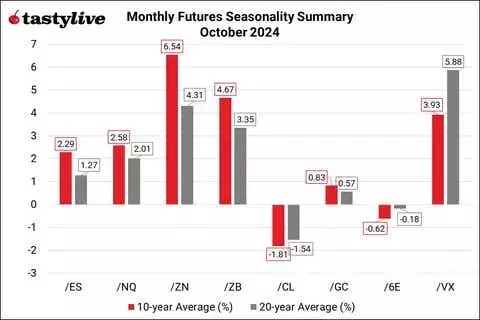

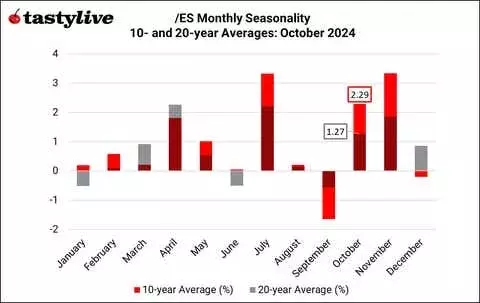

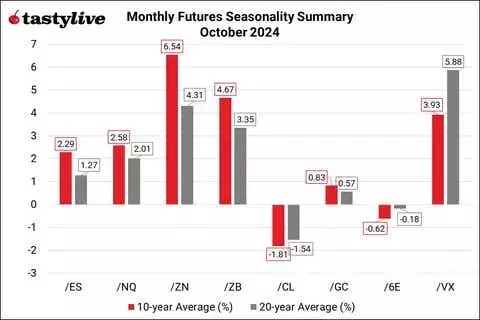

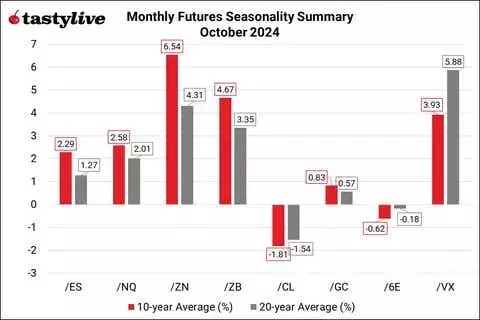

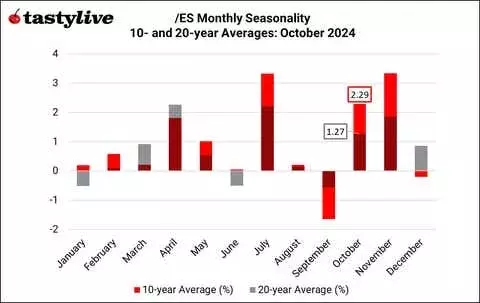

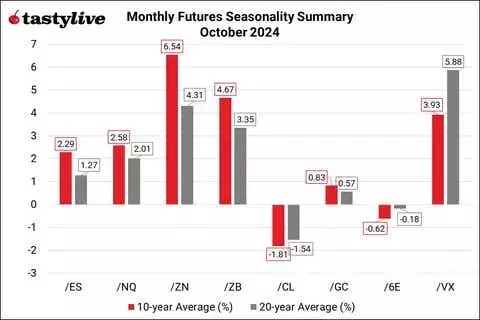

Historically, October has been a month of mixed fortunes for the S&P 500. While the index has averaged a gain of 2.1% in the fourth quarter when entering the final stretch of the year up by more than 20% year-to-date, the past nine instances of such a scenario have seen stocks fall 77.8% of the time, with an average loss of 3%. This suggests that the market's current bullish momentum may face significant challenges in the coming months.Adding to the complexity, the first half of October has traditionally been the second-worst two-week period during presidential election years for the S&P 500 since 1928. This underscores the potential for heightened volatility and uncertainty as the political landscape takes center stage.Nasdaq 100: Riding the Tech Wave or Facing Turbulence?

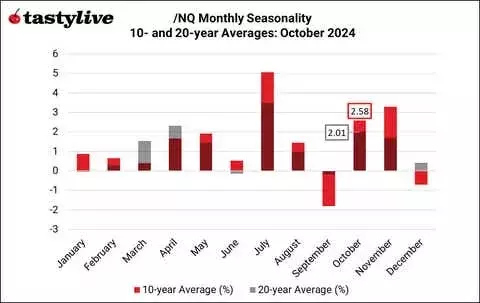

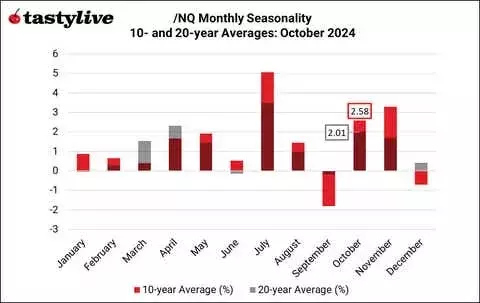

The Nasdaq 100 index has also exhibited strong seasonal patterns, with October being the third-best month of the year over the past 10 and 20 years, averaging gains of 2.58% and 2.01%, respectively. However, the same caveats regarding the S&P 500 apply, as the unique circumstances of the current market environment may override historical trends.Investors in the tech-heavy Nasdaq 100 will need to closely monitor the interplay between the sector's inherent volatility, the broader market's performance, and the potential impact of the upcoming election.Bonds: Seeking Refuge or Facing Challenges?

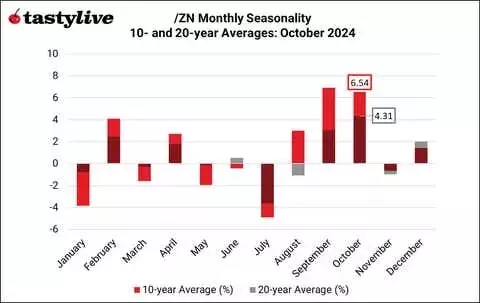

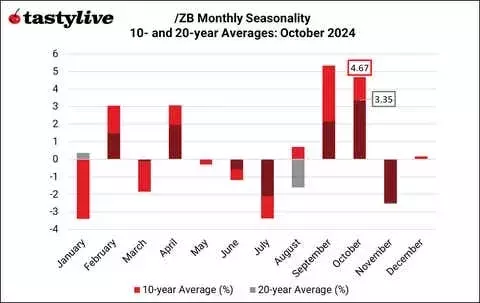

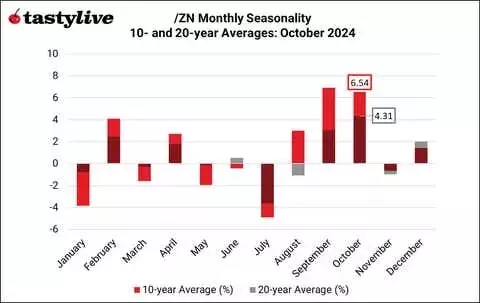

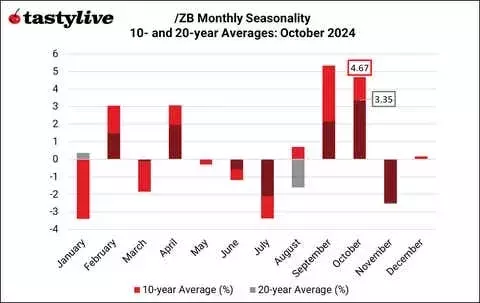

The fixed-income market has historically shown a more consistent seasonal pattern, with October being the second-best month of the year for 10-year Treasury notes and the best month for 30-year Treasury bonds over the past 10 and 20 years.This suggests that bonds may offer a relative haven for investors seeking to mitigate the potential volatility in the equity markets. However, the ongoing shifts in the interest rate environment and the Federal Reserve's monetary policy decisions will be crucial factors to consider.Commodities: Navigating the Seasonal Shifts

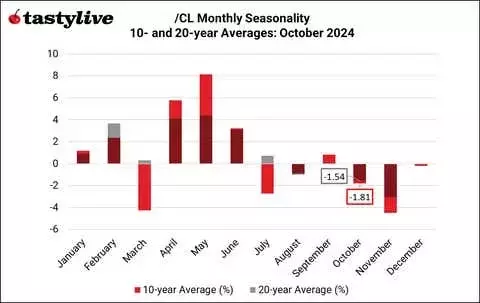

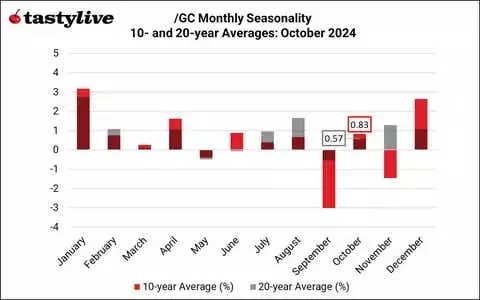

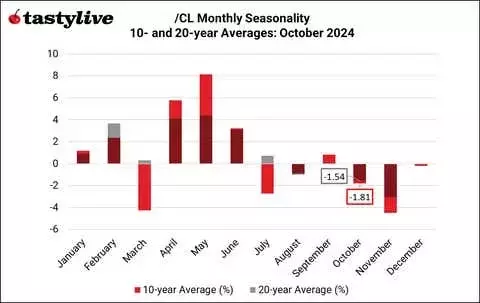

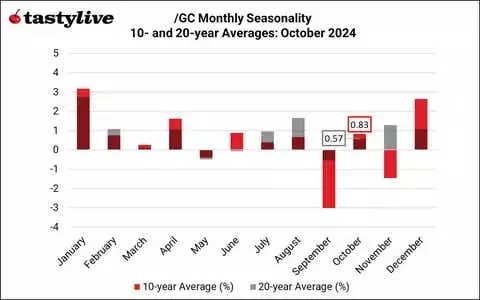

The seasonal patterns in the commodities market present a more nuanced picture. Crude oil has historically been a bearish performer in October, while gold has shown a slightly bullish trend. Investors will need to closely monitor the interplay between geopolitical tensions, global economic conditions, and the potential impact of the upcoming election on the commodities landscape.Currencies: Weathering the Seasonal Storms

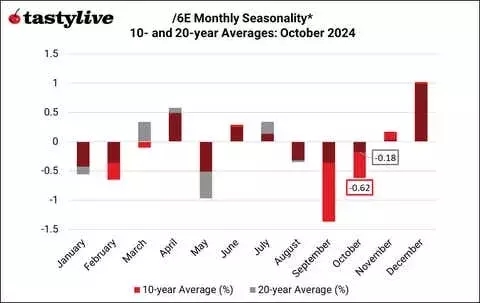

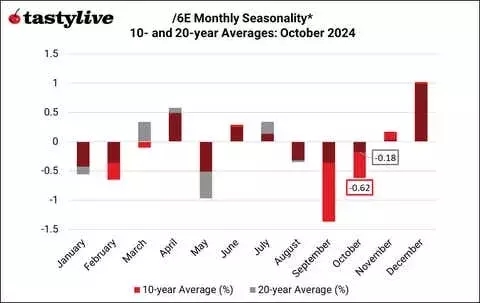

The foreign exchange market also exhibits seasonal patterns, with the euro typically experiencing a bearish October. However, the limited historical data for the euro futures contract (/6E) and the use of spot rates as a proxy warrant caution in interpreting these trends.Investors will need to closely monitor the broader macroeconomic factors, central bank policies, and geopolitical developments that can influence currency markets, as the seasonal patterns may not provide a complete picture.Volatility: Bracing for Potential Swings

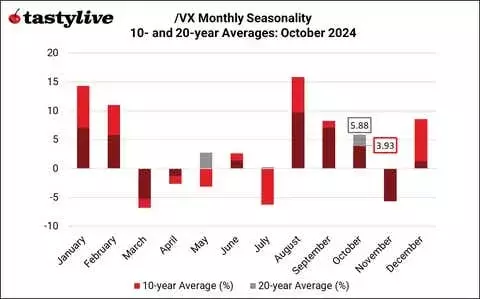

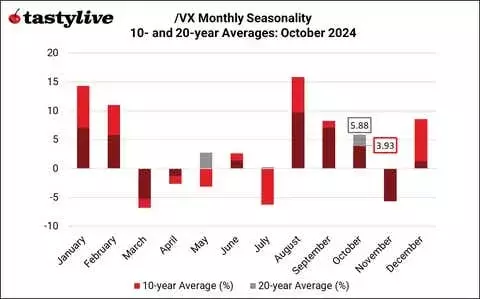

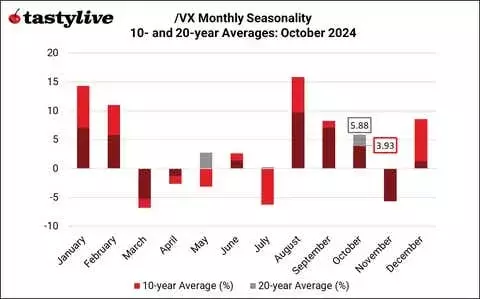

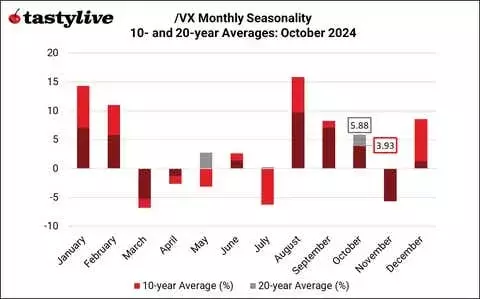

The VIX, a measure of market volatility, has historically shown a bullish trend in October, with the index averaging gains of 3.93% and 5.88% over the past 10 and 20 years, respectively. This suggests that investors may need to prepare for increased market turbulence in the coming months, regardless of the underlying asset class performance.As the markets navigate the final quarter of 2024, investors would be wise to approach the seasonal patterns with a nuanced and cautious perspective. While historical trends can provide valuable insights, the unique circumstances of the current market environment, the upcoming presidential election, and the evolving macroeconomic landscape will ultimately shape the path forward. By staying informed, diversifying their portfolios, and maintaining a disciplined approach, investors can navigate the unpredictable terrain and potentially capitalize on the opportunities that may arise.