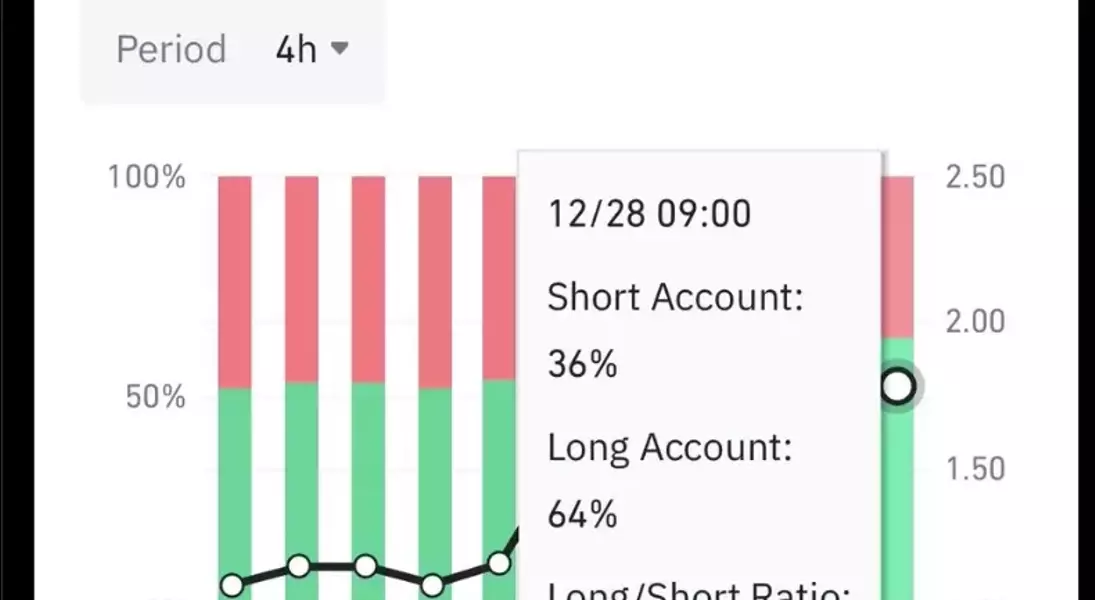

Data from on-chain analysis indicates a significant shift in trader sentiment towards Bitcoin, with the majority positioning for potential gains. As of late December, over 60% of futures traders on a major exchange are betting on an upward movement. This optimistic outlook is closely tied to broader market expectations, including anticipated financial inflows and supportive economic policies.

Traders Show Optimism Amid Market Consolidation

Recent data reveals a marked increase in bullish positioning among Bitcoin traders. Over 60% of participants on one of the largest trading platforms are now expecting an upward trend. This shift comes as Bitcoin stabilizes around a key price point, suggesting that traders are increasingly confident about future performance. The current market dynamics reflect a growing belief in the asset's resilience and potential for growth.

The rising optimism can be attributed to several factors. Firstly, the consolidation phase near this specific price level has provided traders with a sense of stability. Secondly, there is anticipation of increased liquidity following the holiday season, which typically brings fresh investment activity. Additionally, positive expectations surrounding policy changes from the incoming U.S. administration further bolster market confidence. Traders are leveraging these factors to position themselves strategically, anticipating favorable market conditions.

Expectations Align with Broader Economic Indicators

The bullish stance taken by a majority of traders aligns with broader market sentiments. Analysts observe that the current market environment supports the possibility of renewed upward momentum. Investors are looking forward to post-holiday financial flows, which historically have contributed to market strength. Moreover, there is hope that new policies will create a conducive environment for digital assets.

Market analysts highlight that the combination of stable price levels and anticipated policy support contributes to the overall positive outlook. Traders are not only focusing on short-term gains but also considering long-term prospects. The alignment of various economic indicators with trader sentiment suggests that the market may be entering a phase of sustained growth. This period of consolidation could serve as a foundation for future expansion, driven by both internal market factors and external policy influences.