The financial markets are bracing for potential shifts as the incoming administration considers sweeping changes to trade policies. Early indications suggest a cautious optimism, with stock futures trending upward amid uncertainty over how tariffs might reshape business landscapes. Technology remains a beacon of hope, with industry leaders showcasing innovations at CES that could redefine sectors like artificial intelligence and semiconductors.

Embrace the Future: Unveiling New Horizons in Trade and Tech

Trade Policies Under Scrutiny

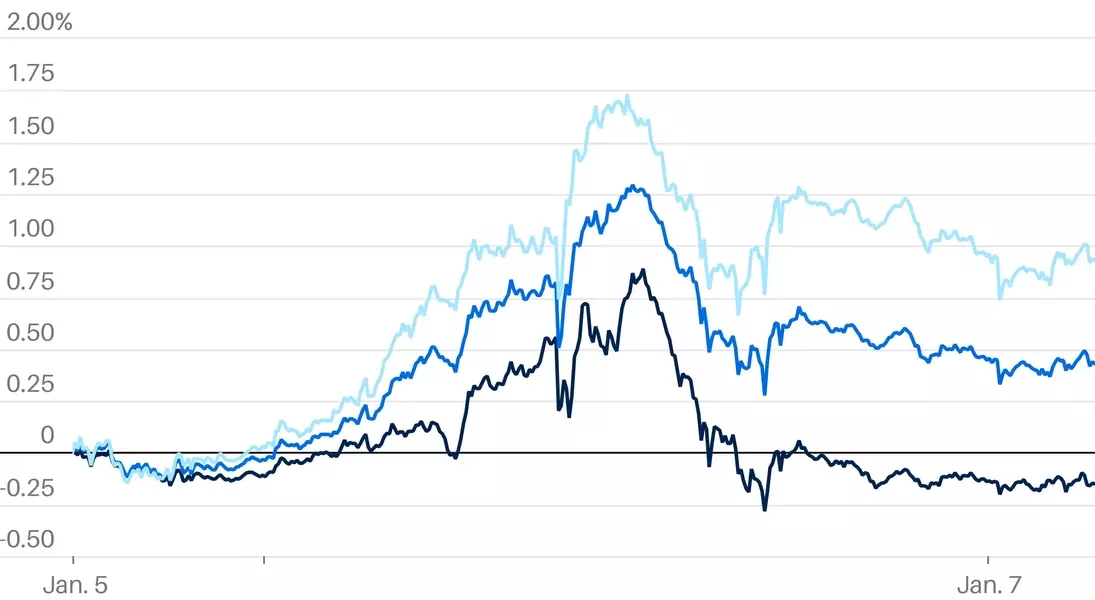

The incoming administration's stance on trade has sent ripples through the market. Speculation about tariff implementation has been met with mixed reactions. While some companies may see an advantage from reduced competition, the broader implications could be more challenging. Firms engaged in international commerce would likely face increased operational costs, which could erode profit margins and dampen investor sentiment. The interplay between domestic and global markets will be crucial in determining the overall impact. Analysts predict that industries reliant on imports could experience significant disruptions, leading to adjustments in supply chains and pricing strategies.Moreover, the ripple effects of tariffs extend beyond immediate cost concerns. The potential retaliatory measures from trading partners could lead to a more complex geopolitical landscape. Businesses must now navigate not only economic factors but also diplomatic relations. This added layer of complexity underscores the need for strategic planning and adaptability. Companies that can pivot quickly to mitigate risks may find opportunities in this evolving environment.Technological Innovation Takes Center Stage

Amidst the uncertainty surrounding trade policies, the technology sector is emerging as a stabilizing force. Events like the CES trade show in Las Vegas highlight the ongoing advancements in fields such as artificial intelligence and semiconductor technology. These innovations hold the promise of driving future growth and creating new market opportunities. Investors are increasingly optimistic about the potential for breakthroughs that could revolutionize industries.Artificial intelligence, in particular, is capturing the imagination of both consumers and businesses. Its applications range from enhancing consumer experiences to optimizing industrial processes. The integration of AI into everyday products and services is expected to spur demand and create value across multiple sectors. For instance, smart home devices powered by AI are gaining popularity, offering convenience and efficiency to users. Meanwhile, in manufacturing, AI-driven automation is streamlining operations and reducing costs.Semiconductor sales are another area of focus, with experts predicting robust growth driven by the increasing demand for advanced computing power. From data centers to consumer electronics, semiconductors play a critical role in enabling the technologies of tomorrow. As these components become more sophisticated, they open up new possibilities for innovation. The tech industry's resilience and forward-thinking approach position it as a key driver of economic progress, even in uncertain times.Market Sentiment and Investor Confidence

Despite the challenges posed by potential tariffs, the market's underlying strength remains intact. Investor confidence is bolstered by the continued innovation in technology and the resilience of key sectors. Stock futures rising early Tuesday reflect a cautious optimism that the market can weather short-term disruptions. Traders and analysts are closely monitoring developments, ready to adjust strategies as needed.The balance between risk and reward is always a delicate one, especially in volatile markets. However, history has shown that periods of uncertainty often pave the way for new opportunities. Companies that innovate and adapt to changing conditions tend to thrive. Investors who maintain a long-term perspective may find that current challenges present valuable entry points. The market's ability to adapt and evolve is a testament to its enduring strength and resilience.In conclusion, while the potential impacts of tariffs introduce a degree of uncertainty, the technology sector offers a beacon of hope. The ongoing advancements in AI and semiconductors underscore the market's capacity for innovation and growth. Investors should remain vigilant, but also recognize the opportunities that arise from navigating these dynamic conditions.You May Like