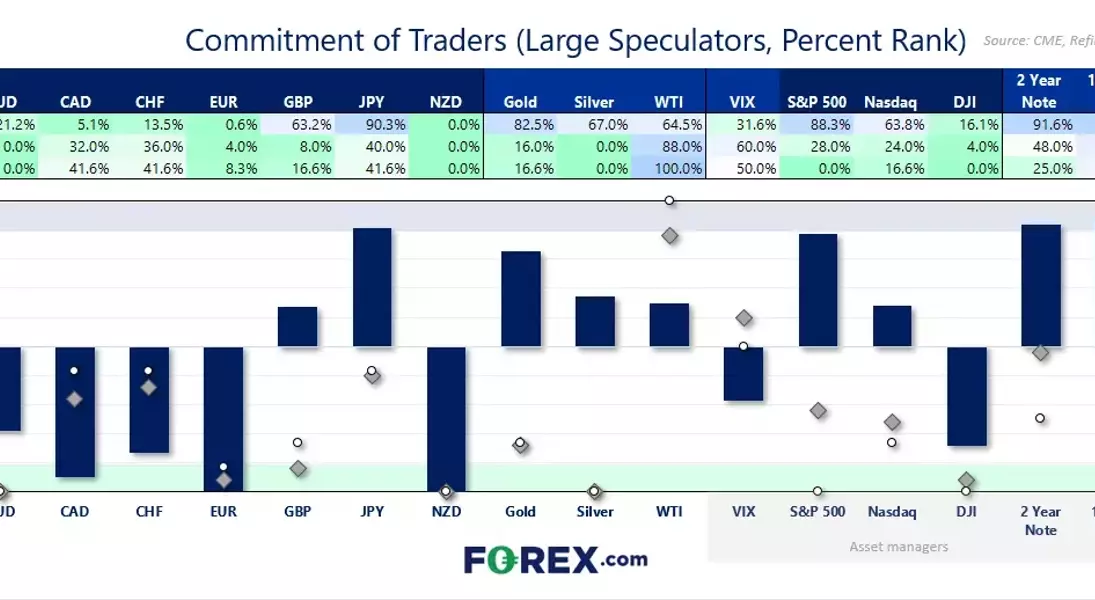

The latest Commitment of Traders (COT) report reveals significant shifts in market positioning as we transition into the new year. By the end of December 2024, futures traders held a substantial net-long position in the US dollar, while speculative bets on commodity currencies like the New Zealand and Australian dollars reached record lows. The WTI crude oil market saw increased bullish sentiment, and Wall Street indices showed mixed signals. Metals such as gold remained supported by strong investor interest, while silver and copper faced uncertain prospects.

USD Surges to Two-Year High Amidst Market Positioning Adjustments

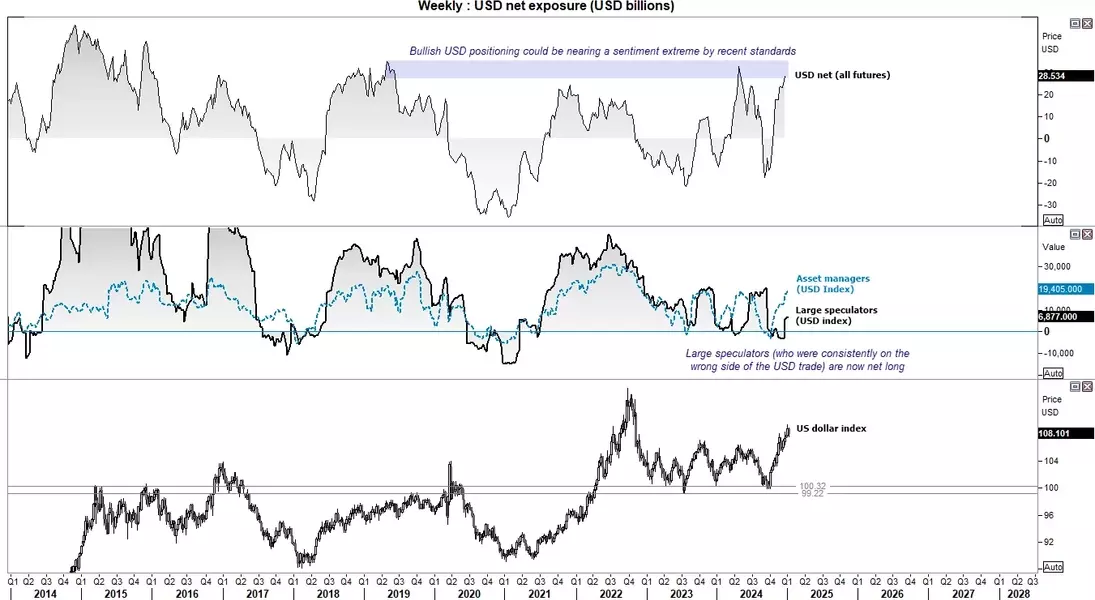

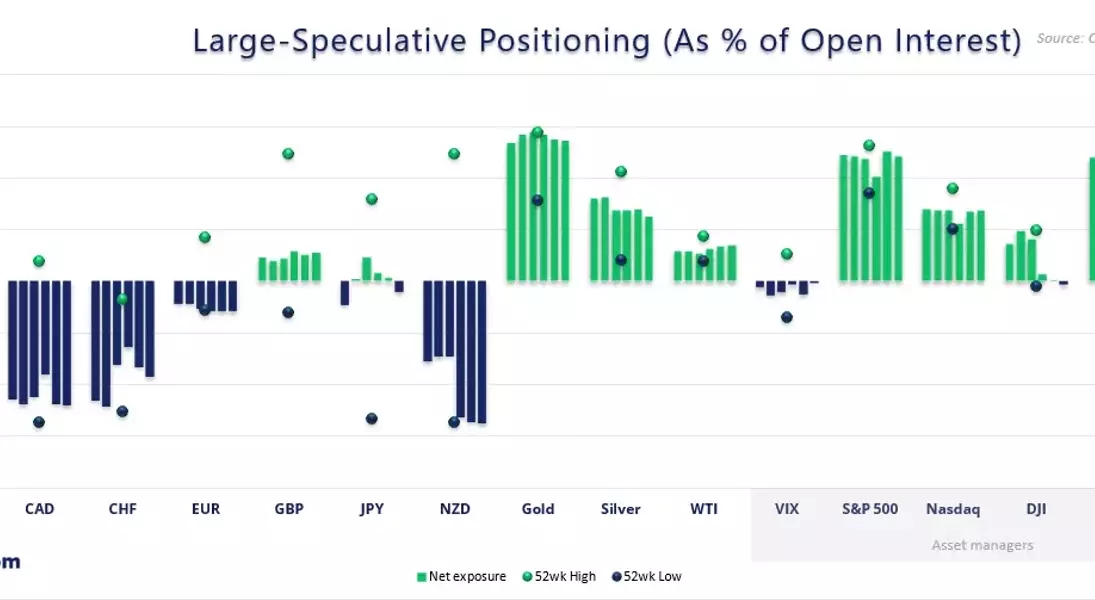

In the final days of 2024, the US dollar index climbed to its highest level in two years, driven by robust market positioning. Asset managers significantly increased their net-long exposure, reaching levels not seen since early 2023. Gross long positions hit a one-year high, while gross short positions dwindled to just 220 contracts. Futures traders were notably bullish on the USD, holding a net-long position worth $28.5 billion, marking a 33-week high. Large speculators maintained their net-long stance for the third consecutive week, though some analysts caution that this could be a red flag, as large speculators have historically been late to capitalize on USD movements.

The strengthening USD has already shown signs of reversing in early January due to reports suggesting that Trump's trade policies may be less aggressive than anticipated. This shift could lead to an unwinding of the "Trump trade," potentially impacting various asset classes.

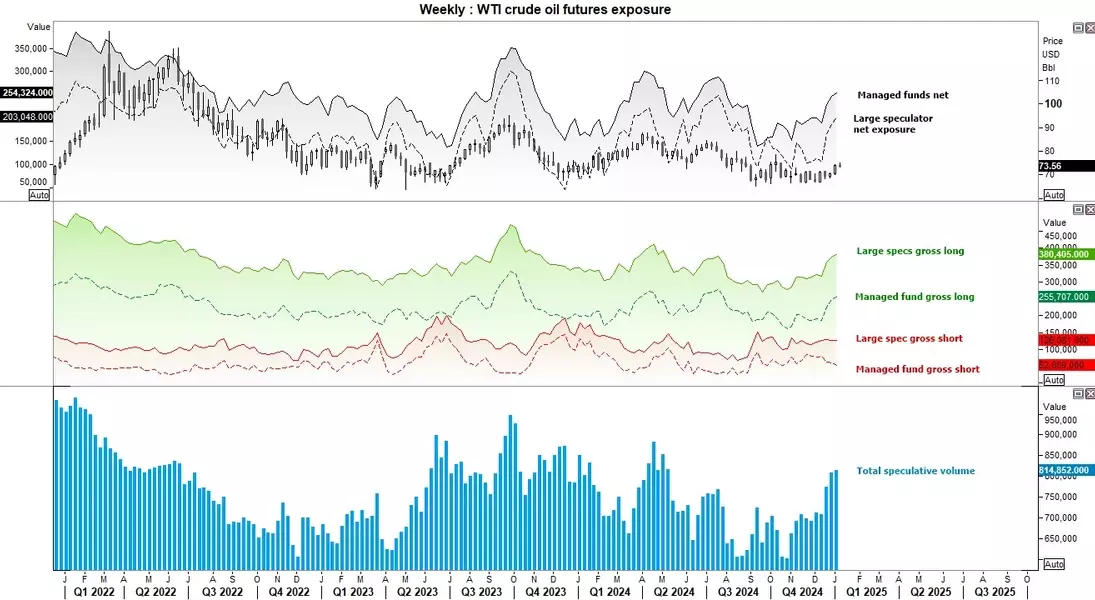

WTI Crude Oil Sees Bullish Momentum but Prices Lag Behind

The WTI crude oil market witnessed a surge in net-long exposure to a 23-week high, accompanied by a rise in speculative volumes. Both sets of traders increased their gross long positions, while gross shorts remained flat for large speculators and decreased for managed funds. Despite the bullish bets, oil prices have not risen proportionally, indicating a potential divergence. If prices do not catch up soon, it could lead to a reversal of these bullish positions or further suppression of prices.

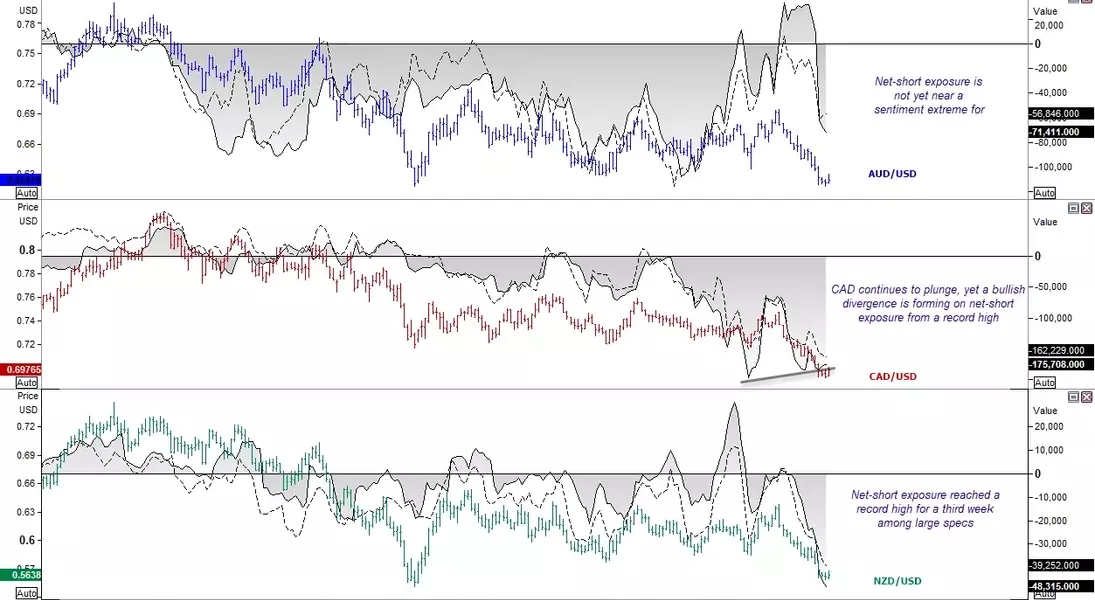

Commodity Currencies Under Pressure from Trump Trade

Commodity currencies, including the Australian, Canadian, and New Zealand dollars, faced significant downward pressure as they mirrored the decline of the Chinese yuan amid expectations of central bank cuts. Net-short exposure to NZD/USD futures reached a record high for the third consecutive week among large speculators, with prices struggling to stay above the 2022 low. The Canadian dollar also experienced a freefall, though net-short exposure appears to be stabilizing at bearish levels. A slight bullish divergence is forming, hinting that the bearish trend might be nearing its end, pending the right catalyst.

AUD/USD could potentially dip below 60 cents, although historical data suggests it has difficulty sustaining such low levels. With net-short exposure still bearish but not extreme, further losses may occur if the yuan continues to weaken.

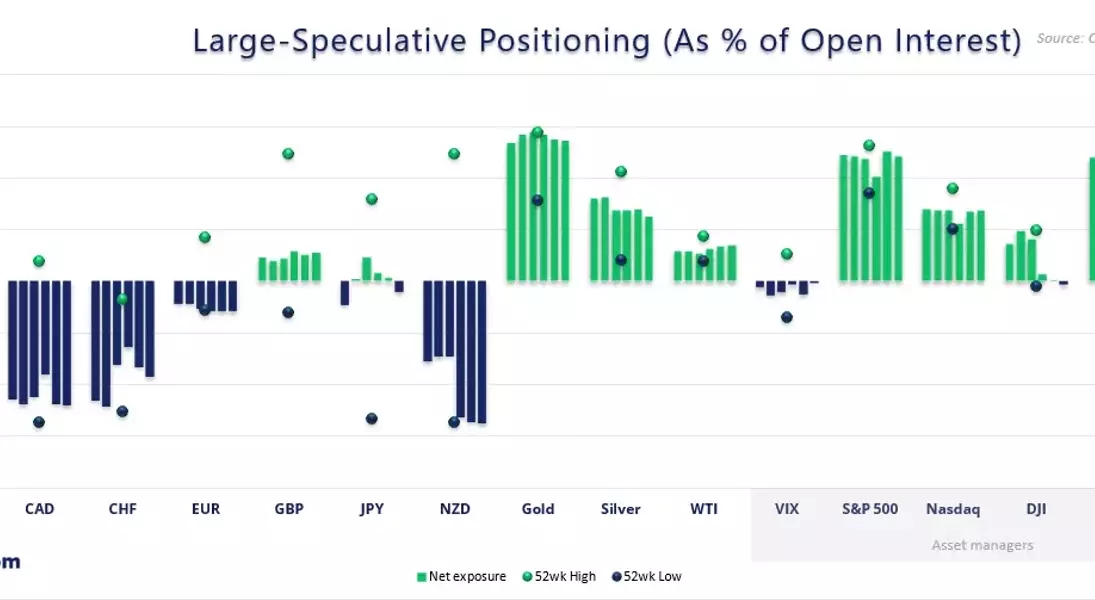

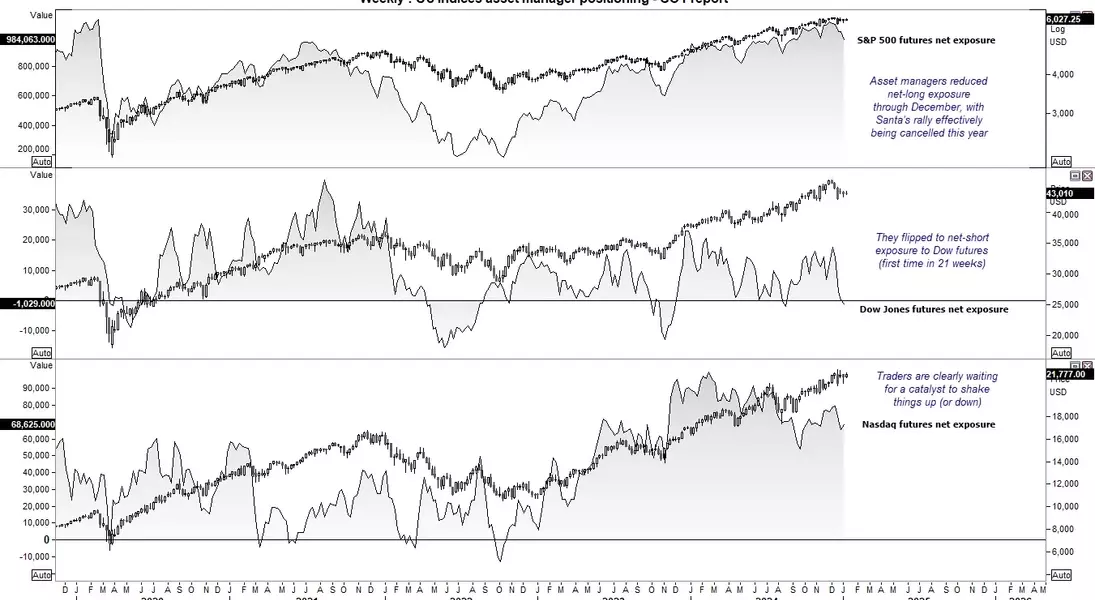

Wall Street Indices Show Mixed Signals Ahead of Policy Uncertainty

Asset managers reduced their net-long exposure to S&P 500 futures for four out of the last five weeks, despite December typically being associated with strong gains. Instead of a traditional Santa Claus rally, the market moved sideways. Asset managers also flipped to a net-short position on Dow Jones futures for the first time in 21 weeks. Meanwhile, net-long exposure for Nasdaq slightly increased, keeping it and the S&P 500 in a tight range just below record highs. Traders seem cautiously optimistic, awaiting fresh catalysts, particularly the impact of Trump's policies.

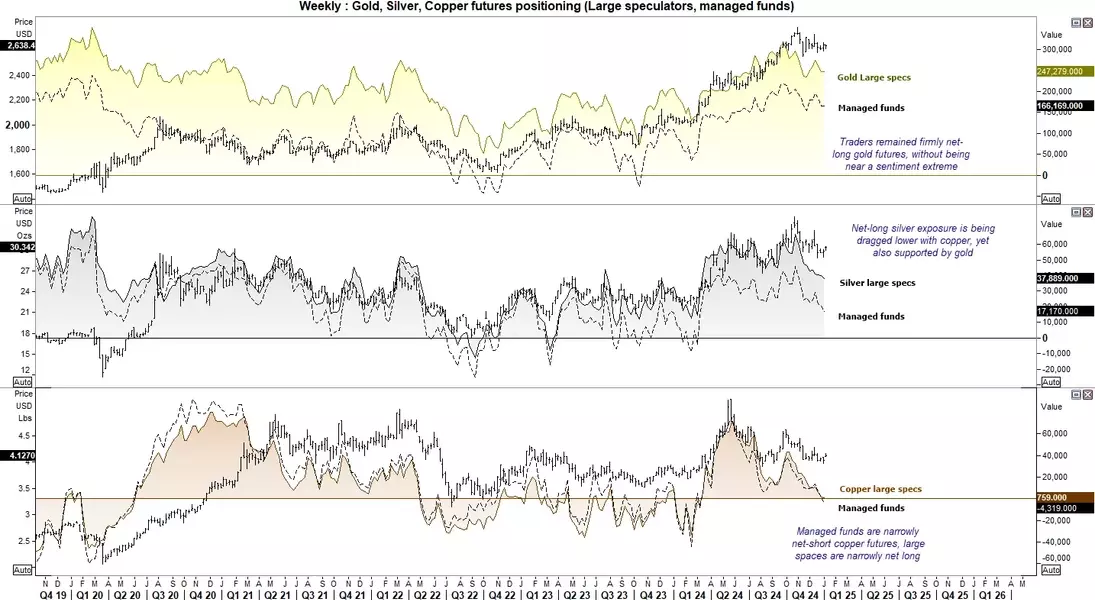

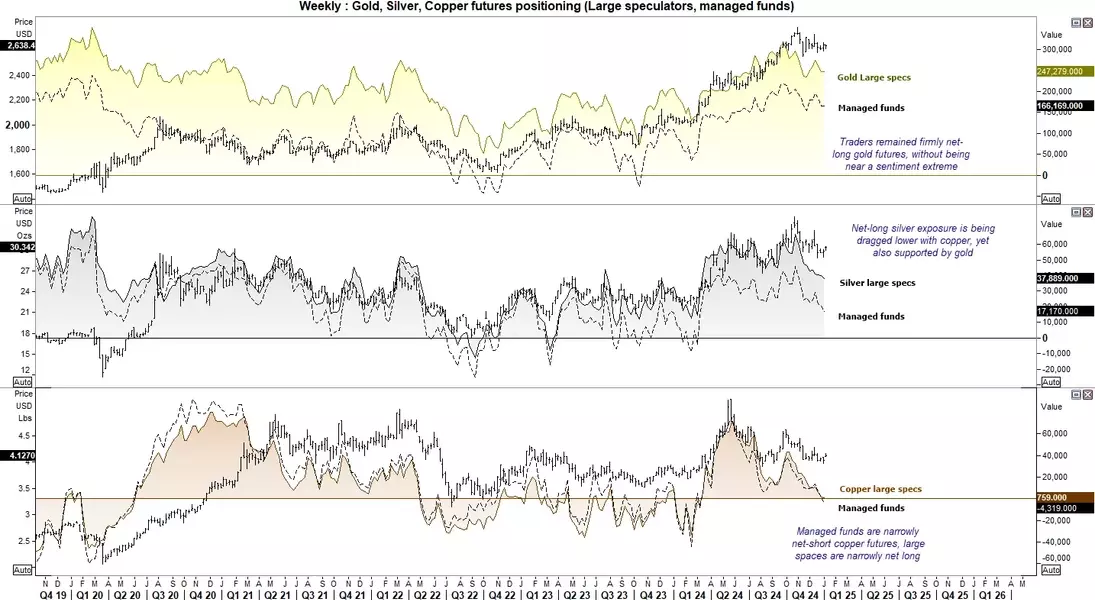

Metal Markets Await Policy Clarification

Gold appears to be in a healthy correction within a strong bullish trend, supported by both large speculators and managed funds. Investors are likely to view dips as buying opportunities throughout the year. Silver, caught between the flows of gold and copper, faces mixed influences. Managed funds have shifted to a net-short position, while large speculators have trimmed their net-long exposure to just 759 contracts. As we await policy adjustments from the Trump administration, a less aggressive stance could boost bullish bets on copper and silver, weaken the USD, and aid a recovery in commodity currencies.

From a journalistic perspective, the COT report highlights the complex interplay between market sentiment and policy expectations. The strength of the USD and the weakening of commodity currencies underscore the global economic uncertainties tied to trade policies. Investors and policymakers alike will be closely watching how these dynamics evolve in the coming months, especially as new policies come into play. The report serves as a reminder that markets are constantly adjusting to new information, and staying informed is crucial for navigating these shifts.