The real estate sector is currently navigating a period of considerable flux, characterized by protracted selling times for overpriced properties and an evolving landscape of buyer hesitancy. This intricate dynamic is largely driven by a clear oversupply of listings and the looming specter of potential alterations to property taxation. These factors collectively weave a complex narrative, necessitating a nuanced approach from sellers in setting prices and from buyers in navigating uncertainties.

As the market experiences shifts, a noticeable divide has emerged between northern and southern regions in terms of selling efficiency. While some areas are witnessing swift transactions and sustained price growth, others contend with prolonged sales cycles and stagnant values, reflecting the localized impact of prevailing market conditions and buyer preferences. Understanding these regional disparities is crucial for stakeholders to make informed decisions and adapt to the prevailing market realities.

The Price Sensitivity Challenge in Home Sales

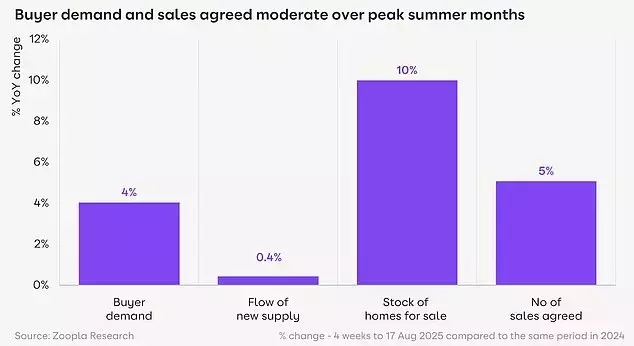

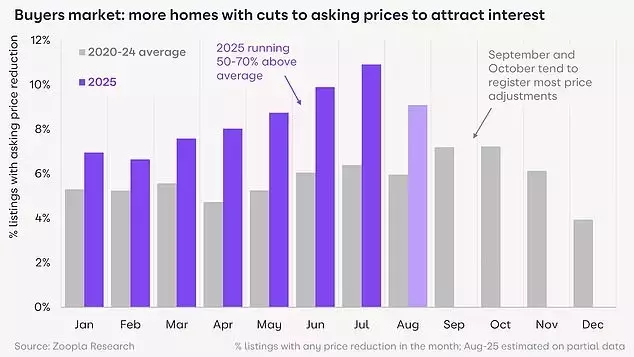

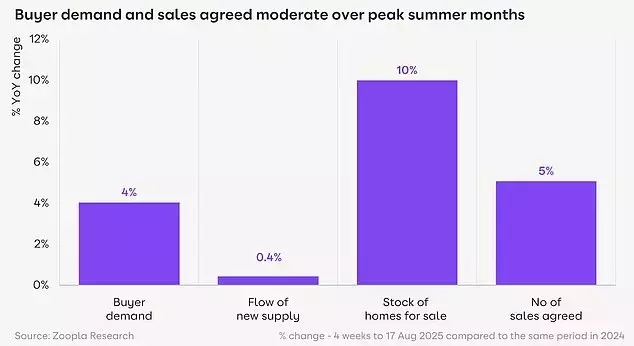

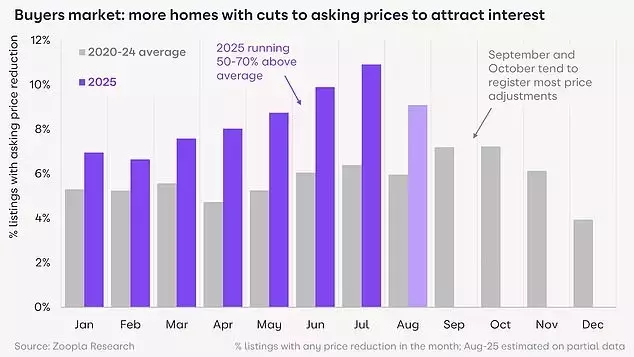

The current housing market is undeniably favoring buyers, with a significant number of homes remaining on the market for extended periods due to ambitious pricing strategies by sellers. Data indicates that properties initially listed at elevated prices require an average of 2.4 times longer to secure a sale than those that forgo price reductions. This phenomenon underscores the critical importance of accurate initial pricing in facilitating timely transactions. In a market where buyers possess a greater array of choices, coupled with heightened scrutiny over property values, homes that necessitate price adjustments are prone to languishing on the market. This scenario highlights a broader trend: a substantial portion of available homes have been listed for over six months, signifying a marked slowdown in sales velocity. Furthermore, a rising trend in asking price reductions, notably exceeding the five-year average, serves as a clear indicator of a prevailing buyer's market, compelling sellers to recalibrate their expectations to align with current market realities and attract serious buyers.

The extended selling periods for homes with initial overpricing underscore a fundamental shift in market dynamics, where buyer discretion and ample inventory empower purchasers. When faced with a multitude of options, buyers are naturally inclined to gravitate towards properties perceived as offering better value or those that are more realistically priced. Consequently, homes failing to meet these expectations become less appealing, leading to their prolonged presence on listing platforms. This situation is further compounded by the growing prevalence of price adjustments, which, while necessary for some sellers, can inadvertently signal potential issues or a lack of urgency, making the property less attractive to proactive buyers. Therefore, for sellers aspiring to achieve a swift and successful sale, a meticulously researched and competitive pricing strategy from the outset is paramount. This strategic approach not only captivates buyer interest more effectively but also significantly diminishes the likelihood of prolonged market exposure and the eventual necessity for price markdowns.

Tax Speculation and Regional Market Divergence

Current discussions surrounding potential alterations to property taxation are casting a considerable shadow over the housing market, leading to increased caution among prospective buyers and consequently, a reduction in transactional activity. Rumors of significant tax reforms, such as the potential replacement of stamp duty with an annual property tax and the introduction of capital gains tax on high-value properties, are creating an environment of uncertainty. This speculative atmosphere is particularly problematic as it precedes the Autumn Budget, a period traditionally associated with increased market engagement. The historical precedent of tax changes influencing market behavior suggests that these rumors will likely suppress buyer confidence, delaying purchase decisions and leading to a probable slowdown in sales volumes. Such uncertainty makes it challenging for both sellers and buyers to commit, further dampening an already delicate market.

Beyond the national implications of tax policy, regional disparities in the housing market are becoming increasingly pronounced. While southern England faces a challenging buyer's market characterized by longer selling times and minimal price growth, northern regions are experiencing a more robust sales environment. In areas such as the North West and North East, homes are selling significantly faster than the national average, coupled with stronger annual price appreciation. This contrast is largely attributable to a lower supply of available properties in these northern areas, fostering a more competitive environment among buyers. Conversely, the southern market is saturated with listings, offering buyers extensive choice and therefore diminishing the urgency to make rapid purchase decisions. This oversupply, especially in coastal regions and areas with a high number of second homes, has led to stagnant or even declining prices. Thus, a bifurcated market has emerged, with differing conditions dictating the pace and success of property transactions across the country.