Navigating Uncertainties: A Closer Look at Shifting Housing Sentiments

August Market Overview: A Slight Dip in Housing Confidence

In August, American consumers displayed a marginal decrease in their confidence levels concerning the housing sector. This shift was largely influenced by increasing anxieties regarding job market stability, the ease of selling properties, and the prospective direction of residential property values. These findings stem from Fannie Mae's comprehensive monthly National Housing Survey, which tracks various aspects of consumer attitudes towards housing.

Key Indicators and Their Performance in August

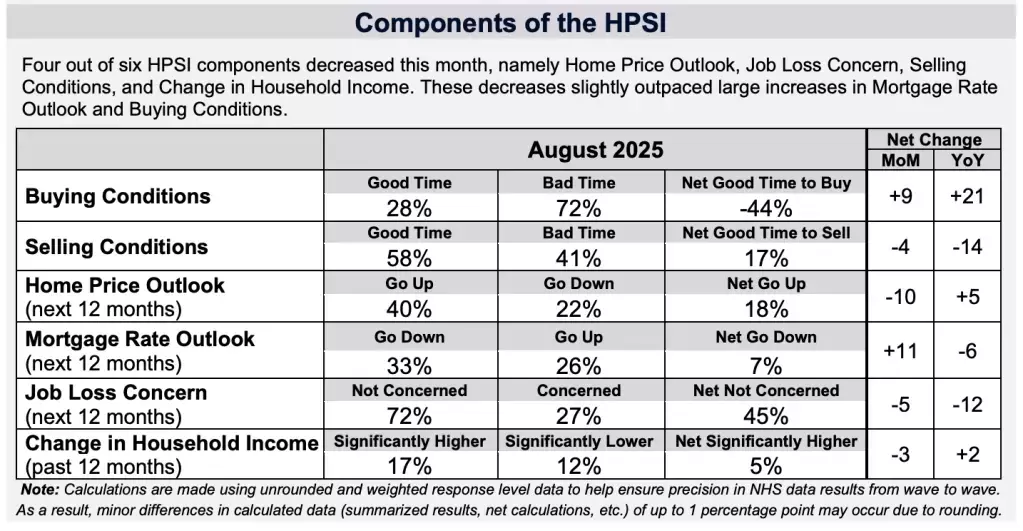

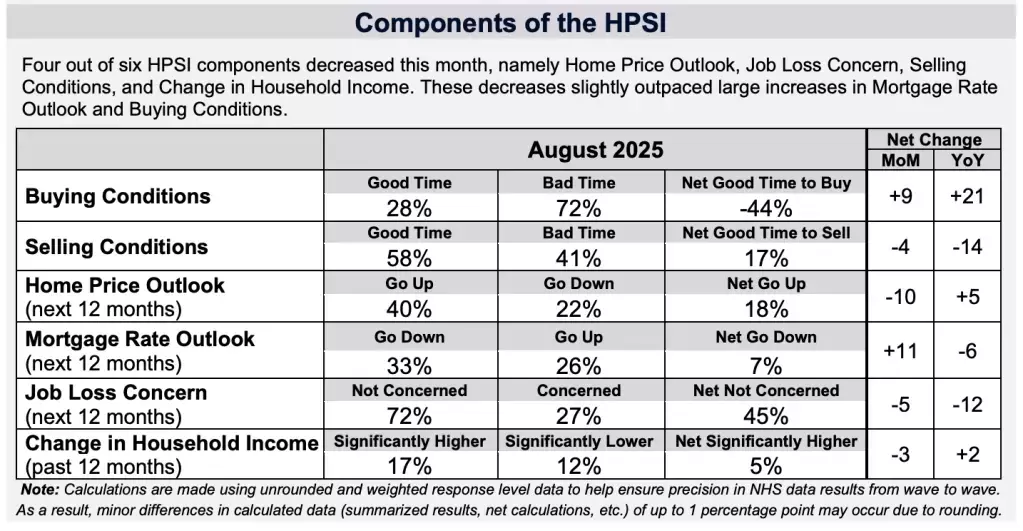

The Home Purchase Sentiment Index (HPSI), a crucial measure of consumer sentiment, registered a modest decline of 0.4 points, settling at 71.4. A majority of its six constituent components showed a downturn. While there was a more favorable perception of mortgage rates and the conditions for purchasing a home, these encouraging signs were insufficient to counteract the negative trends observed in seller confidence, anticipated housing appreciation, household income expansion, and employment security.

Buyer vs. Seller Sentiment: A Diverging Path

Despite the overarching drop in sentiment, a notable proportion of consumers viewed August as a more opportune moment for acquiring a residence. Approximately 28% of respondents considered it a good time to buy, marking a five-percentage-point increase from the previous month. Conversely, the percentage of those who deemed it a poor time to buy decreased to 72%. This collective shift resulted in a nine-point improvement in net buyer sentiment. However, seller optimism moved in the opposite direction, with 58% believing it was a good time to sell and 41% viewing it negatively. Furthermore, expectations for property appreciation softened, with only 40% anticipating a rise in home values over the coming year.

Mortgage Rates and Job Security: Mixed Signals

A notable positive development was the sentiment surrounding mortgage rates. For the first time since January, more respondents anticipated a decline in rates over the next 12 months than an increase. In contrast, confidence in job security and household income saw a decline. The proportion of employed individuals who felt secure in their jobs fell by five points to 45%, and only 17% reported an increase in their income compared to the previous year, with the majority (70%) stating their earnings remained unchanged.

Rental and Home Price Expectations: A Comparative Analysis and Other Survey Highlights

Expectations for rental price increases moderated, with consumers forecasting an average rise of 4.9% over the next year, a decrease from July's projections. Conversely, home prices were expected to climb by an average of 1.4%, an uptick from July's estimates. Additional insights from Fannie Mae's August survey indicated that 68% of respondents would prefer to buy rather than rent if they were to relocate, a two-point increase. About 55% described securing a mortgage as challenging, a slight increase from July. Approximately one-third expected their personal finances to improve, while 22% foresaw a decline, figures that remained consistent. Views on the broader economic landscape showed a slight improvement, with 35% believing the U.S. economy was on the right trajectory, a three-point increase.