Navigating Uncertainty: The Future of Property Investment Amidst Policy Shifts

Understanding the Recent Decline in Mortgage Activity

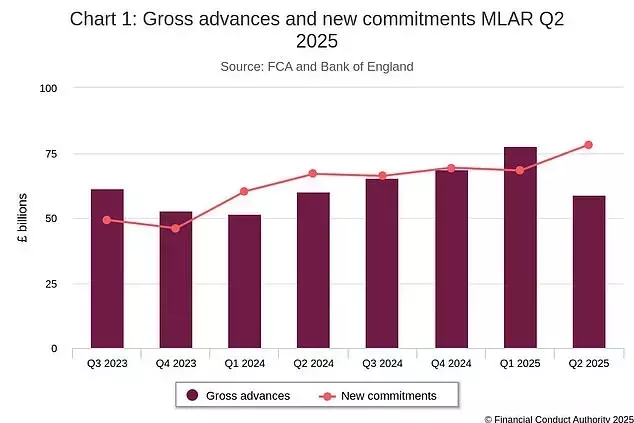

Following the implementation of revised stamp duty regulations on April 1st, the United Kingdom's property sector witnessed a notable contraction in mortgage lending. Data from the Financial Conduct Authority indicates a substantial reduction in the total value of new mortgages issued by financial institutions during the second quarter of the year. Specifically, the period from April to June recorded a nearly one-quarter decrease in new mortgage disbursements compared to the preceding quarter, marking the lowest lending volume since early 2024.

The Impact of Stamp Duty Adjustments on Market Dynamics

The alterations to stamp duty thresholds, which took effect on April 1st, mandated property purchasers to incur stamp duty on homes valued above £125,000, a decrease from the previous £250,000 threshold. This change translated into an additional £2,500 tax burden on a £250,000 property. First-time buyers were particularly affected, as their tax exemption limit was reduced from £425,000 to £300,000, leading to a £6,205 stamp duty payment on a £425,000 purchase. In London, where average property prices are higher, first-time buyers now face an increase from £6,950 to £18,200.

Budgetary Speculation and its Influence on Property Market Confidence

Current rumors regarding potential extensive revisions to property taxation in the forthcoming Autumn Budget are contributing to a climate of uncertainty within the housing market. Industry experts suggest that this ongoing speculation is already fostering a hesitant environment, potentially leading to a sustained market slowdown until definitive policy announcements are made. This pre-budget anxiety could prompt prospective sellers to defer their plans, further exacerbating the market's subdued activity.

Expert Perspectives on Lending Trends and Market Outlook

Karen Noye, a mortgage specialist at Quilter, noted that the initial months of 2025 saw a surge in lending activity as buyers expedited purchases ahead of the stamp duty changes. However, she indicated that the subsequent decline was anticipated, given the elevated interest rates and increased stamp duty expenses. While new mortgage commitments (agreements awaiting disbursement) showed an increase, some analysts, like Simon Gammon of Knight Frank Finance, observe that overall lending remains modest. Gammon points out that lenders are increasingly focusing on the first-time buyer segment to capture market share, despite the challenging conditions.

Anticipating Future Market Shifts Amidst Tax Discussions

The latest data, compiled prior to the full impact of budget tax speculation, may not fully reflect the current market sentiment. There is a growing belief that the housing market's deceleration is a direct consequence of these rumors, potentially leading to another dip in mortgage lending. As Noye suggests, the prospect of new property-related taxes could compel both buyers and sellers to pause, awaiting greater clarity, thus posing a risk of further market stagnation in the immediate future.