In the third quarter of 2025, homeowners across the United States realized an average profit margin of 49.9% from the sale of single-family residences and condominiums. This data, compiled by ATTOM, shows a slight increase from the 49.3% recorded in the preceding quarter, yet it represents a decrease from the 55.4% margin observed during the same period last year. On average, sellers gained approximately $123,100 per transaction, a modest rise of 1.9% from the previous quarter but a 3.5% reduction compared to the third quarter of 2024. The national median sales price reached an unprecedented $370,000, indicating a 1.2% rise from the second quarter and a 3.4% annual increase, marking the second consecutive quarter of record-high prices.

Despite the overall increase in median sales prices, profit margins experienced a decline in almost 59% of the 157 metropolitan areas examined in the report. On a year-over-year basis, more than 84% of these areas witnessed a reduction in profit margins. Notably, several markets in Florida, such as Ocala, Punta Gorda, and North Port–Sarasota, recorded significant drops. For instance, Ocala's profit margin decreased from 103.9% to 55.1%, and North Port–Sarasota fell from 61.1% to 38.8%. In contrast, a few metro areas saw an improvement in profitability, including St. George, Utah, which rose from 26.3% to 37.2%, and Gulfport, Mississippi, which climbed from 26.2% to 35.7%. Among larger metropolitan areas with over a million residents, Tampa, Seattle, and Boston experienced the most substantial annual declines in profit margins.

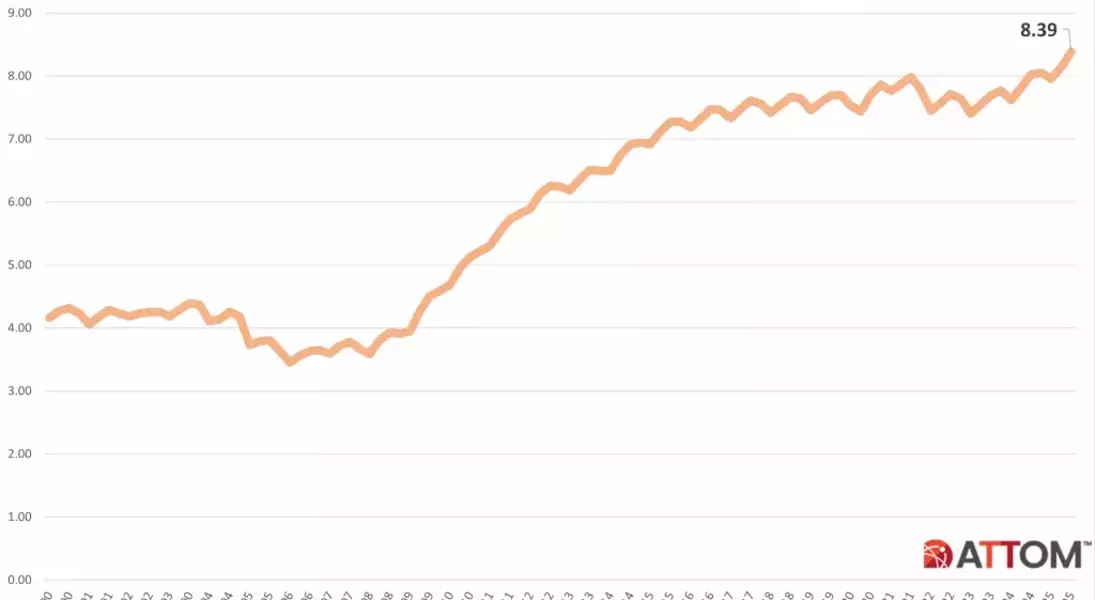

Market outcomes varied significantly across different regions, particularly in Texas and California. While over half of all metro areas reported profit margins exceeding 50% in the third quarter, Texas cities generally showed lower returns. New Orleans had the lowest profit margin at 19.6%, followed by several Texas cities like San Antonio (22.8%), Houston (30%), Austin (31.8%), and Dallas (33.5%). Conversely, major California metropolitan areas like San Jose led in raw profit gains, with an average of $740,500, followed by San Francisco ($450,000) and San Diego ($350,000). The average homeowner held their property for 8.39 years before selling, representing the longest tenure in a quarter-century, with Barnstable, Massachusetts, recording the longest average tenure at 14.4 years.

The Midwest region notably led in terms of price growth, with median sales prices increasing annually in 77% of the metro areas. Birmingham, Alabama, experienced a 23.5% increase, followed by Detroit (17.4%), Dayton, Ohio (14.8%), Flint, Michigan (12.9%), and Indianapolis (12.8%). In contrast, some areas saw price reductions, including Cape Coral, Florida (down 10.7%), Lake Havasu, Arizona (down 8.6%), and Austin (down 8.2%). The stability of lender-owned and cash sales remained a noteworthy trend, with lender-owned homes constituting a mere 1.2% of all U.S. sales. All-cash transactions accounted for 38.9% of sales, an increase from 37.6% a year prior, with the highest rates observed in Hilo, Hawaii, and Claremont, New Hampshire. Institutional investors acquired 6.4% of homes sold, a slight decrease from the previous quarter, with Texas and Missouri leading in this segment. Federal Housing Administration (FHA) loans supported 8.3% of all purchases, predominantly in California metros like Merced and Bakersfield.

This quarter's housing market report underscores a complex landscape where record-setting prices coexist with a contraction in seller profit margins across many regions. While the dip in mortgage rates may have sustained buyer interest, the varied performance across different metro areas highlights regional economic factors and demand-supply dynamics. The extended tenure of homeownership further suggests a cautious market, where sellers are holding onto properties longer. The continued strength of cash transactions and the presence of institutional investors point to diverse purchasing powers shaping the market, even as FHA loans remain a crucial tool for a segment of homebuyers, particularly in California.