Navigating the Path to Homeownership: Gen Z's Ambitions and Hurdles

The Generational Divide in Homebuying Perceptions

A recent poll conducted by Realtor.com revealed that a significant majority of Generation Z, specifically 82% of those aspiring to or already owning a home, believe that the journey to purchasing property is considerably more difficult for their age group compared to preceding generations. This sentiment underscores a widespread recognition of the unique economic pressures faced by young adults today.

Affordability: A Primary Concern for Young Adults

The study, which surveyed 1,000 individuals aged 18 to 27, brought to light that nearly one-fifth of Gen Z participants consider housing affordability to be their most pressing life concern. This pervasive worry reflects the current landscape of escalating property prices and stagnant wage growth, making the prospect of homeownership seem increasingly distant for many.

Unyielding Aspirations for Property Ownership

Despite the formidable challenges, the desire for homeownership remains strong among Gen Z. A substantial 67% of respondents still view owning a home as an important life ambition. Furthermore, 69% recognize real estate as a viable method for wealth accumulation, and 51% consider property ownership an essential component of the American dream, indicating a deep-seated belief in its long-term value and significance.

Strategic Adaptations for Future Homebuyers

Danielle Hale, chief economist at Realtor.com, noted that Generation Z has matured during a period of significant shifts in the housing market, leading them to approach homeownership with a pragmatic mindset. Instead of abandoning their aspirations, they are adopting adaptive strategies, such as prioritizing career development, initiating savings early, and maintaining realistic expectations regarding what they can genuinely afford. This proactive and flexible approach is anticipated to be advantageous as market conditions continue to evolve.

Accumulating Funds for an Initial Investment

Approximately one-third of Gen Z individuals who expressed interest in buying a home have already commenced saving for a down payment. On average, they anticipate needing around $54,546 to secure a home. This figure, while less than 20% of the national median list price of $425,000, surpasses the average U.S. down payment of $30,250 recorded recently. To achieve their financial targets, many are engaging in supplementary employment or implementing stringent cost-reduction measures.

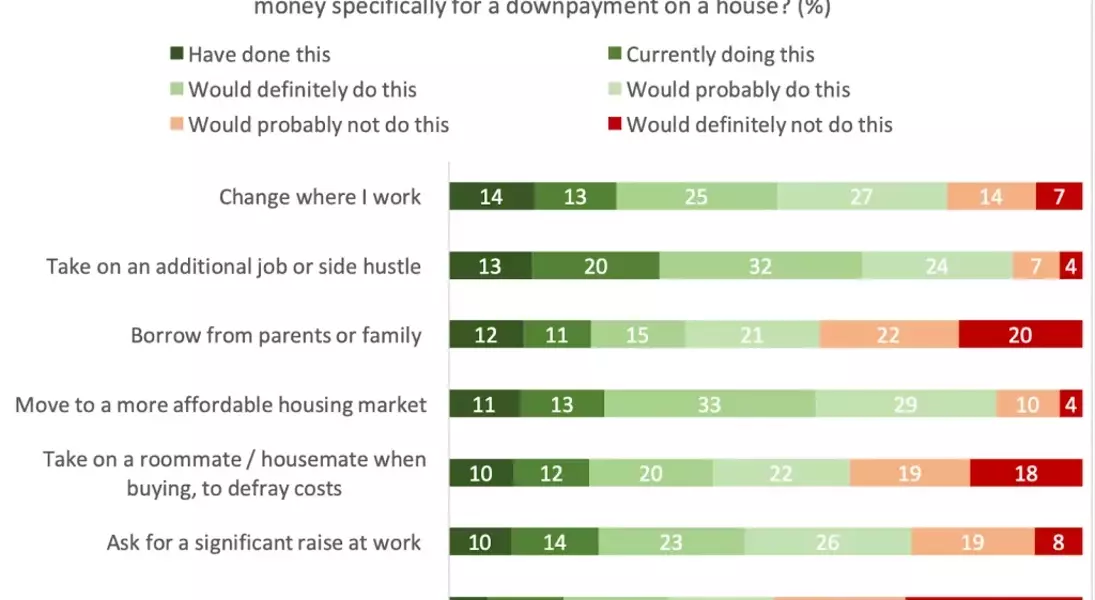

Innovative Savings Approaches and Relocation Considerations

Thirty-three percent of respondents indicated their intention to take on additional jobs or side hustles to save for a home. Others are exploring options such as relocating to areas with more favorable housing costs, seeking new employers, or requesting salary increases. Fewer individuals are inclined towards riskier financial ventures like stock or cryptocurrency investments, relying on family assistance, or sharing living expenses with roommates.

Bridging the Gap Between Readiness and Financial Preparedness

The survey highlighted a noticeable disparity between Gen Z’s general readiness for homeownership and their actual financial capacity. While 46% felt somewhat prepared to purchase a house, only 36% reported being financially ready. This gap suggests a need for enhanced financial literacy and support systems to help young adults align their aspirations with practical financial planning.

Career Progression Outweighs Homeownership for Many

For a significant portion of Gen Z, career advancement holds greater importance than buying a home, getting married, or starting a family. Nearly half (49.5%) identified career growth as their foremost milestone, followed by homeownership, marriage, and then family formation. A gender-based difference was observed, with 52% of women prioritizing career advancement compared to 45% of men. Conversely, 23.7% of men ranked homebuying as their top goal, compared to 19.4% of women.

The Impact of Increased Earning Potential on Homeownership Desires

The vast majority of respondents, 82%, affirmed that a higher-paying job would significantly increase their motivation to become homeowners. Similarly, 80% stated that their desire for homeownership would grow if they could more easily afford it. About half, 51%, expressed high concern about future housing affordability, with 16% ranking it among their most critical life worries, underscoring the profound link between income, affordability, and homebuying aspirations.