The U.S. housing market has recently seen a notable downturn in home flipping activities and associated financial gains. A new report highlights that the proportion of homes flipped by investors has reached its lowest point in over 15 years, with profit margins experiencing a substantial contraction. This trend reflects a challenging environment for property investors, as increased acquisition costs and competitive demand from prospective homeowners compress potential returns.

Amidst a shifting real estate landscape, regions like Georgia have emerged as surprising hubs for home flipping, despite the national trend of declining profitability. These areas showcase localized dynamics where investment opportunities persist, often driven by unique market conditions. Meanwhile, the prevalence of cash transactions and extended holding periods for flipped properties underscore investors' adaptation strategies in response to evolving market pressures.

Investor Returns Diminish as Market Dynamics Shift

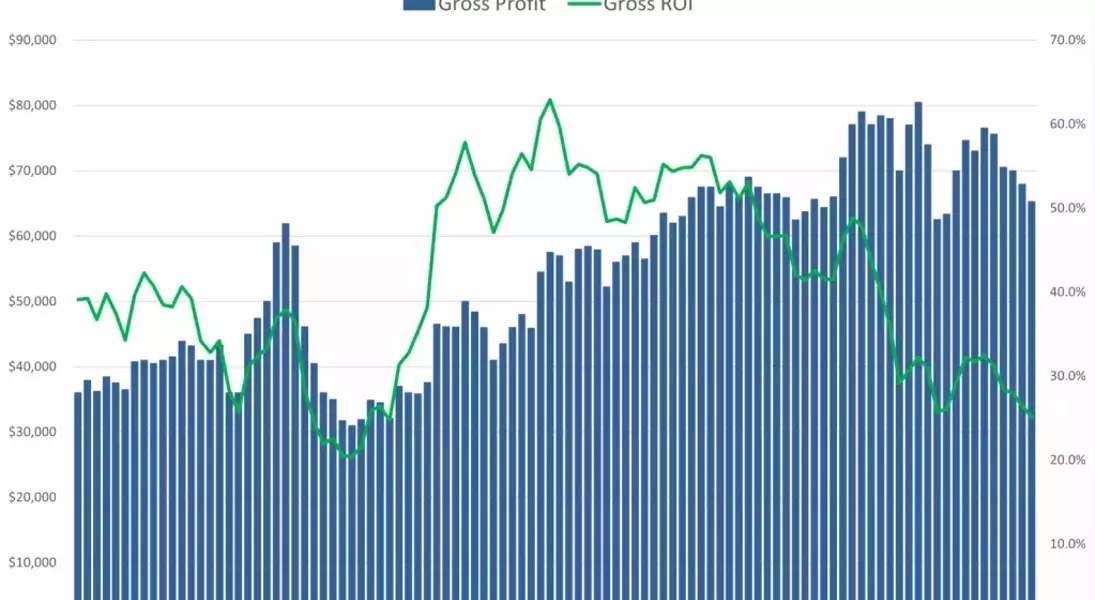

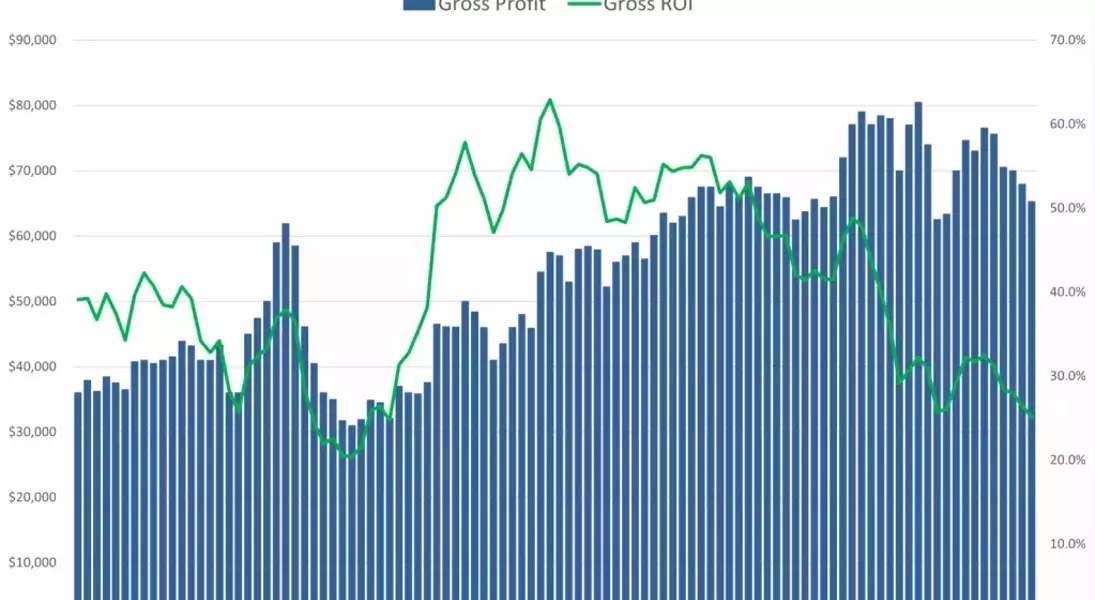

In the second quarter of 2025, the number of homes purchased and resold by investors in the United States saw a significant reduction, contributing to a broader slowdown in the flipping market. This period recorded only 7.4% of all home sales as flips, a decline from previous quarters, signaling a cautious approach from investors. The corresponding decrease in profit margins, reaching a 15-year low of 25.1% before expenses, underscores the heightened challenges in achieving substantial returns within the current market conditions. This trend, exacerbated by rising median purchase prices, forces investors to contend with a more competitive and less lucrative environment.

The financial landscape for home flippers has grown increasingly difficult, with the median gross profit falling to $65,300, a 13.6% annual decrease. This erosion of profitability is primarily attributed to the soaring costs of acquiring properties suitable for renovation and resale, which have reached a record median of $259,700. As first-time homebuyers increasingly compete for lower-priced homes, the pool of affordable properties for investors shrinks, further tightening margins. This scenario forces investors to either accept smaller profits or seek opportunities in less competitive markets, fundamentally altering the traditional profitability model of home flipping.

Geographic Variations and Strategic Adjustments in Flipping

Despite the national trend of declining home flipping activity and profitability, certain metropolitan areas have defied this pattern, particularly in Georgia. Cities such as Warner Robins, Macon, Atlanta, and Columbus reported some of the nation's highest flipping rates, indicating strong localized demand or unique market conditions that favor investor activity. These regional hot spots contrast sharply with areas like Seattle and Boston, which exhibited the lowest flipping shares, illustrating a fragmented market where success is highly dependent on specific geographic factors and local economic health.

In response to narrowing profit margins across the country, investors are employing strategic adjustments, including a continued reliance on cash purchases and extended holding periods for properties. Cash transactions accounted for 62.6% of flips, reflecting a preference for avoiding loan-related costs and complexities. Additionally, the median holding period for flipped homes slightly increased, suggesting that investors are taking more time to optimize their investments or waiting for more favorable market conditions to resell. This adaptive behavior, coupled with varying FHA-backed loan uptake rates by buyers in different regions, highlights the dynamic strategies investors are adopting to navigate a challenging and evolving real estate market.