A recent analysis from Redfin reveals that homeowners in specific high-tax regions, such as New York and Washington, D.C., are set to experience substantial financial relief thanks to an expanded federal deduction for state and local taxes (SALT). This policy change, which elevates the deduction ceiling from $10,000 to $40,000, significantly benefits those who itemize their federal tax returns. The study underscores a clear geographical disparity in these advantages, with coastal areas and states having higher property and income taxes realizing the most considerable savings, while states without a state income tax observe only marginal benefits. This development is poised to reshape the financial landscape for many property owners across the nation.

Homeowners in New York and Washington, D.C., are positioned to gain the most from the recently revised federal cap on state and local tax (SALT) deductions. According to a report issued by Redfin, typical households in these areas could save over $7,000 annually. This adjustment, stemming from the 'One Big Beautiful Bill Act' enacted under President Donald Trump, increased the deduction limit for SALT from $10,000 to $40,000. This deduction is particularly relevant for property owners who itemize their federal tax returns, encompassing state and local income, property, and sales taxes.

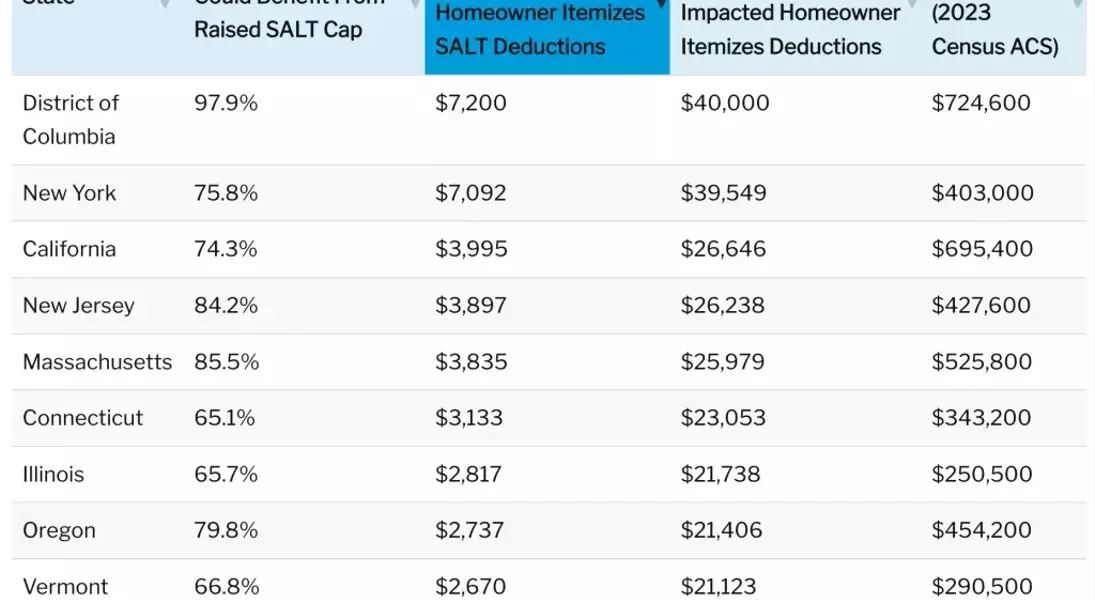

The report highlighted that the average New York homeowner affected by the elevated SALT cap is projected to save an impressive $7,092 each year, placing it second only to the District of Columbia, where residents could see savings of approximately $7,200. Following these top two, California homeowners could save an average of $3,995, with New Jersey ($3,897), Massachusetts ($3,835), and Connecticut ($3,133) also experiencing significant benefits. At the metropolitan level, Nassau County, New York, led the nation with average annual savings of $7,200, representing the maximum possible deduction. Other top-saving metros included San Francisco ($6,843), San Jose ($6,661), New York City ($5,473), and Oakland ($5,455).

Conversely, states with lower tax burdens saw much smaller savings. South Dakota homeowners are expected to save the least, with an average of $1,033 annually, followed closely by Alaska ($1,052), Nevada ($1,090), Tennessee ($1,097), and New Hampshire ($1,101). Redfin's senior economist, Asad Khan, noted that for residents in these states, significant benefits primarily occur if their property taxes alone surpass $10,000, and even then, the savings are modest. He also pointed out that all five of the states with the lowest savings lack a state income tax, making it less likely for homeowners to have previously exceeded the original $10,000 cap.

The proportion of homeowners who could benefit from this increased cap varies considerably across states. Massachusetts boasts the highest rate, with 85.5% of households potentially gaining if they itemize deductions. New Jersey (84.2%), Oregon (79.8%), New York (75.8%), and California (74.3%) also show high percentages. In stark contrast, only 1% of Tennessee homeowners are anticipated to benefit, the lowest figure nationwide. Other states with minimal impact include Nevada (1.2%), Wyoming (2.2%), South Dakota (2.8%), and Alaska (3.3%). Khan explained that the wide variation in benefits is due to the diverse mix of home values, property taxes, and income taxes in different regions, citing West Virginia as an example where nearly a third of homeowners could benefit despite having the lowest median home value in the country.

While the expanded SALT deduction offers considerable savings for many, its impact on home prices is expected to be limited. Khan suggested that in states like Illinois, where potential tax savings are high relative to home prices, the new cap might encourage some homebuyers to increase their budgets, potentially stimulating demand and driving up prices. However, in more expensive coastal metropolitan areas, these tax breaks are modest compared to overall home values. The report indicates that homeowners in Midwest cities such as Cleveland, Indianapolis, Chicago, and Pittsburgh are likely to see more substantial returns in relation to their property prices.

This federal tax policy adjustment has created a varied landscape of financial benefits for homeowners across the United States. While high-tax coastal states and metropolitan areas are experiencing substantial annual savings, primarily due to higher property and income tax rates, states with lower tax burdens or no state income tax are seeing more moderate or minimal advantages. This divergence highlights how federal tax policies can interact with local economic conditions to produce distinct outcomes for taxpayers depending on their geographical location and individual financial circumstances.