A recent comprehensive study has unveiled a notable transformation within the United Kingdom's buy-to-let property landscape: a substantial proportion of newly formed property ventures now involve non-British investors. This development, rooted in an analysis of corporate registry data, indicates that approximately 20% of all buy-to-let limited companies established over the past year have at least one foreign shareholder. This evolving pattern reflects broader changes in global migration and investment strategies, with a clear shift towards leveraging corporate structures for property acquisition due to inherent tax advantages. The findings illuminate how international capital continues to play a pivotal role in shaping the domestic housing market.

The estate agency Hamptons conducted an in-depth examination of records from Companies House, revealing that one in five of the buy-to-let limited companies newly incorporated last year reported at least one shareholder who is not a citizen of the United Kingdom. While some of these individuals may reside abroad, a considerable number are believed to be non-UK citizens living within Britain. Aneisha Beveridge, a leading researcher at Hamptons, pointed out that while foreign-based investors contribute to this trend, the primary driver for these non-UK nationals is domestic demand. The composition of these investors has also seen a marked change. Before 2021, a significant portion of this demand originated from EU nationals residing in the UK. However, recent years have witnessed a pivot, aligning with shifts in overall migration patterns. Investors from India and Nigeria are now notably more inclined to acquire UK buy-to-let properties through limited company frameworks.

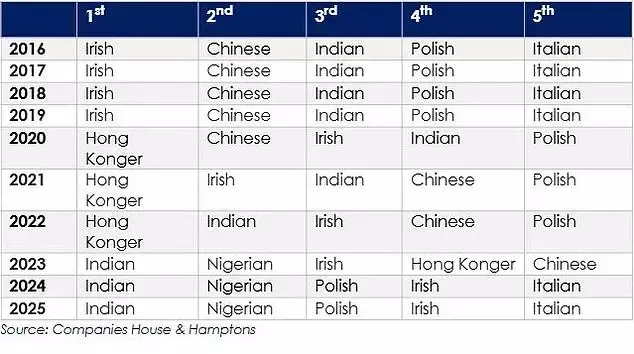

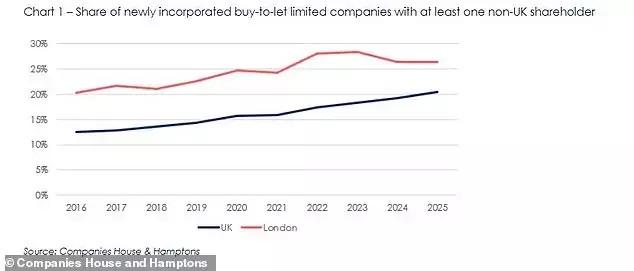

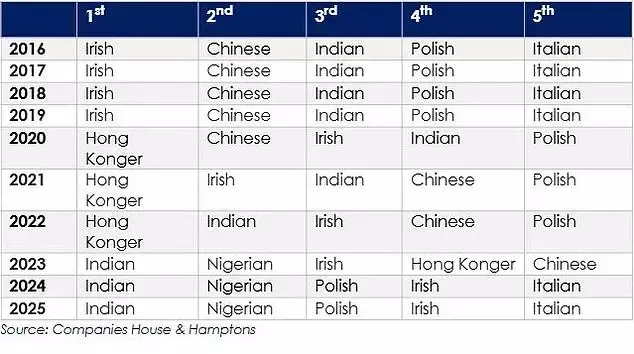

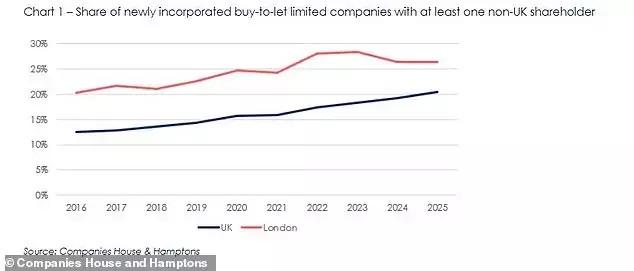

The data further illustrates a persistent upward trajectory in the involvement of overseas shareholders in buy-to-let companies, with an increase observed in nine out of the last ten years. In 2016, this figure stood at 13%, indicating a steady rise in foreign engagement within the sector. It is worth noting that while these companies may be newly formed, they often facilitate the transfer of properties previously held by landlords in their personal names, capitalizing on the benefits of corporate ownership. Among the nationalities forming new buy-to-let companies, Indian investors have consistently constituted the largest group since 2023, followed by those from Nigeria, Poland, Ireland, and Italy. Interestingly, the share of shareholders from EU countries has decreased since Brexit, mirroring general migration trends. In 2016, EU nationals accounted for about 65% of non-UK shareholders, a figure that has dropped to 49% by 2025. Despite this, certain Eastern European nationalities, such as Polish and Romanian investors, have bucked the trend, establishing a greater number of new buy-to-let companies in the first half of 2025 compared to 2016.

Beveridge emphasized that despite prevailing challenges within the landlord sector, the allure of UK buy-to-let remains strong for non-UK nationals. While London has historically been a magnet for international property investors, drawing interest from East Asia, the US, and the EU, demand is increasingly diversifying. Foreign investment is steadily moving into lower-value markets beyond the capital, regions that have recently experienced the most significant growth in both house prices and rental yields. London continues to lead in the proportion of non-UK shareholders in registered buy-to-let companies, with 27% of new registrations in the capital by non-UK nationals this year. This percentage escalates significantly in boroughs like Kensington & Chelsea (54%) and Hammersmith & Fulham (51%). Nevertheless, regions outside London have seen the most substantial growth in foreign ownership. Between 2016 and 2025, the East Midlands, West Midlands, and Scotland more than doubled their share of new non-UK national landlords. Runnymede in Surrey recorded the highest proportion of new companies established by non-UK nationals this year, reaching 59% across all local authorities.

The escalating trend of landlords utilizing limited companies to hold their buy-to-let properties is largely attributable to the potential tax advantages they offer. A previous Hamptons report highlighted this surge, noting a 332% increase in buy-to-let companies between February 2016 and February 2025, with numbers rising from 92,975 to 401,744. The principal advantage of incorporating property holdings is the disparity between corporation tax and income tax. Corporation tax, applicable to companies, is considerably lower than income tax, which individual landlords are subject to. This allows landlords to retain more profit within the company, facilitating faster reinvestment into additional properties. Furthermore, company landlords can fully offset their mortgage interest against rental income before taxation, a benefit not extended to individual landlords who only receive tax relief on 20% of their mortgage interest payments. Effectively, individual landlords are taxed on turnover, whereas company landlords are taxed solely on profit. Hamptons estimates that approximately 70% to 75% of new buy-to-let acquisitions are now structured within a company framework.