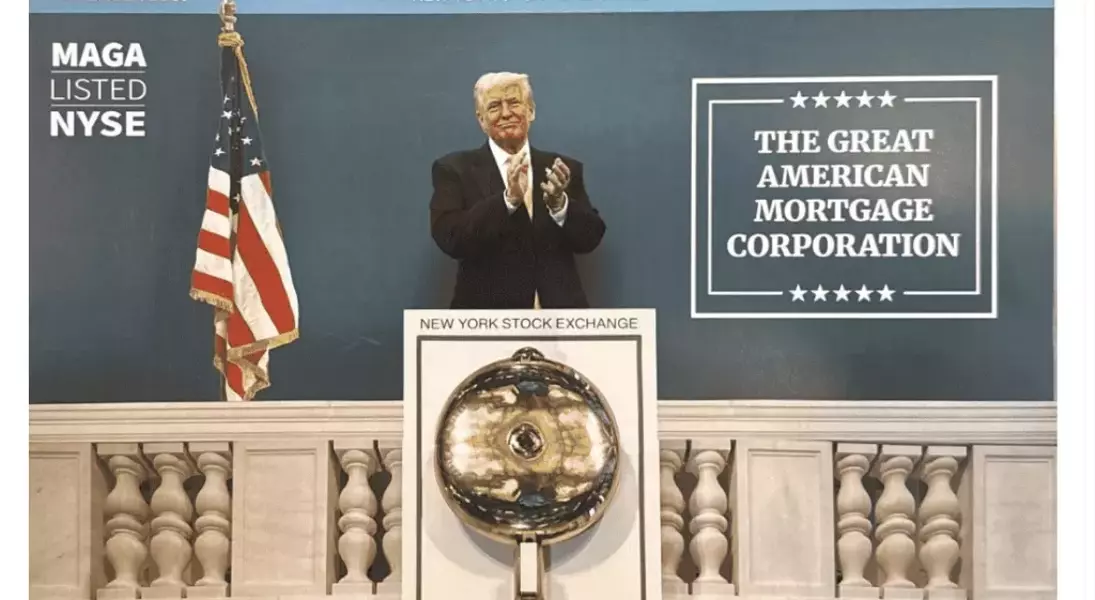

Former President Donald Trump has reignited discussions about the potential privatization of government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac. His recent pronouncements suggest an ambitious plan to take these entities public, possibly as early as late 2025, a move that could significantly reshape the landscape of the American mortgage market. This initiative, which he has hinted might consolidate the two under a new banner, the Great American Mortgage Corporation, aims to transition these key players from conservatorship to publicly traded companies. However, this complex undertaking is met with considerable doubt from financial experts who question the aggressive timeline and the substantial logistical hurdles involved.

A primary concern for stakeholders across the mortgage industry is the continuation of a government guarantee post-IPO. Such a guarantee is widely considered crucial for ensuring the stability and affordability within the housing finance system, directly influencing mortgage rates and overall market confidence. Trump's past statements indicate an awareness of this need, affirming his commitment to maintaining implicit government backing to prevent a surge in borrowing costs for homeowners. This delicate balance between privatization and market assurance will be central to any successful reform.

The Proposed Privatization Plan and Market Receptivity

Donald Trump has outlined a plan to bring Fannie Mae and Freddie Mac to the public market, potentially under the consolidated identity of the Great American Mortgage Corporation, with an anticipated timeline stretching into late 2025. This initiative follows earlier reports from The Wall Street Journal and has been amplified by Trump himself through social media. While specific financial details are sparse, projections suggest the IPO could generate approximately $30 billion, with some officials estimating the combined market value of the GSEs at over $500 billion. The sheer scale and speed of this proposed transformation have, however, elicited considerable caution from financial analysts.

Industry experts, including those from Keefe, Bruyette & Woods and Wells Fargo, have voiced skepticism regarding the feasibility of completing such a massive endeavor by the end of 2025. They highlight the intricate regulatory and financial adjustments required, particularly concerning capital levels, which typically demand a more extended preparation period. The complexity of transitioning these deeply integrated entities from government conservatorship to public ownership within a year suggests that the proposed timeline might be overly optimistic. This significant undertaking would necessitate meticulous planning and execution to navigate the inherent challenges effectively, potentially extending the process beyond initial targets.

Balancing Market Stability with Government Guarantee

A critical aspect of the proposed IPO for Fannie Mae and Freddie Mac is the preservation of a government guarantee, a factor paramount to maintaining the stability and efficiency of the U.S. mortgage market. Stakeholders across the housing industry emphasize that such a guarantee is indispensable for ensuring liquidity, managing risks, and, most importantly, keeping mortgage rates affordable for consumers. Without this backing, there are widespread concerns that the cost of homeownership could increase significantly, potentially disrupting the broader housing market. Donald Trump has previously indicated his understanding of this necessity, pledging that any move to privatize would not compromise the implicit government guarantees that underpin the system.

The administration’s commitment to preventing an increase in mortgage rates is a guiding principle in their approach to GSE reform. HousingWire's Lead Analyst, Logan Mohtashami, points out that the administration would likely avoid any action that could destabilize mortgage pricing. He views Trump's public statements on social media as "test balloons," gauging public and market reactions to the proposals. This cautious approach suggests that while the intent to privatize is clear, the final strategy will likely prioritize market stability and affordability, ensuring that the transition does not adversely impact the broader economy or prospective homeowners. The eventual release of comprehensive details will provide crucial clarity on how these competing objectives will be reconciled.