Despite a robust performance in its second quarter, Figma, the innovative digital design software firm, has seen a considerable reduction in its share price. While the company's initial public offering was met with enthusiastic investor response, leading to a soaring stock valuation, subsequent market adjustments have prompted a reassessment of its investment appeal. This downturn is largely attributed to a revised sales outlook for the coming quarter and the impending expiration of share lock-up periods for early investors and employees, which could introduce more shares into the market.

Figma's Recent Financial Landscape and Market Reaction

On September 3, 2025, Figma released its inaugural earnings report as a publicly traded entity, shedding light on its second-quarter performance. The report indicated a remarkable 41% year-over-year surge in revenue, reaching $249.6 million, complemented by a substantial increase in gross profit to $221.8 million from $137.6 million in the prior year, signaling effective cost management. The company's financial health was further underscored by a solid balance sheet, boasting $2 billion in total assets and a significant cash reserve of $621.6 million. However, the projected third-quarter sales, ranging between $263 million and $265 million, signify a deceleration in growth compared to previous periods, which appears to have tempered investor enthusiasm. This revised forecast, alongside the full-year revenue projection of $1 billion (representing 37% year-over-year growth), suggests a potential slowdown in the company's rapid expansion. This outlook, coupled with the imminent end of the lock-up period allowing insiders and employees to sell shares, has contributed to the downward pressure on Figma's stock price. Despite these market fluctuations, Figma's core business remains robust, with a growing customer base, particularly those with significant annual recurring revenue, underscoring the sustained demand for its products.

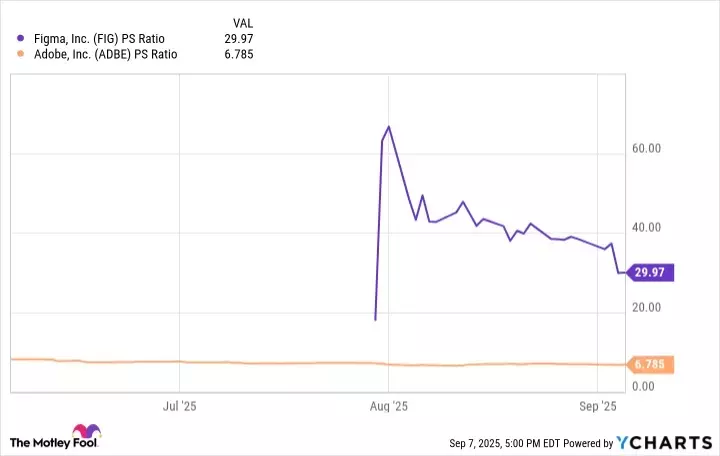

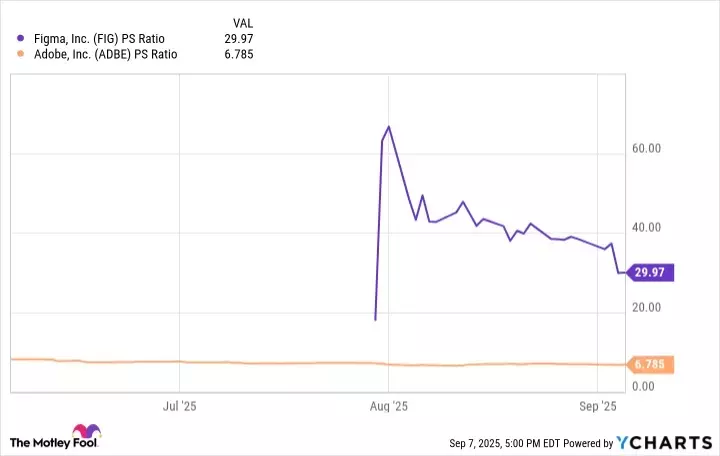

The recent dip in Figma's stock presents a complex scenario for potential investors. While the company's underlying business health and product popularity are undeniable, its valuation remains elevated when compared to industry peers like Adobe. Therefore, a judicious approach would involve monitoring Figma's performance over several quarters and awaiting a more favorable valuation before making any investment decisions. This period of observation would allow investors to better understand the company's long-term growth trajectory and market stability.