Ethereum, the second-largest cryptocurrency by market capitalization, is facing a growing risk of a short-squeeze that could potentially help its price surge. The cryptocurrency's futures market is showing signs of extreme leverage, indicating that a significant number of traders are betting on a continued price decline. If Ethereum's price were to surge unexpectedly, these traders could be forced to cover their positions, potentially driving the price higher in a potential short squeeze, in which short sellers would become forced buyers to cover their positions.

Uncovering the Potential Ethereum Short Squeeze

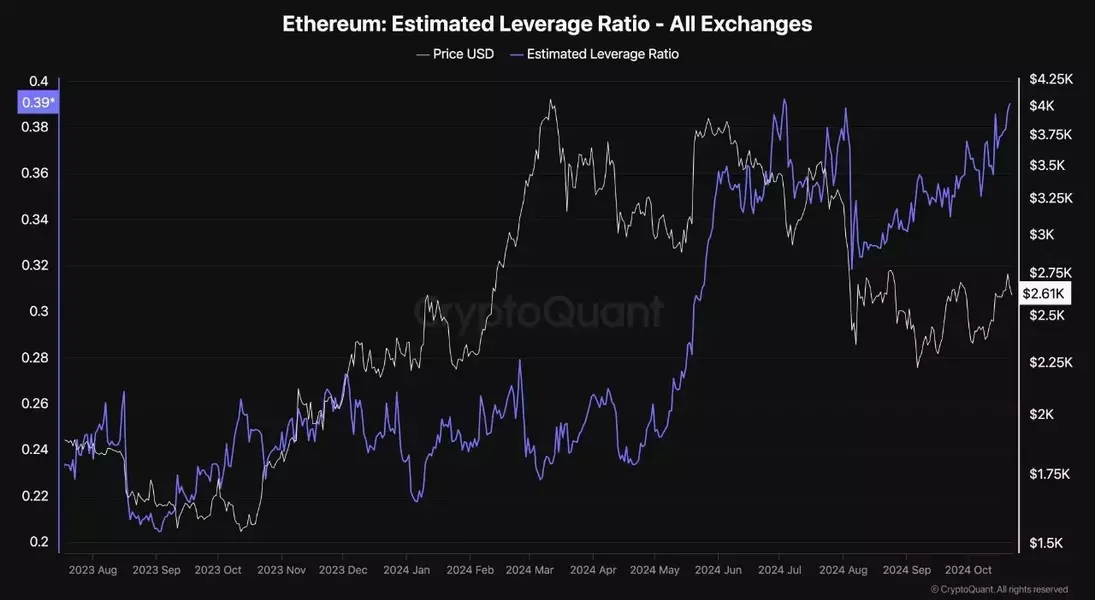

Leveraged Positions on the Rise

A key metric for gauging the level of risk in the futures market is the Estimated Leverage Ratio (ELR), which according to CryptoQuant analyst 'ShayanBTC' has been steadily rising in recent months, suggesting an increase in leveraged positions. Given Ethereum's recent underperformance relative to Bitcoin, the metric implies that many traders are opening high-leverage short positions. This leaves Ethereum vulnerable to a potential short-squeeze, as a surge in price could force these traders to close their positions, further driving the price higher.Overheated Futures Market

The futures market is now considered overheated, with leverage at potentially dangerous levels according to the analyst. This leaves Ethereum susceptible to a short-squeeze, which could create a positive feedback loop, driving the price even higher as more traders scramble to close their positions. With Ethereum's 100-day moving average at $2,700, the level is seen as a critical resistance level for the cryptocurrency.Potential Price Surge

If a short squeeze leads to a breakout above the $2,700 level, the cryptocurrency's price could keep on climbing. As reported, another cryptocurrency analyst predicted Ethereum's price could hit a $10,000 high after breaking out of an ascending trendline pattern formed with symmetrical triangles. This suggests that a successful short-squeeze could propel Ethereum to new heights, catching many traders off guard and potentially leading to a significant price surge.Implications for Investors

The potential for a short-squeeze in the Ethereum futures market presents both risks and opportunities for investors. Those with long positions may benefit from a sudden price surge, while short-sellers could face significant losses if forced to cover their positions. Investors should closely monitor the Ethereum futures market and the ELR metric to gauge the level of risk and potential for a short-squeeze. Diversification and prudent risk management strategies may be crucial in navigating the volatile cryptocurrency market.You May Like