Emerging Markets Struggle as China's Stimulus Fails to Lift Sentiment

In a surprising turn of events, currencies in developing economies have mostly weakened against the US dollar, despite China's new stimulus measures. The MSCI index of emerging currency returns dropped 0.1%, with the South African rand and South Korean won losing about 0.7% against the greenback. The equities equivalent also pared initial gains as optimism over the impact of the fresh stimulus measures on the Chinese economy abated.Navigating the Turbulent Landscape of Emerging Markets

China's Stimulus Measures Fall Short of Expectations

Investors had high hopes for the outcome of the highly-anticipated briefing in Beijing on Saturday by Finance Minister Lan Fo'an. The minister pledged new steps to support the property sector and hinted at greater government borrowing, but fell short of providing the headline figure for the stimulus and didn't announce additional plans to shore-up consumption. This disappointing fiscal news out of China has curtailed upside momentum for risk assets and offered support for the US dollar, as there is greater room for an upward reassessment in US interest rate expectations relative to other major economies.Emerging Markets Struggle to Regain Footing

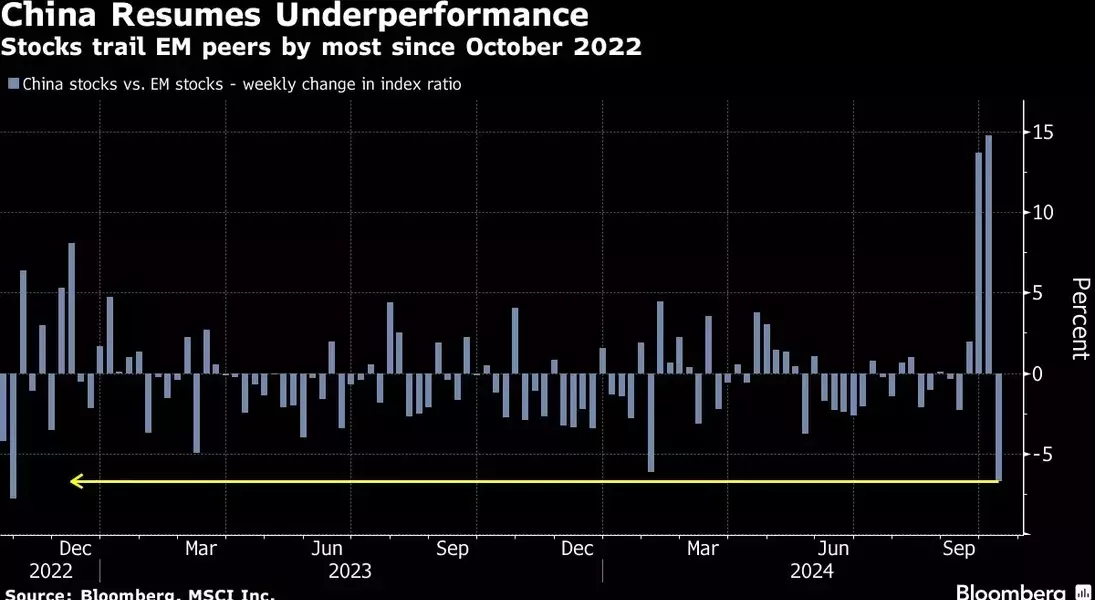

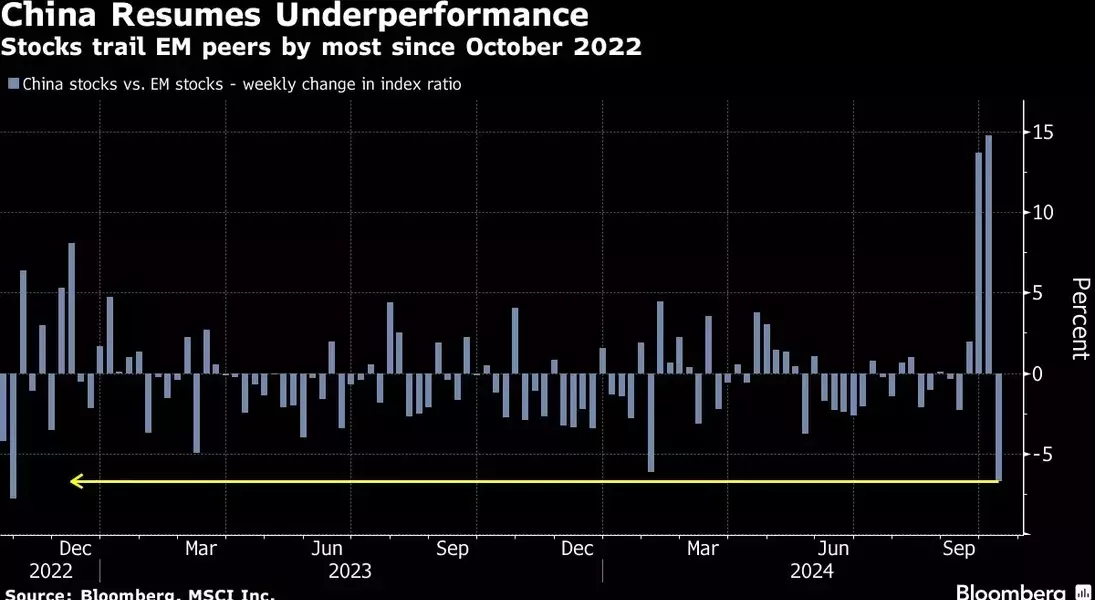

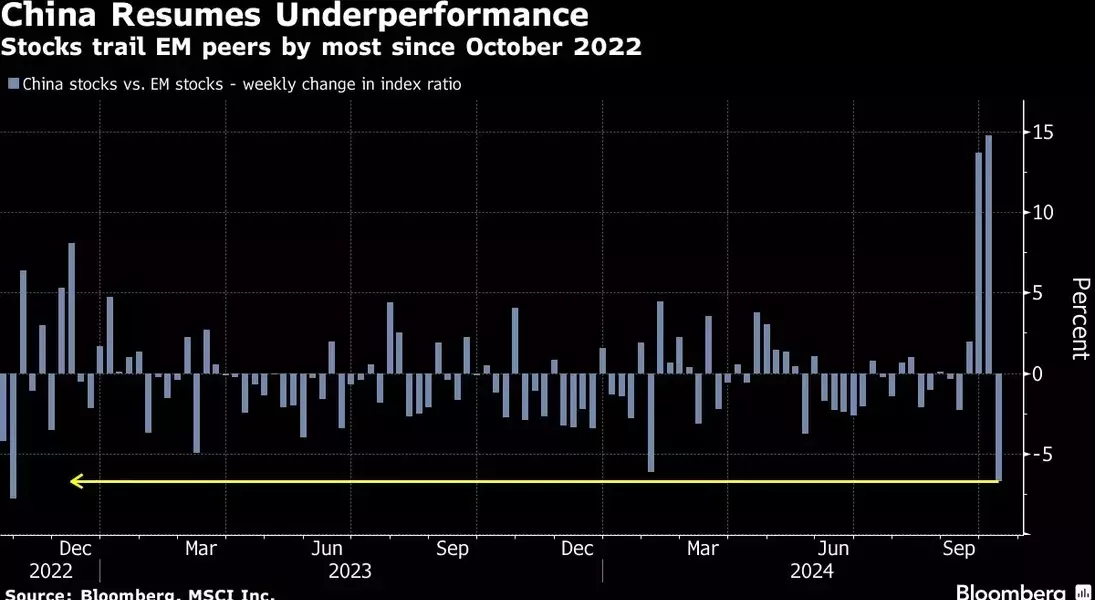

The decline in Hong Kong-listed shares has offset the impact on the EM equity benchmark, as Chinese mainland stocks jumped on Monday. This underperformance of Chinese stocks, which had initially outperformed the rest of emerging markets amid the initial enthusiasm about stimulus, has resumed. Chinese stocks trailed EM stocks on Monday, building on the biggest weekly underperformance since October 2022 last week.Diverging Fortunes in Emerging Europe

In emerging Europe, the Hungarian forint outperformed regional peers with a 0.2% gain to the euro, and holding mostly flat against the dollar, after the government unveiled the latest plan to help growth before 2026 elections. The Economy Ministry in Budapest on Monday circulated a draft measure designed to allow savers to tap into their private pension funds tax free to buy or renovate property next year.Implications for Investors and Policymakers

The muted reaction to China's stimulus measures and the continued underperformance of Chinese stocks have raised concerns among investors and policymakers. The bias for a stronger US dollar, driven by the potential for an upward reassessment in US interest rate expectations, could further exacerbate the challenges faced by emerging markets. Policymakers in these economies will need to carefully navigate the turbulent landscape, implementing targeted measures to support their respective currencies and equity markets.As the global economic landscape continues to evolve, the performance of emerging markets will remain a crucial barometer for the overall health of the financial system. Investors and policymakers alike will need to closely monitor the developments in these markets, adapting their strategies and policies to ensure resilience and stability in the face of ongoing uncertainties.You May Like