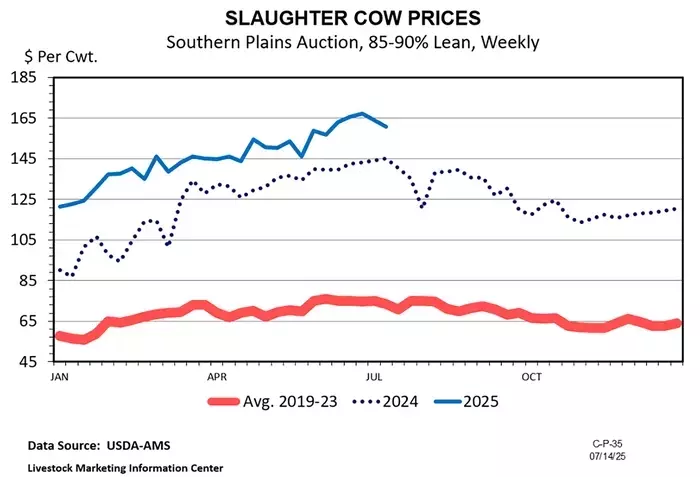

The cattle market is currently witnessing a remarkable surge in cull cow prices, reaching unprecedented levels in 2025. This robust performance is primarily attributed to a notable reduction in slaughter numbers for both beef and dairy cows, coupled with a resilient consumer appetite for beef products, particularly ground beef. Furthermore, evolving trends in beef quality grading have indirectly fueled the demand for lean trim, a key component derived from cull cows, contributing significantly to their elevated market value. The confluence of these supply and demand forces has established a dynamic and highly favorable environment for producers in the cull cow sector.

Soaring Cull Cow Prices: A Deep Dive into Market Dynamics

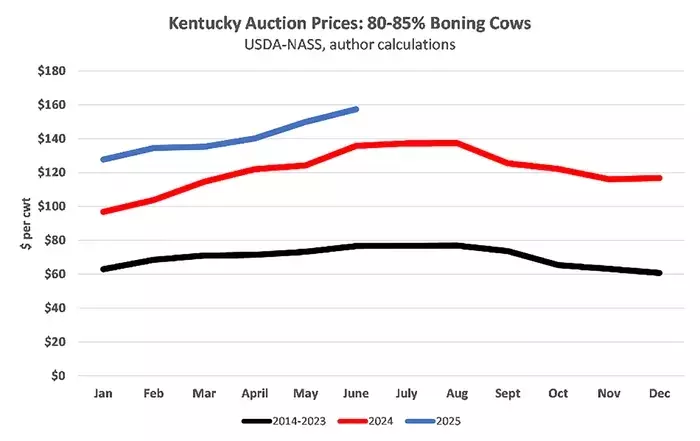

In a significant development for the livestock industry, the cull cow market has reached historic highs in 2025. Specifically, Kentucky’s monthly average price for 80-85% average dress boning cows achieved a record in June and is poised to set another in July. These figures represent a substantial increase, with June 2025 prices standing 16% higher than those recorded in June 2024 and an impressive 62% above June 2023 levels. This upward trend is not isolated, but rather a widespread phenomenon observed across various regions of the United States.

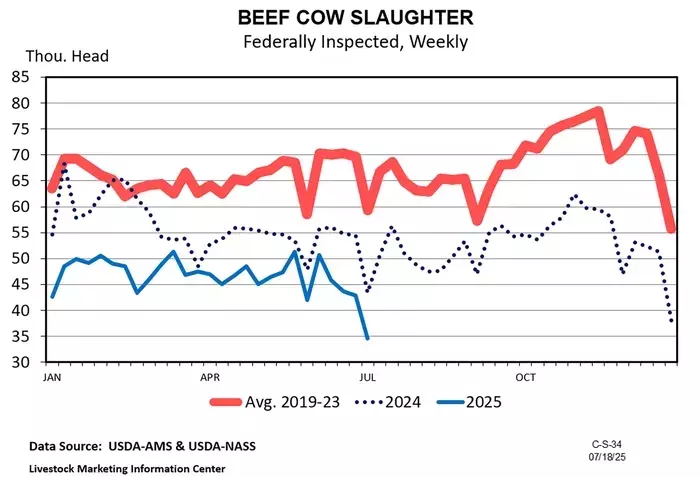

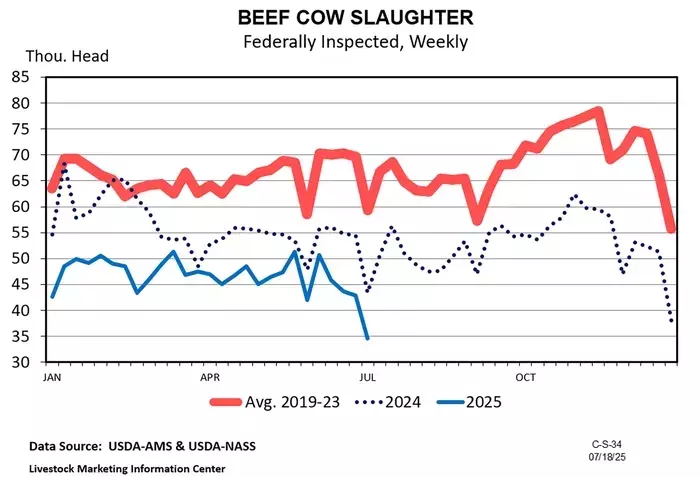

Several interconnected factors are driving this exceptional market strength. A primary contributor is the sharp reduction in slaughter rates. As of late July 2025, beef cow slaughter has seen a 17% year-to-date decrease compared to 2024. Should this pattern persist throughout the year, it could lead to a reduction of over 450,000 beef cows processed. This decline follows aggressive culling practices between 2021 and 2023, which likely removed less productive animals from the herd. Additionally, the current strong calf market incentivizes producers to retain their cows longer than typical, further tightening supply.

The diminished supply is exacerbated by a 7% year-to-date drop in dairy cow slaughter, contributing to the overall scarcity of cull animals. On the demand side, consumer preference for beef has remained consistently strong, despite ongoing discussions about tight supplies. Ground beef, a significant portion of overall beef consumption, relies heavily on cull cow slaughter for its production. It is also plausible that elevated retail prices for premium cuts are steering some consumers towards more affordable ground beef options, thereby boosting its demand.

A less recognized but equally important factor influencing the market is the improvement in beef quality grades. Over recent years, cattle have been brought to higher slaughter weights, resulting in a substantial increase in quality grades. In 2024, 10.6% of cattle were graded Prime, a figure that has climbed to approximately 11.8% in 2025. This enhanced marbling, while desirable, also means a higher fat content in the trim. Consequently, there is an amplified need for lean trim for blending purposes, and cull cows serve as a crucial source for this lean component. This increased demand for lean trim further strengthens the market for cull cows.

Ultimately, the current robust pricing in the cull cow market is a complex interplay of reduced supply, unwavering consumer demand for ground beef, and the evolving dynamics of beef quality and its impact on the need for lean trim. These elements collectively paint a picture of a flourishing segment within the broader cattle industry.

Reflections on a Resilient Market: Adaptability and Opportunity in the Beef Industry

The current state of the cull cow market provides fascinating insights into the intricate balance of supply, demand, and evolving consumer preferences within the agricultural sector. From a reporter's perspective, this story underscores the dynamic nature of commodity markets, where seemingly disparate factors like consumer ground beef consumption and the quality grading of prime cuts can intricately link to influence the value of an often-overlooked segment of the cattle population. It highlights the remarkable resilience of the beef industry, demonstrating its ability to adjust to changes in herd management, processing trends, and market signals. For producers, this period of high cull cow prices represents a significant opportunity, rewarding sound management practices and strategic herd planning. It emphasizes that even the 'cull' portion of the herd can become a valuable asset under the right conditions, reminding us that every aspect of the agricultural supply chain holds economic importance and potential for innovation.