Navigating the Crypto Landscape: CoinDesk Indices Unveils Daily Market Insights

In the ever-evolving world of digital assets, CoinDesk Indices has once again provided a comprehensive market update, shedding light on the performance of the CoinDesk 20 Index. This broad-based index, traded globally across multiple platforms, offers a valuable snapshot of the cryptocurrency market's ebbs and flows.Unlocking the Crypto Puzzle: CoinDesk Indices Decodes the Daily Trends

The CoinDesk 20 Index: A Barometer of Crypto Sentiment

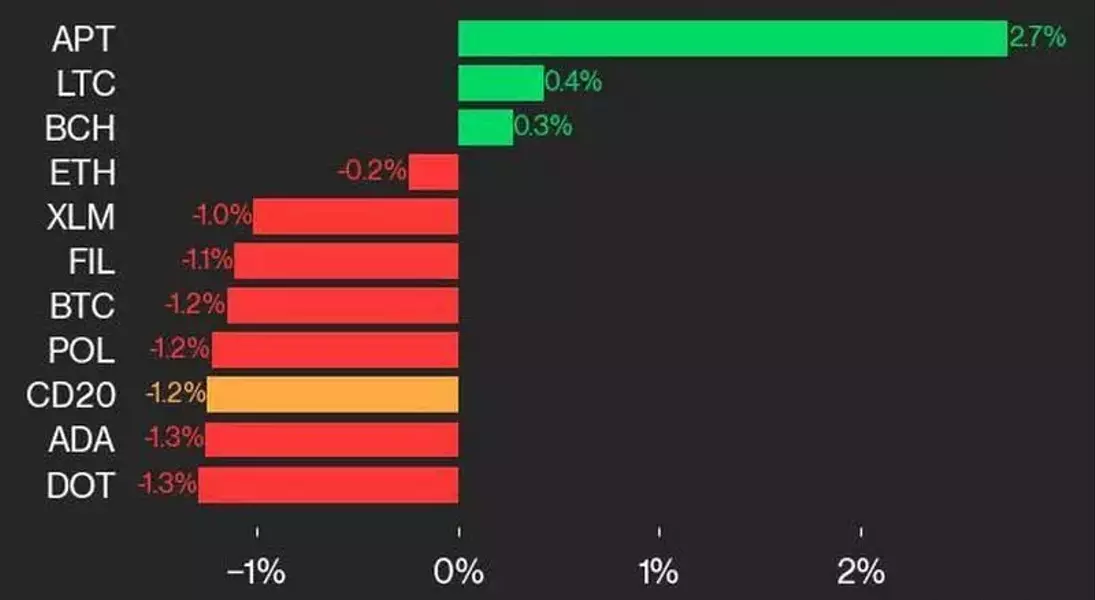

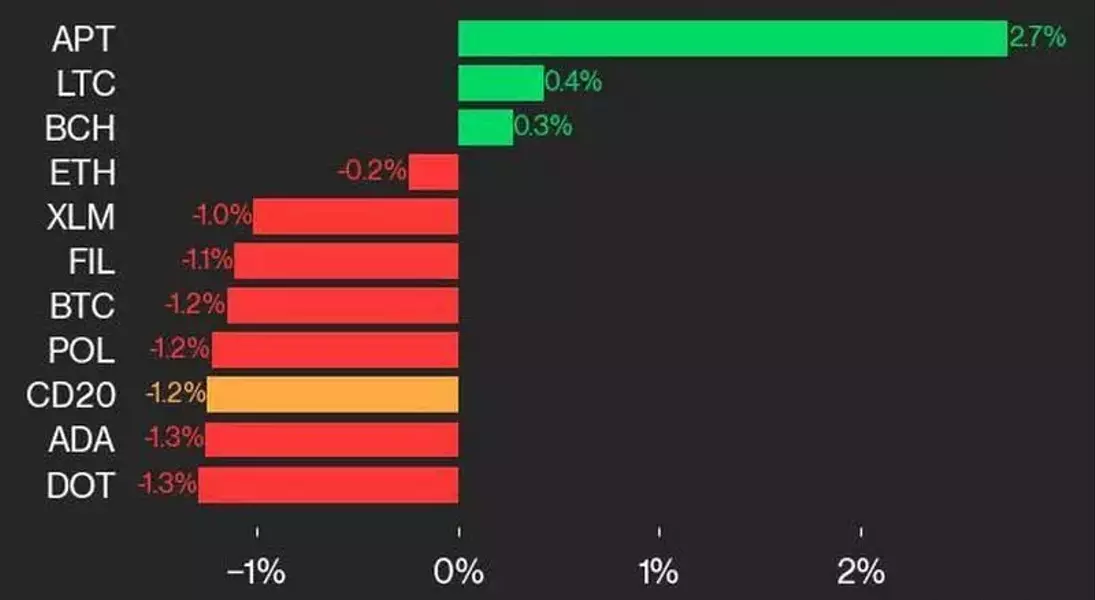

The CoinDesk 20 Index, a widely-followed benchmark in the digital asset space, currently stands at 1930.14, reflecting a 1.2% (-24.34) decline from the previous day's close. This slight dip in the index highlights the dynamic nature of the cryptocurrency market, where volatility and fluctuations are often the norm.Despite the overall downward trend, a closer examination reveals that three out of the 20 assets within the index are trading higher. This divergence underscores the nuanced and complex nature of the crypto landscape, where individual assets can exhibit varying performance based on a multitude of factors, including market sentiment, regulatory developments, and technological advancements.

Among the leaders in the CoinDesk 20 Index, Aptos (APT) stands out with a 2.7% gain, while Litecoin (LTC) has managed to eke out a modest 0.4% increase. These positive movements suggest that certain cryptocurrencies are resonating with investors, potentially due to their unique features, use cases, or perceived growth potential.

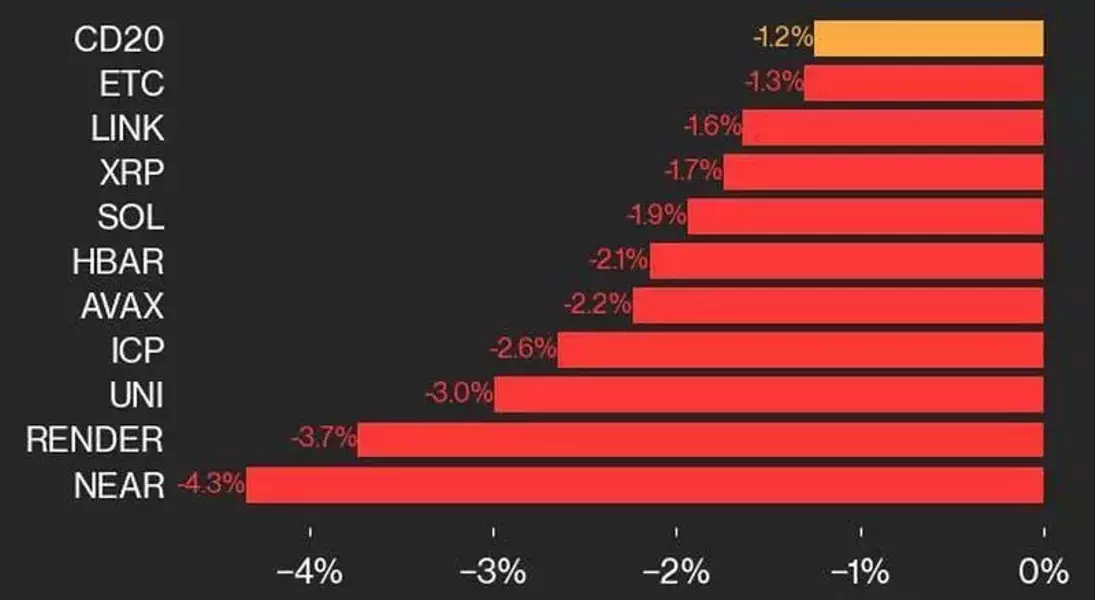

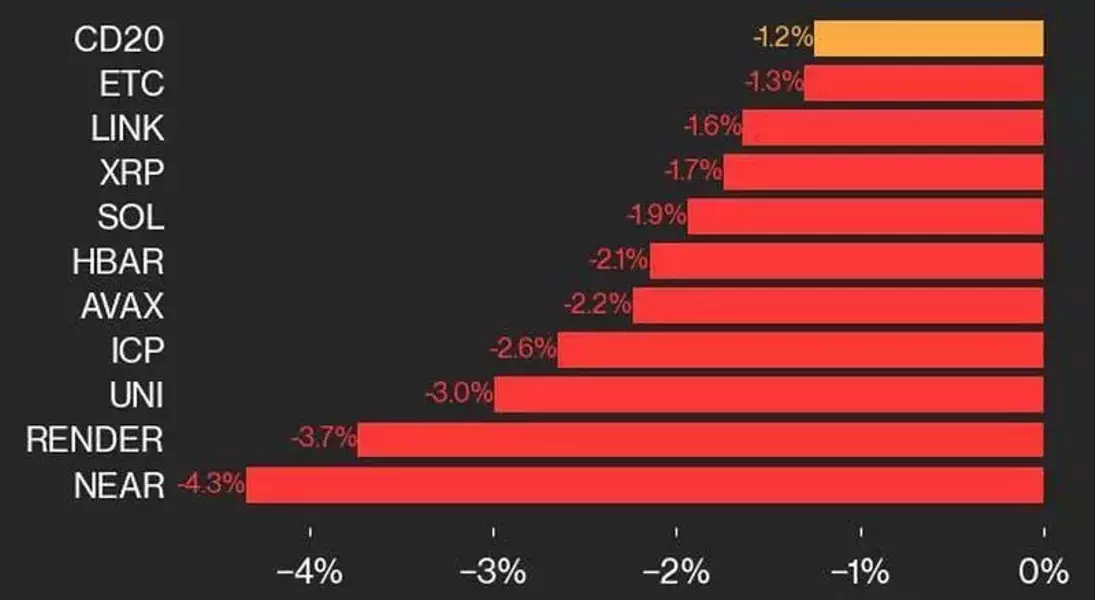

Laggards in the Crypto Realm: Navigating the Downturns

On the flip side, the CoinDesk 20 Index also saw some notable laggards, with Near Protocol (NEAR) and Render Network (RENDER) experiencing declines of 4.3% and 3.7%, respectively. These underperformers highlight the inherent risks and volatility inherent in the cryptocurrency market, where even well-established projects can face headwinds.The performance of NEAR and RENDER serves as a reminder that the crypto landscape is not without its challenges. Factors such as regulatory uncertainty, competition from emerging technologies, and shifting investor sentiment can all contribute to the ebb and flow of individual cryptocurrency prices.

As investors navigate this dynamic market, the insights provided by CoinDesk Indices can serve as a valuable tool in understanding the broader trends and identifying potential opportunities or risks. By closely monitoring the CoinDesk 20 Index and its constituent assets, market participants can gain a more comprehensive understanding of the crypto ecosystem and make informed decisions.

Navigating the Crypto Landscape: A Holistic Approach

The CoinDesk 20 Index, as a broad-based representation of the cryptocurrency market, offers a holistic view of the industry's performance. By tracking the movements of this index, investors, analysts, and industry stakeholders can gain a deeper understanding of the overall sentiment and dynamics shaping the digital asset landscape.Beyond the index itself, CoinDesk Indices' comprehensive market updates provide valuable insights that can inform investment strategies, risk management, and strategic decision-making. By delving into the nuances of individual asset performance, the analysis sheds light on the factors driving the market, empowering market participants to navigate the crypto ecosystem with greater confidence and foresight.

As the cryptocurrency industry continues to evolve, the role of CoinDesk Indices in providing reliable and insightful market data becomes increasingly crucial. By serving as a trusted source of information and analysis, the company plays a vital role in fostering transparency and facilitating informed decision-making within the dynamic and rapidly-changing world of digital assets.