The debut of polysilicon futures on the Guangzhou Futures Exchange marks a significant step in stabilizing a market plagued by price volatility. On its first day, trading saw prices surge to their upper limit, reflecting producers' commitment to cutting output. This new financial instrument aims to provide hedging opportunities for an industry facing overcapacity and reduced profitability. The exchange also plans to introduce options contracts in the near future, following successful ventures in other green materials like lithium.

Initial Trading Surge Signals Market Confidence

The introduction of polysilicon futures has been met with immediate interest from traders and investors. On the opening day, the most active June contract witnessed a robust performance, closing 7.7% higher at 41,570 yuan per ton. A total of 331,253 lots were traded, with the majority focused on the June contract. This strong start suggests that market participants are optimistic about the potential for this new financial tool to mitigate risks associated with price fluctuations.

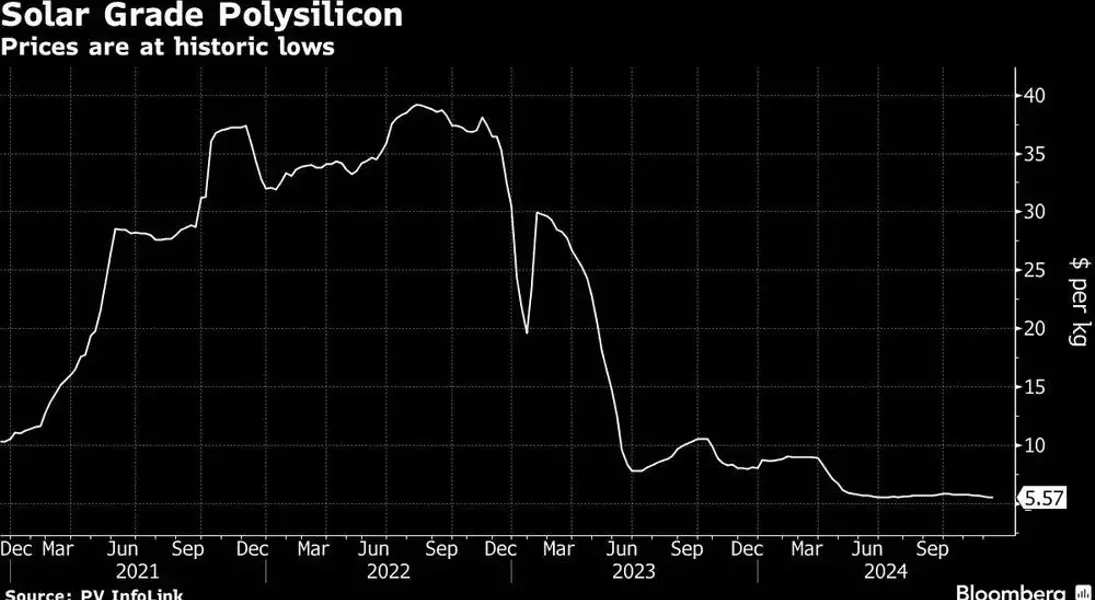

Trading volumes and price movements on the first day highlight the market's response to recent production cuts announced by major manufacturers. These adjustments aim to address the significant surplus in polysilicon supply, which has led to a nearly 90% decline in prices over the past two years. By reducing output, companies hope to rebalance supply and demand, thereby stabilizing prices and improving profitability. The initial trading activity indicates that market confidence is beginning to recover, as participants see the futures as a viable means to hedge against further volatility.

New Financial Instruments to Support Green Energy Sector

The Guangzhou Futures Exchange's venture into polysilicon futures reflects China's broader strategy to support its clean technology sector. As the world's largest producer of polysilicon, China has faced challenges due to overcapacity in the solar panel supply chain. The introduction of these futures contracts offers a new avenue for managing risk and enhancing market stability. The exchange has set margin requirements and price limits to ensure orderly trading, with plans to expand into options contracts in December.

This development aligns with China's efforts to promote economic growth through clean energy initiatives. The success of similar instruments for lithium, used in electric vehicle batteries, demonstrates the potential for green materials to drive both economic and environmental progress. By providing a platform for hedging and price discovery, the Guangzhou Futures Exchange is positioning itself as a key player in the global transition to renewable energy. The introduction of polysilicon futures not only addresses immediate market concerns but also supports long-term sustainability goals, ensuring that the solar industry can thrive amidst changing market conditions.