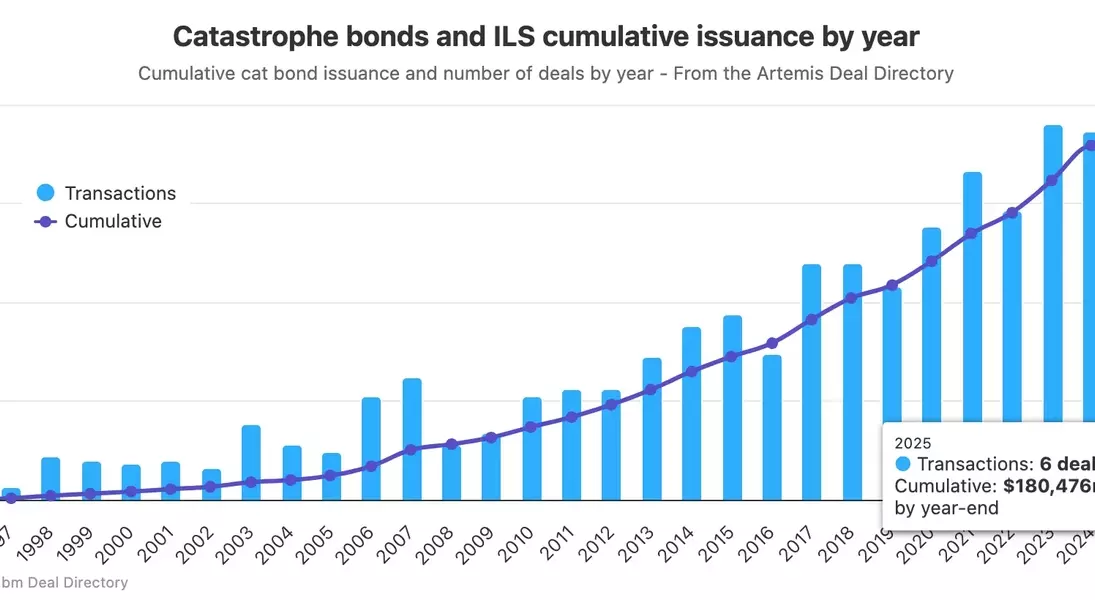

The market for catastrophe bonds and related insurance-linked securities (ILS) has achieved a significant milestone, surpassing a cumulative issuance value of $180 billion. This remarkable growth reflects the increasing importance of these financial instruments in managing risk, especially after two consecutive years of record-breaking issuances. Since its inception nearly three decades ago, this market has seen substantial expansion, with 2023 and 2024 alone contributing over $34 billion to the total. The year 2024 marked another high point, bringing in $17.7 billion from 93 transactions. This upward trend began in earnest around 2017, with only one year, 2019, falling below the $10 billion mark. The market's rapid growth underscores its resilience and attractiveness to both new and repeat sponsors.

Market Expansion and New Entrants Drive Growth

In the span of just a few months during early 2025, more than $1 billion in new capital has already entered the market through settled catastrophe bond issuances. This momentum is further fueled by the influx of new sponsors, with over 40 fresh entities entering the market in the past three years. The robust activity suggests that the market continues to evolve and attract diverse participants. For instance, the first quarter of 2025 is shaping up to be particularly busy, with an additional $1.82 billion in potential transactions expected to close before the end of February. Analysts predict that this trend will likely continue throughout the quarter, indicating a strong start to the year.

Despite some fluctuations in spreads compared to the highs of 2023, the current levels remain attractive to investors and sponsors alike. The continued interest highlights the market's ability to adapt and innovate, pushing the boundaries of risk management solutions. As the market matures, it is increasingly becoming a vital tool for insurers and reinsurers to diversify their risk portfolios.

From a broader perspective, the growth of the catastrophe bond and ILS market signifies a shift towards more sophisticated financial mechanisms for handling catastrophic risks. The data provided by industry trackers like Artemis underscores the market's dynamism and potential for future expansion. With ongoing innovation and new entrants, the future of this sector looks promising.

This impressive growth not only reflects the market's resilience but also its strategic importance in the global financial landscape. As more players enter the fray and existing participants expand their activities, the market is poised to play an even greater role in shaping the future of risk management and financial stability.