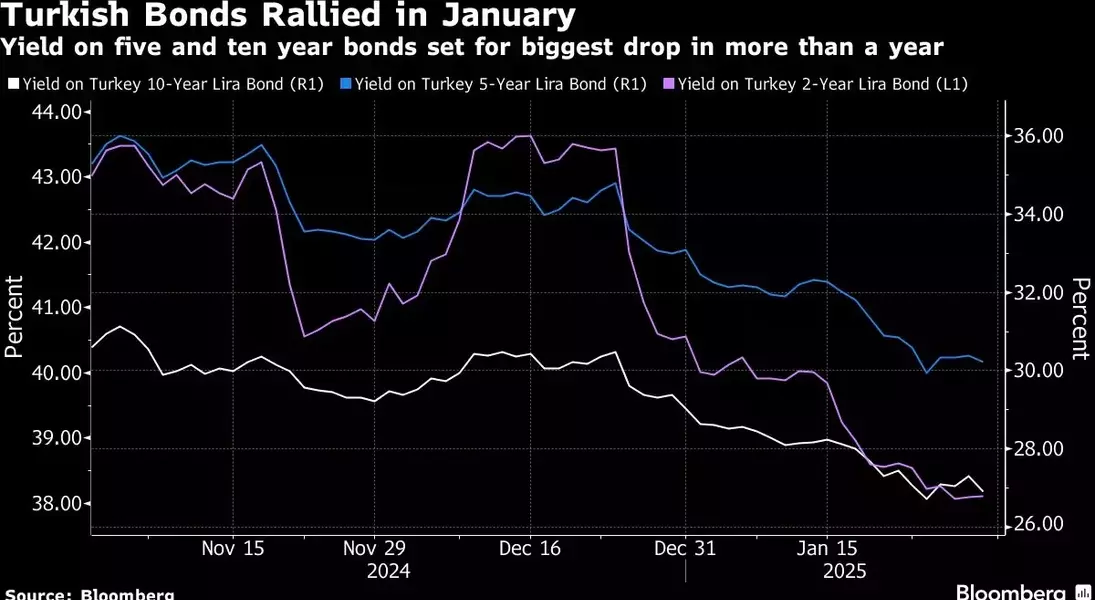

The Turkish bond market is experiencing a significant influx of investments as inflation decelerates and the central bank adopts an easing policy. Yields on medium to long-term government bonds have seen substantial declines, attracting both domestic and foreign investors. This trend marks a shift from currency products and niche instruments towards fixed-rate lira debt. With further rate cuts anticipated, experts predict continued downward pressure on yields, particularly in the mid-term segment of the yield curve.

Market Dynamics Drive Investment Surge

In recent months, Turkey's financial landscape has undergone notable changes, leading to a surge in investment flows into its bond markets. The decline in inflation rates has been a key factor, coupled with consecutive interest rate reductions by the central bank. Investors are now showing renewed interest in Turkish government bonds, especially those with longer maturities. This shift reflects growing confidence in the country’s economic policies and stability.

Since the beginning of the year, over $2 billion has flowed into the Turkish bond market, according to central bank data analyzed by Bloomberg. Foreign funds like Abrdn Investments have become bullish on fixed-rate lira debt for the first time in years. Other firms such as Ninety One Plc are positioning themselves in longer-maturity bonds to capitalize on high yields. The changing investor sentiment is evident as they move away from currency products and floating-rate debt towards more traditional fixed-income securities. This transition underscores a belief in sustained economic improvement and policy consistency.

Prospects for Continued Growth

The outlook for Turkey's bond market remains positive, with expectations of further rate cuts and declining inflation. Analysts predict that the 10-year part of the yield curve will offer attractive long-term investments if the current policy path is maintained. The inclusion of Turkey in major indices like JPMorgan’s GBI-EM Global Diversified Index could also attract additional inflows from index-tracking funds.

Tufan Comert, an emerging market strategist at BBVA SA, anticipates that the mid-term segment of the yield curve, specifically five to seven-year maturities, will attract the most interest. As inflation continues to moderate and the central bank maintains a cautious approach, the entire yield curve is expected to shift downwards. Investors are optimistic about locking in high yields for extended periods, making Turkish government bonds an appealing option. With interest rates currently at 45%, and forecasts predicting seven more cuts in 2025, the market is poised for sustained growth. The central bank aims to bring inflation down to 21% by year-end, reinforcing investor confidence in the country’s economic trajectory.