Impact of Mining Shares

Mining shares have been a key factor affecting the Canadian stock market. The decline in these shares on Thursday had a direct impact on the overall index. Mining companies often face fluctuations in commodity prices and market conditions, which can lead to volatility in their stock prices. In this case, the downward movement of mining shares contributed to the opening lower of the main stock index.For example, specific mining companies may have reported lower-than-expected earnings or faced challenges in their operations. This led to a sell-off in their stocks, dragging down the overall mining sector and subsequently affecting the broader market. The uncertainty surrounding global commodity markets also added to the pressure on mining shares.

Historical data shows that mining stocks have a significant influence on the Canadian stock market. During periods of economic uncertainty or when commodity prices are volatile, mining shares tend to be more sensitive and can cause significant fluctuations in the index. Investors need to closely monitor these stocks and understand the underlying factors driving their performance.

Response to Bank of Canada's Interest Rate Cut

The previous session's gains following the Bank of Canada's interest rate cut initially provided a boost to the stock market. However, on Thursday, the market's reaction was more mixed. The interest rate cut is typically seen as a stimulus measure to support economic growth, but its impact on the stock market can be complex.Some investors may have expected a more significant impact on corporate earnings and economic activity, while others may have been concerned about the potential inflationary effects of the rate cut. This divergence in opinion led to a more cautious approach among investors, resulting in the opening lower of the stock index.

According to economic research, interest rate cuts can have both positive and negative effects on the stock market. On one hand, lower interest rates can make borrowing cheaper for companies, potentially boosting their earnings and stock prices. On the other hand, they can also lead to inflationary pressures, which can erode the purchasing power of consumers and affect corporate profits.

Assessment of U.S. Economic Data

Investors were closely monitoring U.S. economic data as it can have a significant impact on global markets, including the Canadian stock market. Positive U.S. economic data can lead to increased investor confidence and a stronger global economy, while negative data can have the opposite effect.For instance, if U.S. economic indicators such as GDP growth, employment data, or consumer spending show signs of weakness, it can lead to a sell-off in global markets, including the Canadian stock market. On the other hand, strong U.S. economic data can provide a boost to global markets and support the performance of Canadian stocks.

Analysts often use U.S. economic data as a leading indicator for global economic trends. By closely following these data points, investors can gain insights into the direction of the global economy and make more informed investment decisions. In this case, the assessment of U.S. economic data added an additional layer of uncertainty to the Canadian stock market.

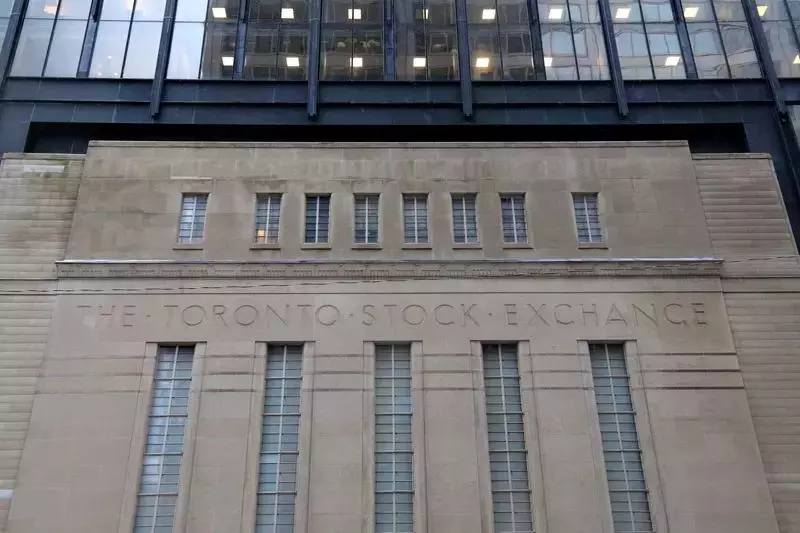

At 9:33 a.m. ET (13:33 GMT), the Toronto Stock Exchange’s S&P/TSX composite index was down 133.90 points, or 0.52%, at 25,253.80.(Reporting by Ragini Mathur; Editing by Vijay Kishore)