The S&P 500, a key indicator of the U.S. stock market, witnessed a significant turn of events on Wednesday. After a two-day losing streak, it staged a remarkable rally, which was triggered by the release of consumer price index data that met expectations. This development had a profound impact on various market sectors, with the tech-heavy Nasdaq Composite emerging as a standout performer. It closed above the 20,000 milestone for the first time, a feat that was largely driven by substantial gains in some of the most influential tech companies such as Tesla, Amazon, Alphabet, and Meta Platforms. These companies' strong performances not only contributed to the Nasdaq's ascent but also sent ripples through the entire market ecosystem.

Unprecedented Rally in S&P 500 and Nasdaq's Historic Milestone

The Impact of Consumer Price Index Data

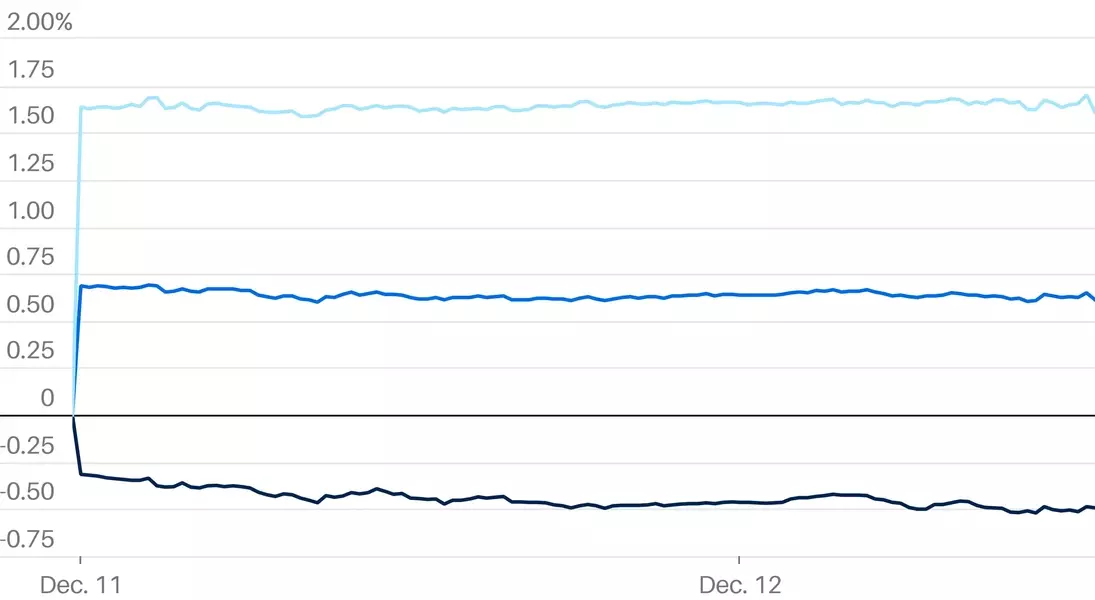

The release of consumer price index data played a crucial role in shaping the market's trajectory. When the data came in as expected, it provided a sense of stability and confidence to investors. This allowed them to regain their footing and initiate a rally in the S&P 500. The market responded positively to the news, as it indicated that inflationary pressures were under control. This, in turn, led to a reallocation of funds from defensive sectors to more growth-oriented ones. As a result, stocks across various sectors saw an uptick in prices, with the tech sector leading the way.The tech sector, with its innovative companies and high growth potential, has always been a key driver of market movements. The significant gains in Tesla, Amazon, Alphabet, and Meta Platforms on Wednesday were a testament to this. These companies have been at the forefront of technological advancements and have managed to maintain their competitive edge in an increasingly competitive market. Their strong performances not only boosted the Nasdaq Composite but also inspired confidence among other investors.The Significance of the Nasdaq Composite's Milestone

Closing above the 20,000 milestone is a significant achievement for the Nasdaq Composite. It represents a major milestone in the history of the tech sector and reflects the growing dominance of these companies. This milestone is not just a number but a symbol of the industry's strength and resilience. It shows that despite the challenges faced by the market, these tech giants have been able to deliver consistent growth and generate value for their shareholders.Moreover, the Nasdaq's ascent above 20,000 has broader implications for the economy. Tech companies play a crucial role in driving innovation and creating jobs, and their success can have a positive impact on other sectors as well. As these companies continue to grow and expand, they are likely to attract more investment and drive further economic growth. This, in turn, can lead to increased consumer spending and a more robust economy.The Future Outlook for the Tech Sector

The strong performance of the tech sector on Wednesday raises questions about its future outlook. While some experts believe that the rally is sustainable and that the tech companies will continue to drive market growth, others are more cautious. They argue that the market is already overvalued and that a correction may be imminent.However, it is important to note that the tech sector has shown remarkable resilience in the face of various challenges. These companies have a proven track record of innovation and adaptability, and they are likely to continue to play a crucial role in the global economy. As long as they can maintain their competitive edge and continue to deliver value to their shareholders, the tech sector is likely to remain a key driver of market growth.In conclusion, the S&P 500's rally and the Nasdaq's milestone are significant events that have captured the attention of investors and analysts alike. While there are uncertainties about the future, it is clear that the tech sector will continue to play a crucial role in shaping the market and driving economic growth. As these companies continue to innovate and expand, they are likely to create more opportunities for investors and contribute to the overall prosperity of the economy.