Broadcom, a prominent entity in the semiconductor industry, has recently demonstrated remarkable financial performance, largely driven by its escalating involvement in artificial intelligence. The company's stock has surged, significantly outpacing the general semiconductor market. This robust growth trajectory is underpinned by accelerating AI-related revenue, substantial new bookings, and the acquisition of additional key clients. Industry analysts foresee a continuation of this upward trend, positioning Broadcom as a compelling investment opportunity. The firm's strategic focus on AI processors appears to be yielding considerable dividends, setting the stage for sustained expansion and value creation in the evolving technological landscape.

Broadcom's recent financial disclosures highlight its impressive trajectory, with its stock experiencing a substantial rally over the past year. This growth far exceeds the performance of the broader PHLX Semiconductor Sector index, underscoring the company's strong market position. The catalyst for this remarkable ascent is largely attributed to Broadcom's robust engagement in the artificial intelligence domain. Following its fiscal 2025 third-quarter report, the company's shares climbed significantly, affirming its strong foothold in the burgeoning AI market. This performance has prompted discussions among investors regarding the sustainability of this growth and whether Broadcom's AI initiatives are substantial enough to propel further gains in the near future.

The AI Revolution: Powering Broadcom's Financial Ascent

Broadcom's latest quarterly report revealed a significant surge in both revenue and earnings, largely propelled by the escalating demand for its AI chips. The company's revenue witnessed a substantial year-over-year increase, with adjusted earnings following a similar upward trend, surpassing market expectations. A considerable portion of Broadcom's top-line growth is now derived from its custom AI processors, a segment that has seen remarkable expansion. Forecasts for the current fiscal quarter suggest continued acceleration in AI revenue, potentially contributing a substantial amount to the company's annual AI-related income. This rapid expansion in the AI sector is a key indicator of Broadcom's successful strategic pivot towards this high-growth market, solidifying its position as a major player in the AI hardware ecosystem.

The burgeoning artificial intelligence sector is undeniably a pivotal driver of Broadcom's impressive financial results. The company's recent earnings report showcased a significant leap in its overall revenue and profitability, largely credited to the burgeoning demand for its specialized AI chips. Sales from custom AI processors surged by a remarkable 63% year over year, now constituting a substantial one-third of the company's total revenue. This momentum is set to continue, with projections indicating further growth in AI revenue for the current quarter, potentially bringing the fiscal year's AI contribution close to $20 billion, marking a significant improvement from the previous year. Furthermore, Broadcom secured a record $110 billion in bookings, primarily fueled by the strong demand in AI. This massive backlog, especially considering the company's projected total revenue for the current fiscal year, signals a robust pipeline for sustained growth. A notable development is the addition of a fourth customer for custom AI processors, reportedly OpenAI, which has placed orders exceeding $10 billion. This expansion of its client base, coupled with the potential for existing customers to increase their spending, positions Broadcom for an even more significant surge in AI revenue in fiscal 2026, with analysts now expecting a doubling of earlier forecasts. As OpenAI continues to expand its AI infrastructure, its substantial cash burn is likely to translate into increased orders for Broadcom, further cementing the company's leading role in the AI chip market.

Investor Returns: Unpacking Broadcom's Future Potential

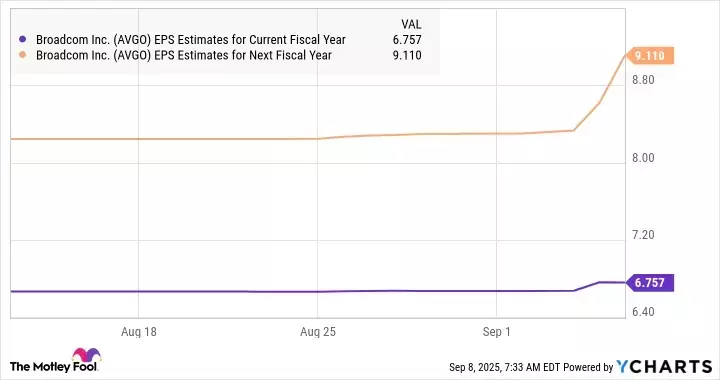

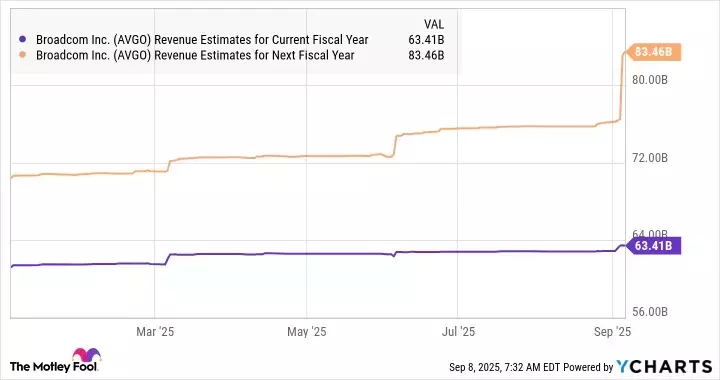

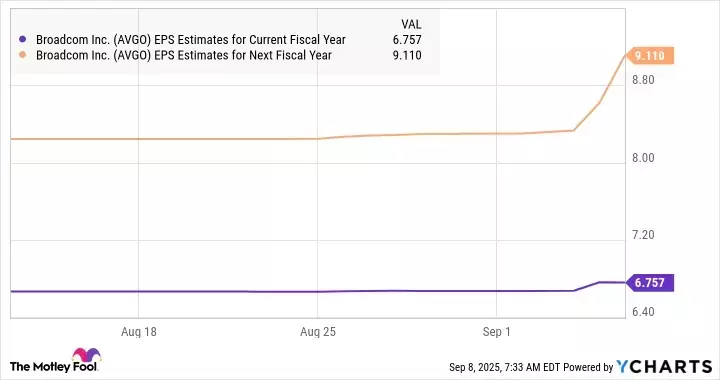

Broadcom's financial outlook for the upcoming fiscal year is highly optimistic, with revenue projected to experience a significant jump. This forecast is influenced by the company's potential to secure additional business from its existing client pipeline and an anticipated increase in spending from current customers. Concurrently, earnings per share are also expected to see a substantial increase, reflecting the company's strong operational performance and market positioning. Should Broadcom meet these heightened expectations, particularly in aligning with the average price-to-earnings ratio of the technology sector, its stock could see a notable appreciation from its current valuation. This potential upside highlights Broadcom as an attractive option for investors seeking growth within the technology and AI sectors.

Investors are keenly observing Broadcom's future prospects, which appear exceedingly promising given the company's current trajectory. According to recent estimates, Broadcom's revenue is anticipated to soar by 31% in the next fiscal year, reaching approximately $83.5 billion. This projection carries the potential for even greater upside if Broadcom successfully converts more opportunities from its existing client base and sees increased expenditure from its current customers. Complementing this revenue growth, the company's earnings are also poised for a significant climb, with a projected 35% increase to $9.11 per share in the upcoming fiscal year. These revised estimates underscore a heightened confidence in Broadcom's financial performance following its latest quarterly report. Should Broadcom achieve these earnings targets and trade at a price-to-earnings ratio comparable to the technology sector average, its stock price could appreciate considerably. Even when factoring in a discount from its historical trailing earnings multiple, the potential for a substantial jump in stock value remains. The accelerating growth in Broadcom's AI segment could further entice the market to assign a premium valuation to the company, indicating a strong likelihood of continued robust gains for investors.