The cryptocurrency market has been on a wild ride in recent months, with Bitcoin (BTC) reaching new all-time highs. However, some industry experts are warning of a potential end-of-year tumble for the leading digital asset. CryptoQuant CEO Ki Young Ju has predicted that Bitcoin may close the year under $59,000, citing an overheated futures market as a primary factor. Meanwhile, Collective Shift CEO Ben Simpson believes a pullback to $58,000 is "very unlikely" by the end of 2022, citing various bullish factors that could drive the price higher.

Navigating the Volatility: Experts Offer Insights on Bitcoin's Trajectory

Overheated Futures Market and Potential Corrections

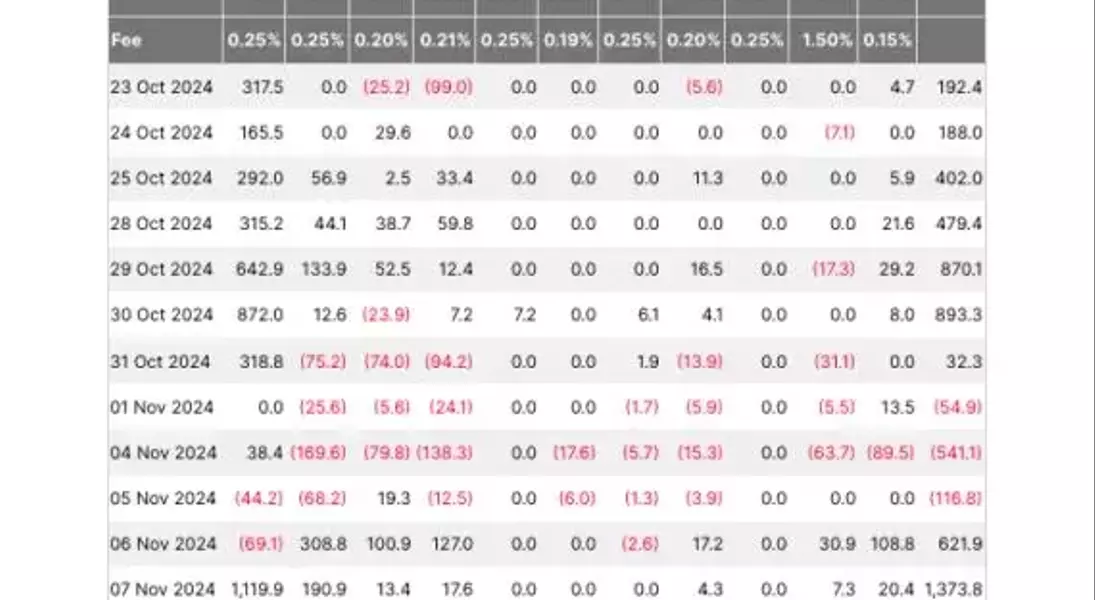

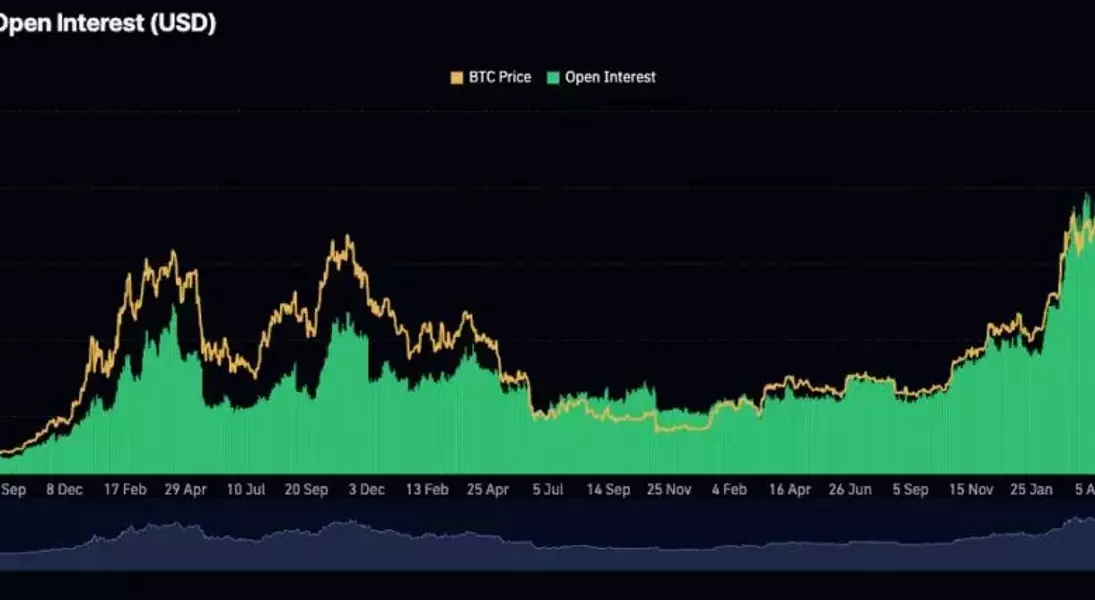

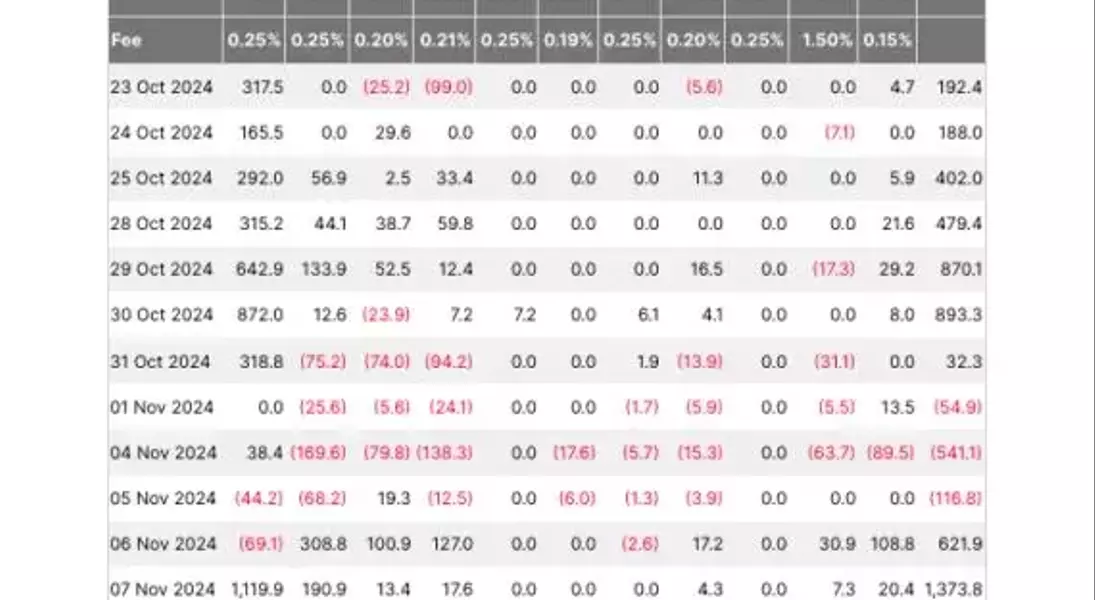

According to Ki Young Ju, the CEO of CryptoQuant, the Bitcoin futures market has become overheated, which could lead to a correction and consolidation in the near future. In a recent post on X, Ki stated that he expects Bitcoin to close the year at $58,974 and challenged others to speculate on the yearly close, offering a 0.1 BTC reward to the person with the closest answer."I expected corrections as BTC futures market indicators overheated, but we're entering price discovery, and the market is heating up even more," Ki said. He acknowledged that a strong year-end rally could set up 2025 for a bear market, though he expressed hope that he might be wrong.The Bitcoin futures market has indeed seen a record level of open interest, with nearly $50 billion in active positions, according to CoinGlass data. This high level of leverage and speculation in the derivatives market could contribute to increased volatility and the potential for a market correction.Bullish Factors Driving Bitcoin's Upward Momentum

In contrast, Collective Shift CEO Ben Simpson believes that a pullback to $58,000 by the end of 2022 is "very unlikely." He cited several bullish factors that could continue to drive the price of Bitcoin higher, including the potential for a Trump election, interest rates coming down, and the possibility of quantitative easing in the future.Simpson also pointed to the consistent days of over $1 billion in Bitcoin ETF volume, suggesting that more people are catching on to the cryptocurrency's potential. "When you've got a limited supply asset like Bitcoin and the amount of demand that's coming in, the space is only going one way," he said.While acknowledging that 20-30% corrections are normal in previous Bitcoin cycles, Simpson noted that the current pullbacks have been relatively small, ranging from 5-6%. He believes the market structure is looking "super strong" and that Bitcoin will likely continue its upward trajectory, despite the potential for sudden dips.The Ongoing Debate: Bullish or Bearish Outlook for Bitcoin?

The differing opinions between Ki Young Ju and Ben Simpson highlight the ongoing debate within the cryptocurrency community regarding Bitcoin's short-term and long-term trajectory. While Ki's prediction of a potential end-of-year plunge under $59,000 is based on the overheated futures market, Simpson's bullish outlook is driven by various macroeconomic factors and the increasing institutional adoption of Bitcoin.Ultimately, the future of Bitcoin remains uncertain, and investors should exercise caution and conduct their own research before making any investment decisions. The cryptocurrency market is known for its volatility, and unexpected events or regulatory changes could significantly impact the price of Bitcoin and other digital assets.As the year-end approaches, the cryptocurrency community will closely monitor the market's performance and the factors that could influence Bitcoin's price movement. Whether the digital asset will end the year above or below $59,000 remains to be seen, but one thing is clear: the debate surrounding Bitcoin's future will continue to captivate the attention of investors, analysts, and enthusiasts alike.