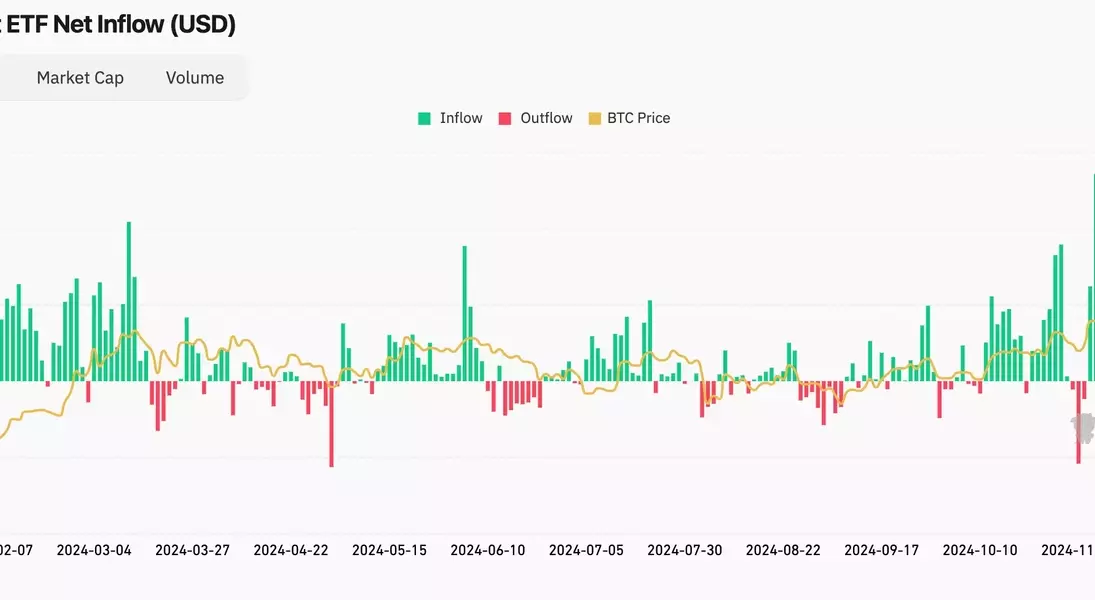

In a notable shift, the U.S.-listed spot Bitcoin (BTC) exchange-traded funds (ETFs) experienced significant capital withdrawal on Thursday, marking an end to a 15-day streak of inflows. This development coincided with a decline in the CME futures premium, signaling reduced short-term demand for Bitcoin. Investors withdrew a substantial amount from these funds, reflecting growing bearish sentiment in the market. The downturn extended to other cryptocurrency ETFs, including those tracking Ether, which also saw their first net outflows since late November. These events highlight the volatility and sensitivity of crypto markets to broader economic indicators.

Record Outflows Signal Bearish Sentiment in Crypto Markets

In the financial world of cryptocurrencies, a pivotal moment occurred on Thursday when U.S.-listed Bitcoin ETFs recorded their largest single-day outflow since inception. According to data from Coinglass and Farside Investors, investors pulled a staggering $671.9 million from 11 different ETFs, breaking a two-week trend of consistent inflows. Leading this exodus were Fidelity’s FBTC and Grayscale’s GBTC, which saw withdrawals of $208.5 million and $188.6 million, respectively. Even BlackRock’s IBIT, which had been performing well, registered its first zero inflow in several weeks.

The weakening demand was further underscored by the performance of Bitcoin itself. Following the Federal Reserve's decision earlier in the week, Bitcoin's price tumbled nearly 10%, dropping to $96,000 from its recent high of $108,268. This decline was mirrored in the derivatives market, where the annualized premium on CME’s regulated one-month Bitcoin futures fell to just 9.83%, the lowest level in over a month. A lower premium indicates that arbitrage strategies involving long positions in ETFs and short positions in CME futures are becoming less profitable, potentially leading to continued weak demand for these funds in the near term.

Ether ETFs did not escape the market's downturn either. After holding steady for nearly a month, they experienced a net outflow of $60.5 million on Thursday. Ether's price has plummeted by 20% since its levels above $4,100 before the Fed's decision on Wednesday. This synchronized movement across both Bitcoin and Ether ETFs highlights the interconnected nature of the cryptocurrency market and its vulnerability to macroeconomic factors.

From a journalistic perspective, this event serves as a stark reminder of the volatility inherent in cryptocurrency markets. The rapid shift from inflows to outflows underscores the importance of staying informed about global economic trends and regulatory developments. For investors, it emphasizes the need for caution and careful analysis when navigating these unpredictable waters. As the market continues to evolve, it will be crucial to monitor how these trends develop and what they might indicate for the future of digital assets.