Navigating Market Dynamics: Applied Materials' Path to Potential New Highs

Key Expectations for Applied Materials' Q1 Earnings Release

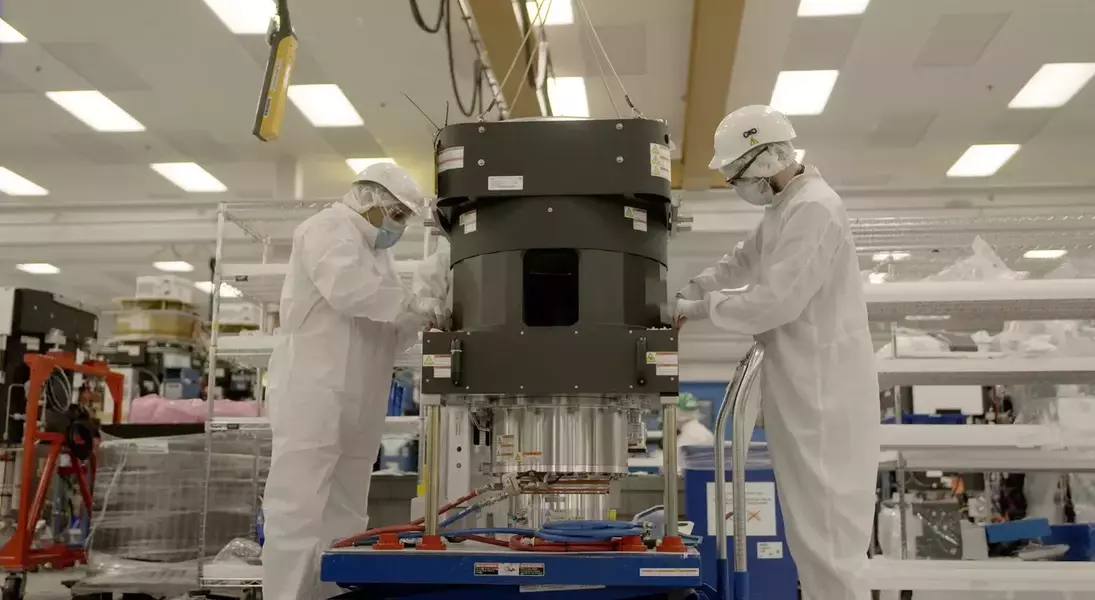

Applied Materials, a prominent manufacturer of equipment essential for semiconductor production, is scheduled to unveil its financial results for the first fiscal quarter following the close of trading on Thursday. Market observers are keenly anticipating this announcement, with many traders forecasting a potential surge in the company's stock to unprecedented levels.

Market Sentiment and Stock Movement Projections

Insights derived from options pricing suggest that investors are bracing for a notable fluctuation in Applied Materials' share price, estimated to be around 6% in either direction. Should the stock experience an upward movement of this magnitude from its recent closing price of $329, it could reach approximately $350, surpassing its previous peak recorded in January. Conversely, a decline of similar proportion would see shares retract to roughly $308.

Applied Materials' Performance in a Booming Sector

The company, a critical supplier in the semiconductor manufacturing ecosystem, has witnessed an impressive nearly 30% increase in its share value since the beginning of the year. Over the past twelve months, this growth has been even more pronounced, exceeding 80%, fueled by robust demand for semiconductor components and advanced AI-specific hardware.

Challenges and Opportunities: Trade Headwinds and Analyst Optimism

Despite the overall positive trajectory, Applied Materials is projected to report a year-over-year decrease in both sales and profitability. This expected downturn is largely attributed to ongoing trade tensions, particularly export limitations imposed on China, and broader geopolitical uncertainties. However, analysts at Morgan Stanley have indicated a strong belief that demand has substantially improved since the company's last earnings disclosure in November, signaling a potential rebound.

Analyst Price Targets and Future Outlook

Echoing this positive sentiment, UBS analysts have adjusted their price target for Applied Materials upwards from $285 to $405. They anticipate that the company will exceed consensus estimates, driven partly by a surge in "catch-up" sales to the Chinese market. According to Visible Alpha's compiled estimates, the company is expected to report adjusted earnings per share of $2.21, a slight decrease from $2.38 in the prior year, and a 3.8% dip in revenue to $6.89 billion. The majority of analysts maintain a bullish stance on Applied Materials' stock, with an average price target suggesting an 11% upside from its recent closing price, underscoring strong confidence in its future performance.