Applied Digital's shares experienced a significant boost, fueled by impressive revenue growth that exceeded expectations. The company, known for its specialized real estate and power infrastructure tailored for artificial intelligence (AI), has seen its stock climb approximately 393% in 2025.

This surge is largely attributed to an expanded agreement with CoreWeave, a fast-growing cloud computing entity, which now boasts a total contract value of around $11 billion. Additionally, Applied Digital secured substantial financing, including a $5 billion preferred equity facility with Macquarie Asset Management. These strategic moves are projected to fund multiple new data center campuses over the coming years, with Polaris Forge 1 already expanding rapidly and Polaris Forge 2 scheduled to come online by late 2026.

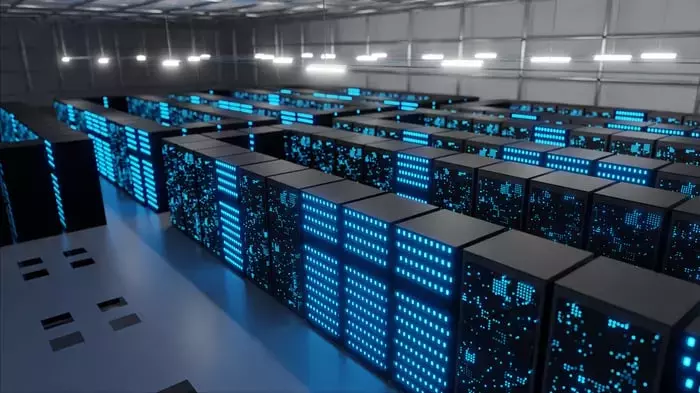

Applied Digital's unique advantage lies in its ability to source large amounts of affordable and stable power, a critical component for AI workloads. Originating from Bitcoin mining, the company leveraged its expertise in power management to transition into a key player in the AI infrastructure market. With Nvidia projecting the AI infrastructure market to reach $3 trillion to $4 trillion in the near future, Applied Digital is well-positioned to capitalize on this growth by providing essential facilities and power for advanced data centers. If the company continues to scale its operations and demonstrates strong operating leverage, its stock could see even greater upside.