The eagerly awaited announcement of the 2026 Social Security cost-of-living adjustment (COLA) has been postponed due to a federal government shutdown, disrupting what is typically a pivotal week for beneficiaries. While the delay has caused some uncertainty, preliminary projections suggest a significant increase, potentially establishing a historical pattern not seen in almost three decades. However, many retirees might find that this adjustment still doesn't adequately address their escalating living expenses, especially in critical areas like healthcare.

Crucial Social Security COLA Announcement Faces Delay Amidst Government Shutdown

Normally, October would bring great anticipation for the over 70 million individuals relying on monthly Social Security benefits, as the Social Security Administration (SSA) typically reveals the upcoming year's cost-of-living adjustment (COLA). This year, however, circumstances have taken an unusual turn. The U.S. Bureau of Labor Statistics (BLS) was scheduled to release the pivotal September inflation report on October 15th at 8:30 a.m. ET, a key component for calculating the 2026 COLA. Yet, an unforeseen federal government shutdown has disrupted this timeline, leading to a delay in the announcement.

The root cause of this postponement is the federal government shutdown, which commenced on October 1st. This shutdown occurred because elected officials in Congress, specifically the Senate, failed to pass federal funding legislation. Although such shutdowns do not affect the timely distribution of monthly Social Security benefits, they do halt or delay the reporting of most economic data, including the monthly inflation figures from the BLS. Consequently, the highly anticipated COLA revelation, crucial for retired workers, those with long-term disabilities, and survivor beneficiaries, has been pushed back.

Fortunately, there is a new scheduled date for the release of the September inflation data. According to information obtained by CNBC, the BLS plans to bring back essential personnel to compile and release the Consumer Price Index for All Urban Consumers (CPI-U) and the CPI-W on Friday, October 24th, at 8:30 a.m. ET. This new date is nine days later than originally planned, providing clarity amidst the disruption. While the SSA usually publishes its comprehensive Social Security Fact Sheet almost immediately after the BLS report, outlining the COLA and other critical program changes, it remains uncertain if this will occur with the usual expediency on October 24th. Nevertheless, beneficiaries will have the necessary data to calculate their own adjustments.

To determine the 2026 COLA, the average CPI-W reading from the third quarter (July, August, and September) of the current year is compared against the average third-quarter CPI-W reading from the previous year, 2024. An increase in the current year's average indicates inflation, leading to a corresponding rise in benefits. The year-over-year percentage difference, rounded to the nearest tenth of a percent, will establish the next year's COLA. For context, the 2024 third-quarter CPI-W readings averaged 308.729. With July and August 2025 CPI-W readings already at 316.349 and 317.306 respectively, the upcoming September figure will complete the calculation, allowing for an immediate, independent determination of the COLA.

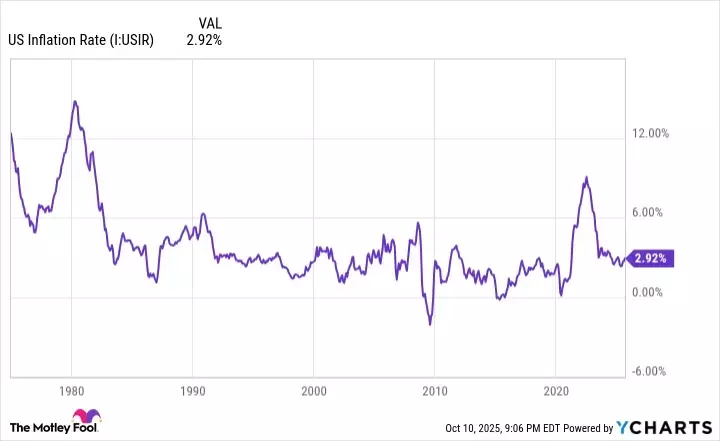

Projections from independent organizations like The Senior Citizens League (TSCL) and policy analyst Mary Johnson indicate that the 2026 Social Security COLA is expected to be approximately 2.7% to 2.8%. If these forecasts hold true, it would mark a historic achievement: the first time this century, and 29 years in total, that beneficiaries would experience five consecutive years of COLAs at or above 2.5%. This trend was last observed between 1988 and 1997, when annual COLAs ranged from 2.6% to 5.4%. Such an increase would translate to an estimated monthly rise of $54 to $56 for the average retired worker, and $43 to $44 for individuals with disabilities and survivor beneficiaries.

Despite the promising figures, the waiting period for the 2026 COLA announcement may ultimately prove underwhelming for many retirees. The method used to calculate the COLA, the CPI-W, tracks inflation faced by urban wage earners and clerical workers, a demographic distinct from the majority of Social Security recipients, who are typically age 62 and above. This inherent flaw means the COLA often fails to accurately reflect the true cost pressures experienced by seniors. Retirees allocate a larger portion of their budgets to essential categories such as shelter and medical care services, which have consistently seen inflation rates higher than the COLAs provided. Consequently, the purchasing power of Social Security income for retirees is likely to continue its decline in 2026, regardless of the numerical increase. Furthermore, beneficiaries enrolled in traditional Medicare are likely to see a portion, or even all, of their COLA absorbed by an anticipated double-digit percentage increase in next year's Part B premium, which covers outpatient services. With the 2025 Medicare Trustees Report projecting an 11.5% hike in the Part B premium to $206.20 per month in 2026, many dual enrollees may once again find themselves at a financial disadvantage.

This situation underscores a recurring challenge in social welfare programs: ensuring that adjustments designed to maintain purchasing power genuinely reflect the economic realities of their recipients. While the projected COLA for 2026 is numerically historic, its practical impact on retirees' financial well-being may fall short, highlighting the need for ongoing evaluation and potential reforms to how cost-of-living adjustments are calculated and implemented.