The agricultural sector is currently experiencing a period of remarkable tranquility, even in the face of summer heatwaves that might typically trigger widespread panic due to historical crop damage. This unexpected stability is largely reflected in key market indicators, such as the corn volatility index, which has plummeted to its lowest point in over a year. Across financial centers, from bustling Wall Street to the local Main Street, investors seem quite content with the prevailing economic climate. This calm precedes pivotal announcements from the Federal Reserve, whose decisions could significantly influence future market dynamics.

Agricultural Markets Show Resilience Amidst Economic Anticipation

In late July 2025, a palpable calm has settled over agricultural markets, defying the historical anxieties typically provoked by intense summer heatwaves. Despite soaring temperatures that rekindled memories of devastating past crop failures, particularly in corn, the market's response has been unexpectedly muted. The December corn futures' Volatility Index, a key measure of market fluctuation, continued its downward trend, reaching a nadir not observed in over twelve months. This surprising stability wasn't confined to corn alone; broader markets, including those on Wall Street, also exhibited remarkable steadiness.

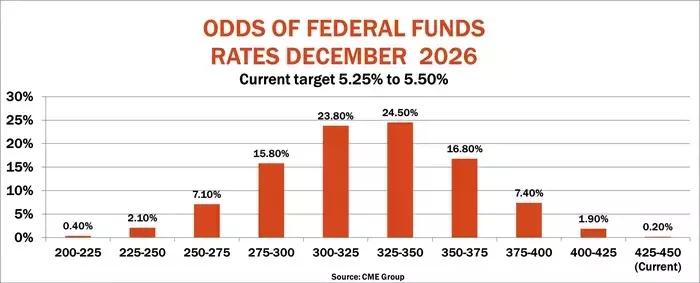

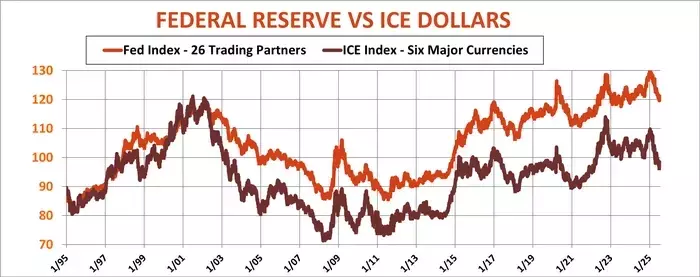

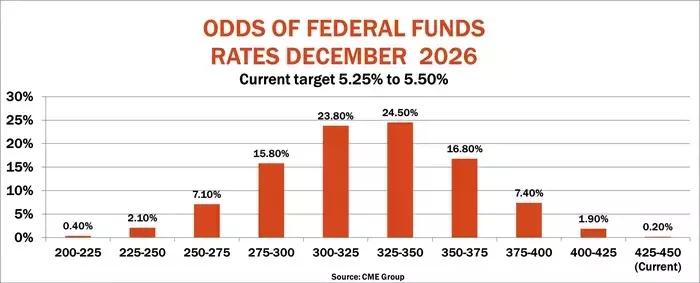

This period of tranquility is poised for a significant test in early August. The Federal Reserve, under the leadership of Chairman Jerome Powell, is scheduled to update its monetary policy. This update forms part of a series of critical economic data releases, encompassing Gross Domestic Product (GDP), inflation figures, and employment statistics. The outcome of these announcements, particularly regarding interest rates, could reshape financial conditions for the agricultural sector. Decisions on interest rates directly impact agricultural financing, influencing everything from storage costs for harvests to the valuation of agricultural land. Lower interest rates, while generally beneficial for growers by reducing borrowing costs, could also intensify competition for land from non-farming investors. Market participants are keenly awaiting the U.S. Department of Agriculture's initial farmer and field surveys, along with the World Agricultural Supply and Demand Estimates (WASDE), both expected around August 12. These reports will provide crucial insights into crop conditions and guide future market movements. Moreover, the Federal Reserve's actions will have broader implications, affecting currency markets, particularly the U.S. dollar's value on the global stage. While a weaker dollar can benefit U.S. corporations by boosting overseas revenues, it also presents inherent risks. The overall market sentiment, especially regarding the Fed's "dual mandate" of maintaining stable prices and full employment, will determine the course of interest rates and, by extension, the financial health of the agricultural economy.

The current market placidity, especially in the face of significant economic events, offers a profound lesson in resilience and the complex interplay of various influencing factors. For both seasoned investors and diligent farmers, the mantra "expect the unexpected" remains ever relevant. While current crop assessments, supported by satellite imagery, suggest promising yields for corn and soybeans, any unforeseen shifts in weather patterns or economic policy could swiftly alter this outlook. This situation underscores the need for constant vigilance and adaptability in navigating the inherently unpredictable nature of agricultural markets and the broader economy.