Fueling Future Fortunes: How Biofuel Policy is Reshaping ADM's Economic Horizon

Biofuel Policy's Impact on Financial Performance at ADM

Archer-Daniels-Midland Company is poised for a significant financial upswing, largely attributed to new and clearer biofuel blending directives in the United States. This strategic pivot is expected to revitalize the crop trading and processing firm, which has faced recent market difficulties. The increased demand for renewable fuels, particularly biodiesel, is projected to commence positively influencing ADM's financial outcomes from the fourth quarter onwards, contributing to sustained earnings growth in subsequent years.

Leadership's Perspective on Emerging Opportunities

Juan Luciano, ADM's Chief Executive Officer, emphasized that greater certainty regarding U.S. biofuel regulations will empower the company to unlock substantial economic advantages and stimulate further capital expenditure. This comes after a period of uncertainty that has clouded the sector, with fluctuating policies impacting demand and profitability for agricultural processors.

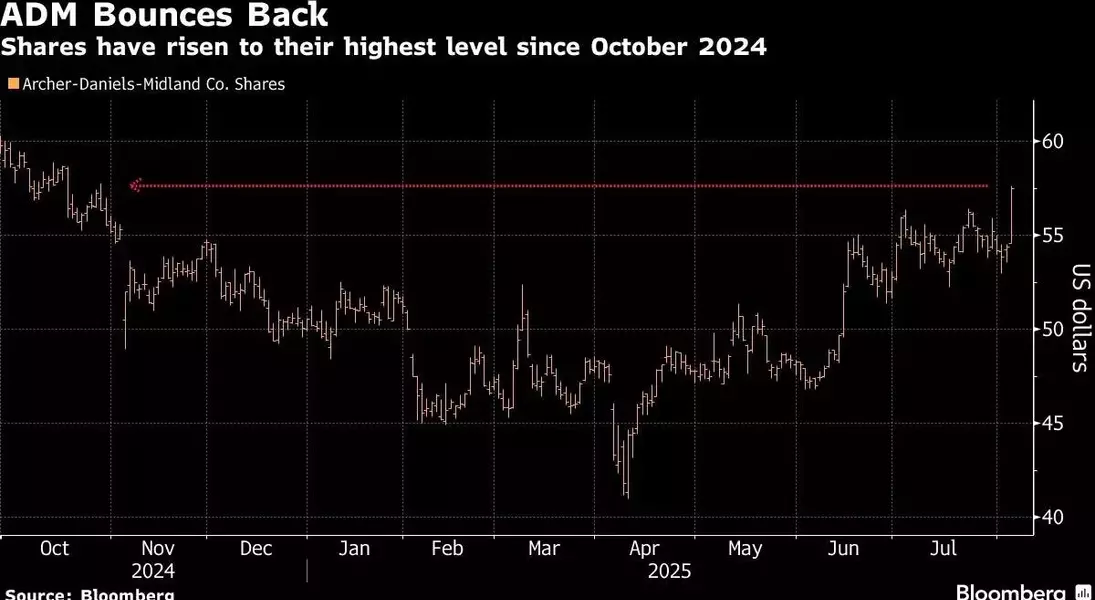

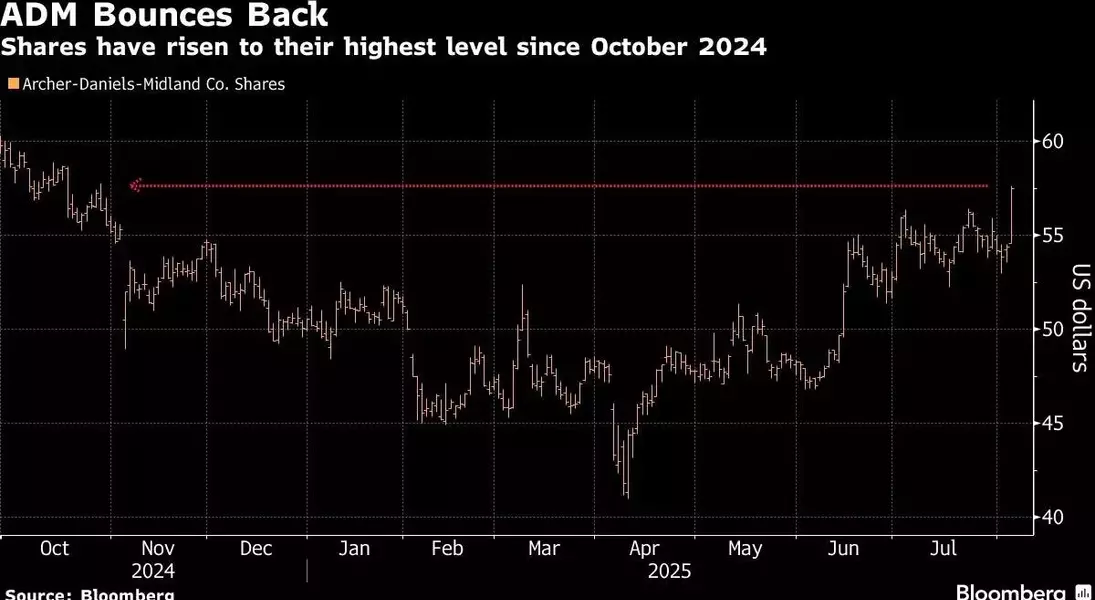

Market Dynamics and Investor Confidence

A recent government proposal to elevate biofuel blending requirements, alongside restrictions on imports, has already led to an increase in prices for key feedstocks like soybean oil. This shift paints a more optimistic picture for crop processors, even as the granular details of the mandates are still being finalized. Such policy developments are seen as a critical catalyst, helping to overcome previous struggles caused by an oversupply and concerns about trade tariffs. Following these positive indications, shares of the Chicago-based company experienced a notable surge, reaching their highest value since October.

Navigating Financial Headwinds and Future Projections

Despite a recent reduction in its full-year earnings guidance, ADM's adjusted earnings for the quarter ending in June surpassed analyst expectations, marking a significant beat even against the highest forecasts. This performance was partly bolstered by reduced operational costs. However, the company continues to grapple with the repercussions of trade policy ambiguities, which have affected trading volumes, and the uncertainty surrounding small refinery exemptions from blending obligations, which could potentially diminish overall biofuel demand.

Addressing Internal and External Challenges

In addition to market volatilities, ADM is also under scrutiny due to ongoing federal inquiries into past accounting irregularities, which previously eroded billions from its market valuation. The company has taken steps to rectify internal control weaknesses related to reporting and pricing. Despite these challenges, CEO Luciano remains optimistic, asserting that if small refinery exemptions are managed effectively, the future outlook for ADM appears promising. Earlier this year, ADM initiated a workforce reduction as part of its broader revitalization strategy.