Navigating Market Volatility: Insights from the Yen and Fed Funds Futures

Despite improving investor sentiment as the markets approach all-time highs, recent price action in the yen and Fed Funds futures warns that it may be too early to think the recent volatility is over. The yen's appreciation and the quick change in Fed rate cut expectations could signal underlying market risks that investors should closely monitor.Uncovering the Yen's Influence and the Fed's Shifting Stance

The Yen's Resurgence and Its Implications

The yen's recent rally against the dollar has caught the attention of market watchers. Starting in early July, the yen began to appreciate as the Bank of Japan (BOJ) raised rates while the prospect of a Federal Reserve rate cut increased. This trend accelerated on August 5th, when the yen spiked, creating havoc in the asset markets. The volatility was largely attributed to investors quickly unwinding the yen carry trade. While the BOJ's verbal intervention helped ease market concerns, the yen has continued to appreciate against the dollar, now trading above the August 5th levels.This sustained appreciation of the yen raises concerns about the potential for further yen carry trade unwinds, which could result in downward pressure on U.S. equities. Investors should closely monitor the yen's movements, as a continued appreciation could trigger more volatility in the markets.The Fed Funds Futures Puzzle

The recent price action in the Fed Funds futures market has also raised eyebrows. Following the release of the CPI and BLS employment reports, the market reduced the odds of a 50-basis-point rate cut by the Federal Reserve to a mere 5% chance. However, on Thursday, the odds spiked back to nearly 50%, despite a lack of significant economic data to sway the Fed's decision.This sudden change in market expectations is curious and may not necessarily reflect the Fed's true intentions. Nonetheless, it is a development that warrants close attention. Investors should be mindful of the potential implications of the Fed's policy decisions and how they may impact the broader market sentiment.Navigating the Volatility Landscape

Both the appreciation of the yen and the quick change in Fed rate cut expectations may ultimately prove to be temporary or insignificant. However, given the recent spate of market volatility, both up and down, complacency is ill-advised. Investors should remain vigilant and prepared for potential market swings.To navigate this environment, it is crucial to maintain a balanced and diversified portfolio, with appropriate risk management strategies in place. This may include taking profits, rebalancing risk, increasing cash levels, and raising stop-loss levels. While the overall market trend remains bullish, it is prudent to be mindful of the potential risks and be ready to adapt to changing market conditions.The Week Ahead: Key Events and Considerations

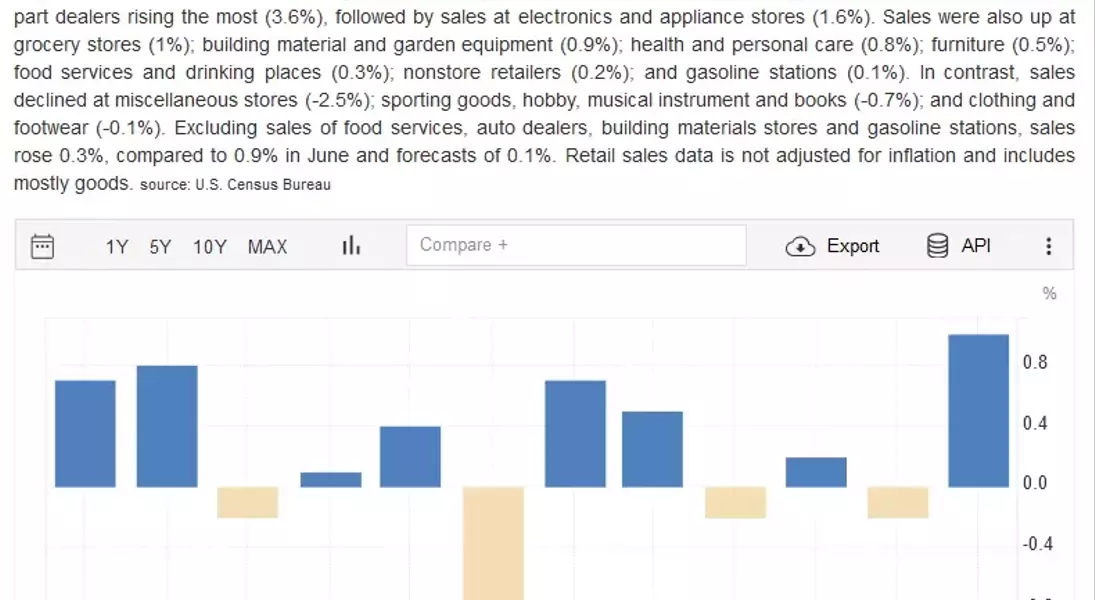

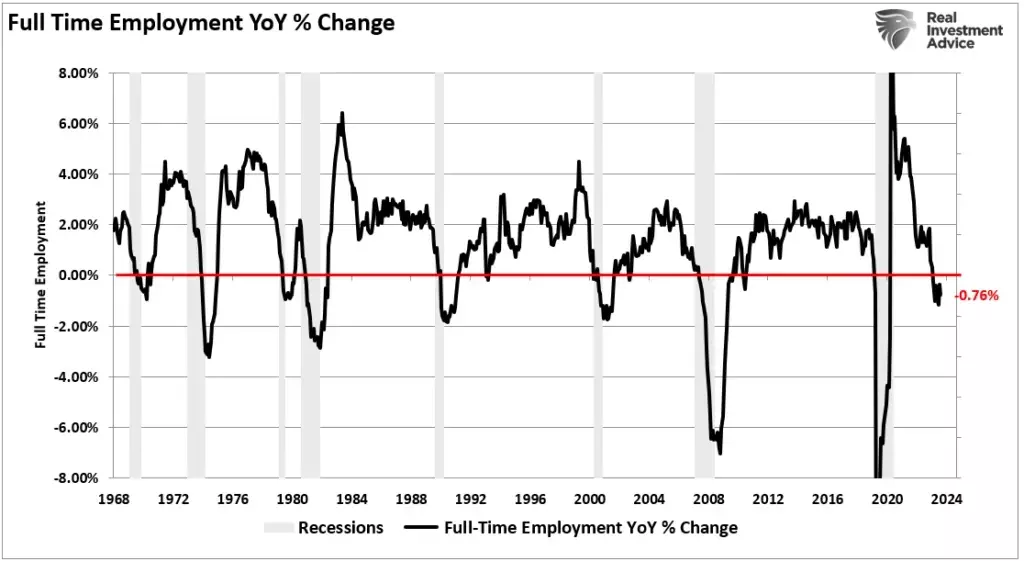

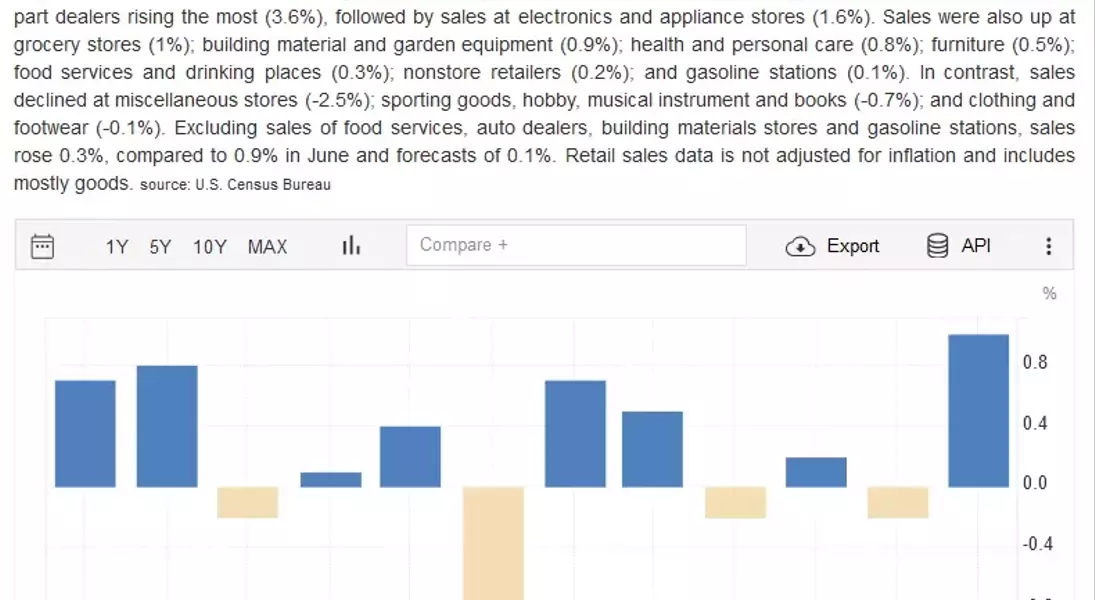

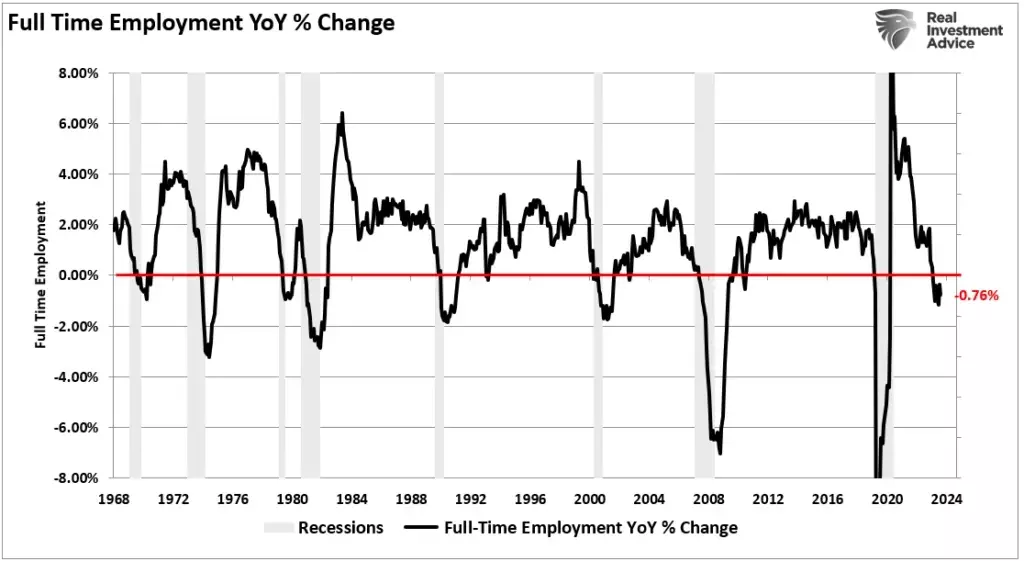

The upcoming week will be highlighted by the Federal Reserve's FOMC meeting on Wednesday. Investors will be closely watching the central bank's decision on interest rates, as the market is currently pricing in a 50/50 chance of a 25-basis-point or 50-basis-point rate cut. A more aggressive 50-basis-point cut could raise concerns among investors, as the economic data may not warrant such a significant move.Additionally, the release of the Retail Sales data on Tuesday will provide insights into the health of the consumer sector, which is a crucial driver of the U.S. economy. Investors should also keep an eye on the labor market, as the recent jobs report highlighted signs of cooling demand for workers, which could have broader implications for the economy and corporate earnings.As the market navigates these events and the ongoing volatility, it is essential for investors to remain vigilant, maintain a balanced approach, and be prepared to adapt to the changing market landscape. By staying informed and proactive, investors can navigate the challenges and capitalize on the opportunities that may arise in the weeks and months ahead.You May Like