In a significant development, the final retail diesel price of the year saw an upward trend on the same day that distillate market fundamentals pushed futures prices notably higher. The Department of Energy/Energy Information Administration reported an average retail diesel price of $3.503 per gallon, marking a 2.7-cent increase from the previous week. Over the past four weeks, prices have fluctuated, rising and falling twice each. Despite this volatility, the overall trend shows a decline of 37.3 cents per gallon compared to the start of the year. This week's price is also down by 60.6 cents from its peak in early January.

Diesel Prices Reflect Market Instability and Winter Weather Impact

In the waning days of the year, the diesel market experienced notable fluctuations driven by both supply concerns and impending winter weather. On a crisp December day, the DOE/EIA recorded a retail diesel price of $3.503 per gallon, reflecting a 2.7-cent increase from the prior week. Over the past 52 weeks, diesel prices have shown a downward trajectory, dropping by 37.3 cents per gallon since the beginning of the year. Notably, this week's price represents the highest point in four weeks, yet it remains the fifth lowest recorded in 2024.

The impact of winter weather on market dynamics became evident as long-range forecasts predicted extremely cold conditions across the U.S. and Europe in January. Traders responded by pushing up prices for ultra-low sulfur diesel (ULSD) and natural gas, key commodities tied to heating demand. ULSD surged by 5.47 cents to settle at $2.2995 per gallon, marking a gain of 2.44%. Natural gas prices at Louisiana’s Henry Hub rose by 12%, settling at $3.936 per thousand cubic feet (Mcf), reflecting a substantial increase from earlier lows.

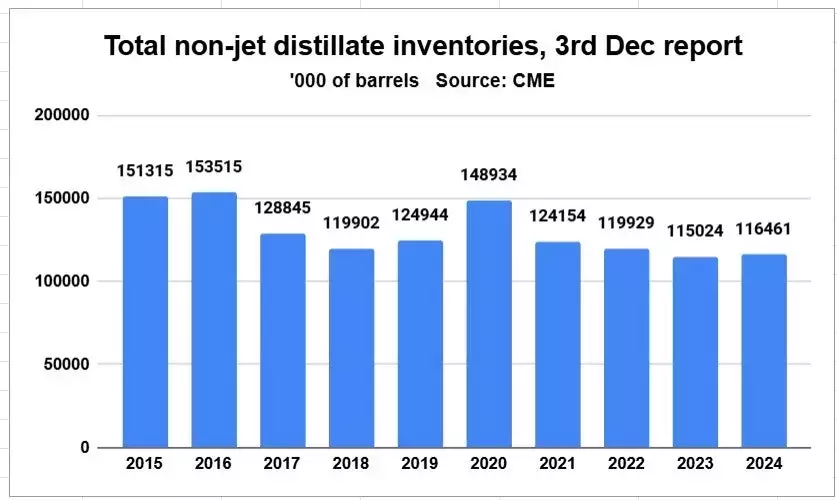

U.S. inventories of non-jet distillates are currently lower than usual for this time of year, standing at 116.5 million barrels. Comparing this figure to historical averages reveals a concerning shortage. For instance, the five-year average, including 2020, stands at 126.6 million barrels. Excluding 2020, the average is slightly lower at 125.4 million barrels. These low inventory levels, coupled with colder-than-average weather predictions, suggest that diesel prices may continue to rise in the coming weeks.

Interestingly, while ULSD saw a significant gain, crude oil benchmarks like WTI and Brent remained stable, and gasoline contracts did not experience similar increases. This divergence highlights the unique pressures faced by the distillate market as it prepares for winter demands.

From a journalist's perspective, the recent surge in diesel prices serves as a stark reminder of the delicate balance between supply, demand, and environmental factors in the energy sector. As winter approaches, the market's response underscores the critical role that seasonal weather patterns play in shaping commodity prices. For consumers and businesses alike, this volatility underscores the importance of planning and adaptability in managing fuel costs during periods of uncertainty.