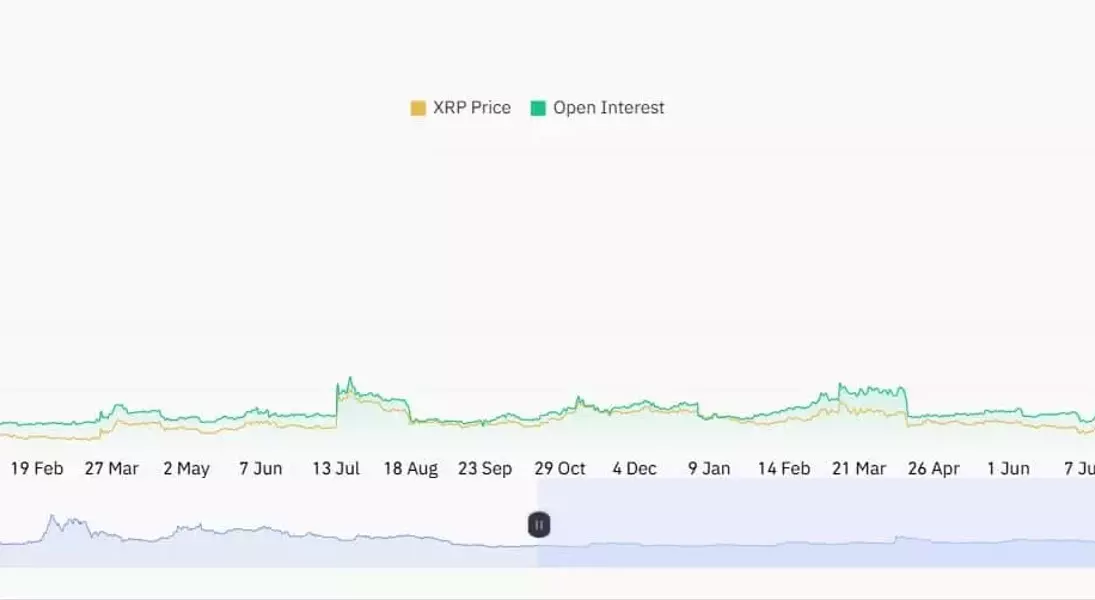

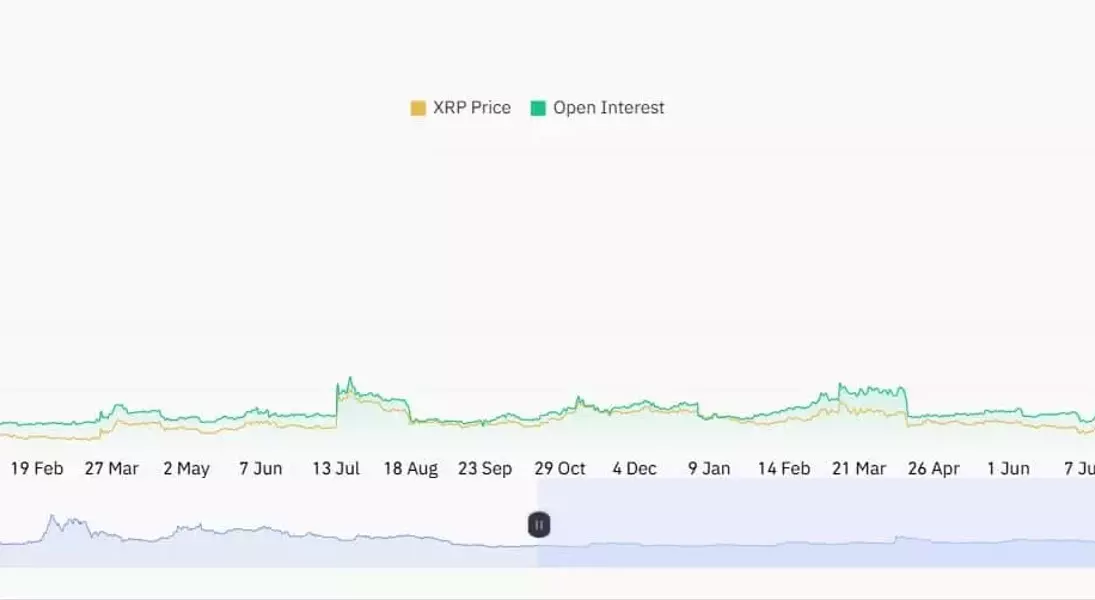

Recently, XRP has experienced a significant downturn in market sentiment as it continues to struggle with breaking through critical resistance levels. The token's inability to surpass the $2.73 mark has led to a substantial decline in investor confidence, reflected by a sharp drop in futures open interest. Over the past month, XRP has remained in a consolidation phase, losing 20% of its value while hovering just above the crucial $2.00 support level. This period of stagnation raises questions about the sustainability of any near-term recovery without improvements in network fundamentals.

Market Sentiment Plummets as XRP Fails to Break Key Resistance

The digital asset has been stuck below vital resistance points for an extended period, leading to mounting frustration among traders. A recent plunge in XRP Futures Open Interest by over $1 billion within 48 hours underscores growing pessimism about the token's short-term prospects. This decline follows a failed breakout attempt that briefly lifted spirits but ultimately failed to materialize into sustained momentum. As investors withdraw capital, the market reflects increasing bearishness towards XRP's immediate future.

In detail, XRP's price action has been characterized by a prolonged consolidation phase beneath the $2.73 resistance level. Despite a brief surge in late November, the subsequent negative divergence between price performance and network activity highlights the speculative nature of recent gains. Without robust on-chain engagement or utility adoption, sustaining upward movement becomes increasingly challenging. Traders' withdrawal of funds further exacerbates this issue, indicating a lack of conviction in XRP's ability to break out of its current trading range.

Consolidation and Key Levels: What Lies Ahead for XRP?

Amidst the ongoing consolidation, key technical indicators offer mixed signals regarding XRP's trajectory. While the Relative Strength Index (RSI) hovers around neutral territory, suggesting indecision, trading volume remains tepid, pointing to a lack of buying pressure necessary for a breakthrough. Additionally, On-Balance Volume (OBV) trends highlight muted capital inflows, raising doubts about the token's capacity to maintain upward momentum without renewed interest from market participants.

The next critical juncture for XRP lies in whether it can decisively break above the $2.73 resistance level or fall below the $2.00 support. A successful breach of the upper boundary could potentially spark a rally towards the all-time high of $3.31, rekindling investor optimism. Conversely, a drop below the lower threshold may deepen the current stagnation and intensify bearish sentiment. Until a clear catalyst emerges, XRP remains in a cautious equilibrium, contingent on broader market dynamics and restored network confidence.