In December 2024, XRP emerged as the most traded altcoin on Binance Futures, boasting an impressive trading volume exceeding $116 billion by mid-month. Despite this significant activity, XRP faced uncertain short-term recovery prospects. Market analysts noted that while the high trading volume could position XRP for a swift rebound among altcoins, recent price trends and technical indicators suggested caution. The total Open Interest (OI) in XRP derivatives stood at $2.05 billion, with Binance accounting for nearly 42% of this amount. Although there was a slight increase in OI, XRP's price had been declining since early December, leading to a cautious outlook in the short term.

XRP's Record-Breaking Trading Volume on Binance Futures

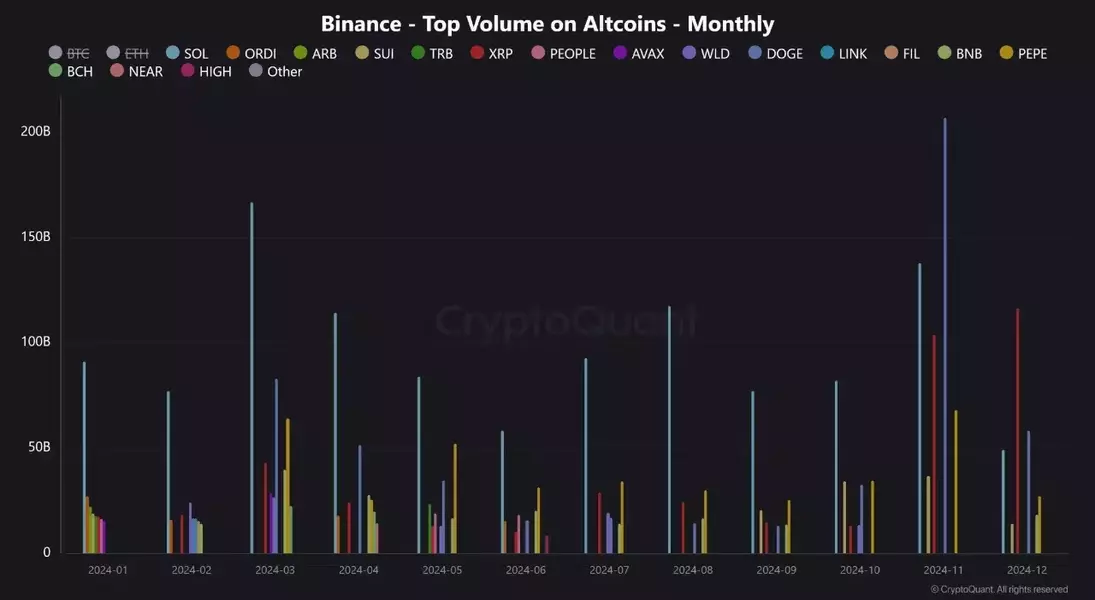

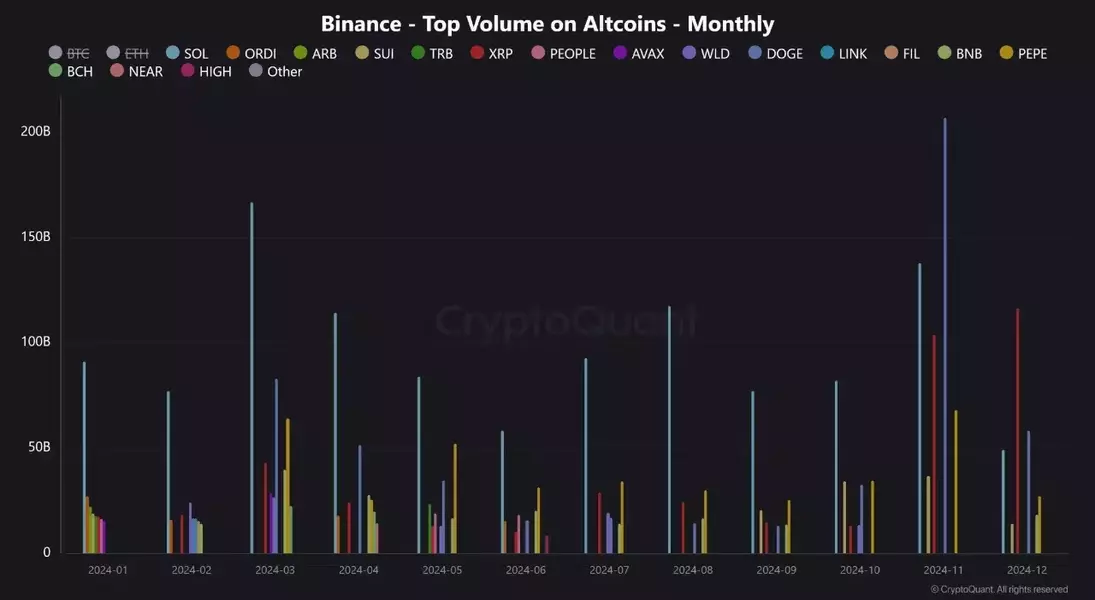

The cryptocurrency market witnessed a remarkable surge in XRP trading activity during December, particularly on Binance Futures. By mid-December, XRP had already surpassed $116 billion in trading volume, making it the most traded altcoin on the platform. Analysts highlighted the importance of monitoring top-traded coins on Binance, as they often dictate market trends and offer valuable insights for traders. This unprecedented volume suggested strong interest in XRP, potentially setting the stage for a rapid recovery among altcoins. Moreover, Binance's significant share of the trading volume underscored its pivotal role in shaping XRP's market dynamics.

CryptoQuant's JA Maartunn emphasized the significance of XRP's trading volume, noting that it could be a key indicator of future performance. With over $116 billion traded by mid-December, XRP's liquidity and market presence were undeniable. The substantial trading volume indicated robust investor engagement, which could fuel further price movements. Additionally, the concentration of liquidity on Binance Futures suggested that the platform's users played a crucial role in driving XRP's market activity. Traders who focused on these top-traded coins might benefit from the heightened volatility and potential opportunities presented by XRP's trading volume.

Short-Term Recovery Challenges and Market Indicators

Despite the record-breaking trading volume, XRP faced challenges in its short-term recovery. Coinglass data revealed that XRP's Open Interest (OI) was around $2.05 billion, with Binance accounting for nearly 42% of this amount. While a positive surge in OI can indicate bullish sentiment, XRP's price charts painted a more cautious picture. Since early December, XRP had experienced a downtrend, losing nearly 24% of its value. After a brief 15% rally last Friday, XRP entered a tight consolidation phase below $2.3, leaving traders uncertain about its immediate future.

The technical indicators provided mixed signals. A failure to hold above the 50-day Moving Average could push XRP lower to the range-low of $1.9, a level that has acted as a liquidity pool since early December. Conversely, a sustained recovery toward the upper channel could yield another 20% in gains. The Relative Strength Index (RSI) indicated a nearly neutral market, highlighting the crossroads at which XRP found itself. Liquidation heatmaps showed that upside liquidity was concentrated at $2.4 and $2.3, suggesting that a liquidity-driven short squeeze could potentially propel XRP to higher levels. However, traders remained cautious, closely monitoring both the technical indicators and market sentiment.