In a surprising turn of events, the US Federal Reserve's efforts to lower interest rates have been met with an unexpected outcome - rates have actually risen instead. This article delves into the complex dynamics at play, exploring the factors that have led to this unexpected development and the potential implications for borrowers, investors, and the broader economy.

Defying Expectations: The Puzzling Rise in US Interest Rates

The Unexpected Reversal

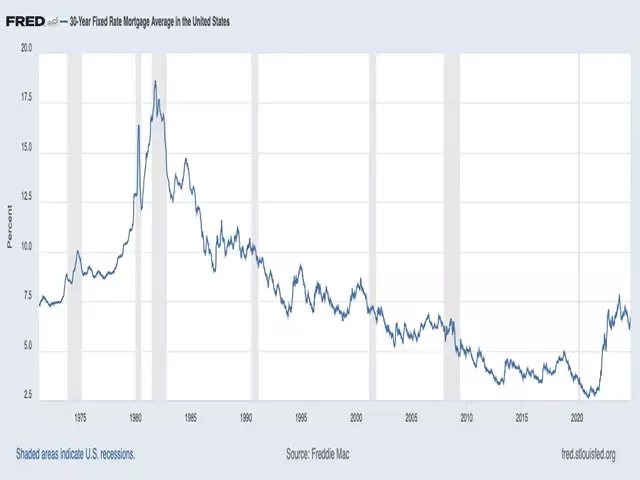

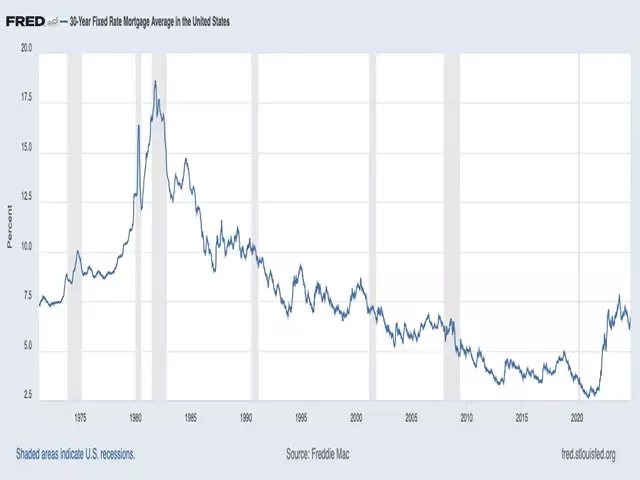

The US Federal Reserve's decision to lower its benchmark interest rate by half a percentage point in September 2022 was expected to pave the way for a broader decline in interest rates across the board. However, the reality has been quite different, as the Treasury's two-year and 10-year notes, as well as the average 30-year mortgage rate, have all risen by half a percentage point or more since the Fed's action.The Limits of the Fed's Control

The primary reason for this unexpected turn of events is that the Federal Reserve does not have complete control over interest rates. The bond market, with its own complex dynamics of supply and demand, plays a significant role in determining longer-term rates, such as those on Treasury notes and mortgages.The Bond Market's Influence

The bond market's influence is a reflection of the inverse relationship between bond yields and prices. When bond demand is weak and supply is strong, bond prices fall, and yields rise. This is precisely what has been happening, as investors have been selling off bonds, driving up yields and, consequently, interest rates.Potential Explanations for the Bond Market's Bearish Stance

There are at least two possible explanations for the bond market's bearish stance:The "Trump Trade"

Some analysts believe that the markets are anticipating a second term for President Trump, which they believe would worsen the federal debt trend and lead to higher inflation. While the markets' forecasts may not necessarily reflect an anti-Trump bias, their decisions to buy and sell bonds are driven by their estimations of inflation risk.Economic Strength and Inflation Concerns

Another explanation for the bond market's sell-off is the strength of the US economy. The September 2022 jobs report showed a significant increase in new jobs, and inflation remained higher than expected, leading to speculation that the Federal Reserve may not need to cut rates as aggressively as previously anticipated.The Shifting Landscape of Interest Rates

The unexpected rise in interest rates has significant implications for borrowers, investors, and the broader economy. Farmers, ranchers, and other business borrowers are now faced with the question of where interest rates are headed from here.The Likely Path Forward

Despite the recent unexpected rise, the most likely path for interest rates is a gradual decline, although perhaps at a slower pace than initially anticipated. The US economy remains strong, and inflation is generally under control. Barring any unexpected economic acceleration or a resurgence of inflation, the current level of interest rates is likely higher than the economic conditions warrant.The Federal Reserve's Potential Response

As the economic conditions stabilize, the Federal Reserve is expected to continue making interest rate cuts, potentially in smaller, quarter-point increments over the next couple of years. This gradual approach is aimed at aligning interest rates more closely with the underlying economic conditions.The Role of Policymakers and the Bond Market

The ultimate trajectory of interest rates will depend on the actions of policymakers, as well as the continued influence of the bond market. If the new administration is able to implement its policies in a restrained manner, and if the bond market regains confidence in the government's fiscal responsibility, the path towards lower interest rates may become clearer.