Wells Fargo, having shed the shackles of a seven-year regulatory asset cap, is now embarking on an ambitious journey to achieve returns on tangible common equity (ROTCE) that rival the industry's best, particularly JPMorgan Chase. This strategic pivot, revealed during their recent third-quarter earnings call, marks a significant shift in the bank's operational outlook under CEO Charles Scharf. The bank, previously constrained by regulatory penalties stemming from past misconduct, is now poised to aggressively pursue higher profitability and expand its market presence. This move sets the stage for an intriguing competition within the upper echelons of the U.S. banking sector.

Wells Fargo's Bold New Direction: Aiming for Elite Returns

In a recent announcement, Wells Fargo's management outlined an aggressive new objective: to achieve a return on tangible common equity (ROTCE) ranging from 17% to 18% in the medium term. This declaration, made during the bank's third-quarter earnings call, signals a renewed and vigorous pursuit of profitability. This ambitious goal places Wells Fargo directly in contention with JPMorgan Chase, a long-standing benchmark for superior financial performance among major U.S. banks, which consistently targets a 17% ROTCE. The removal of the asset cap, a regulatory restriction imposed on Wells Fargo since 2018 due to its fake accounts scandal, has paved the way for this strategic shift. This cap had previously limited the bank's ability to grow its balance sheet and generate interest income. Under the leadership of CEO Charles Scharf, who took the helm in 2019, Wells Fargo has already made substantial progress, elevating its ROTCE from a mere 8% in 2020 to an impressive 15% year-to-date. Scharf's tenure has been characterized by a dual focus on revamping the bank's regulatory compliance framework and streamlining its operations, concentrating on core U.S. banking, high-return credit card ventures, and capital-efficient investment banking services. Chief Financial Officer Michael Santomassimo further highlighted opportunities in wealth management and lending, where Wells Fargo aims to expand its market share to align with industry peers. The bank's ability to achieve these elevated return targets is contingent on several factors, including prevailing interest rates, the broader macroeconomic environment, and future regulatory landscapes. Furthermore, these projections are based on reducing the bank's common equity tier 1 (CET1) capital ratio from 11% to a more efficient range of 10% to 10.5%. Historically, a lower capital reserve can translate into higher returns for a bank.

The Race to Match JPMorgan: A New Era for Wells Fargo?

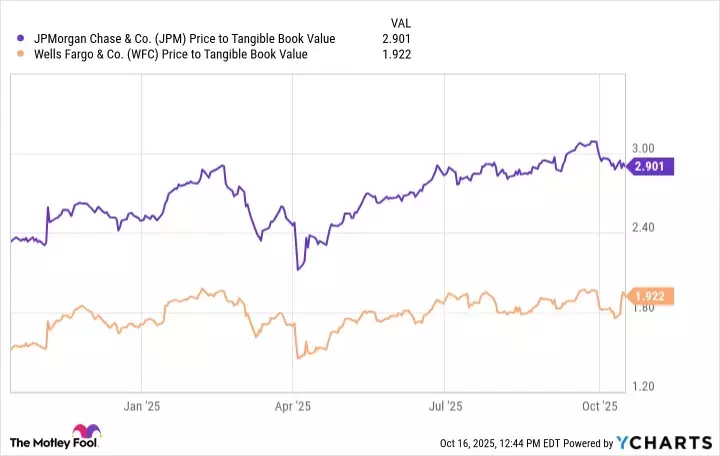

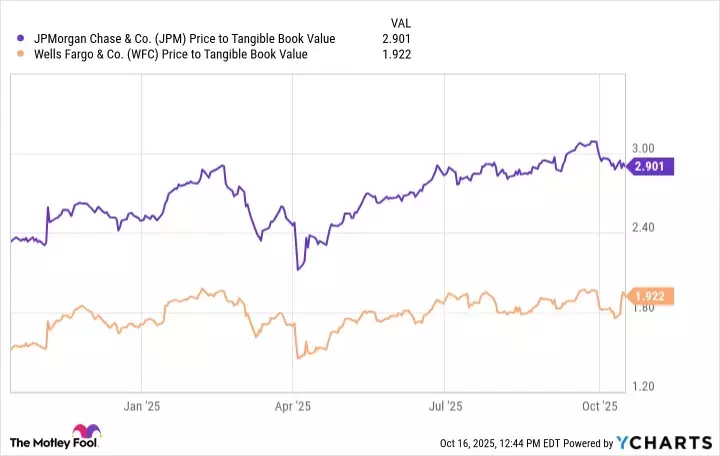

JPMorgan Chase has consistently delivered a ROTCE exceeding its 17% target, often reaching upwards of 19% in recent quarters, all while maintaining a robust CET1 ratio well above regulatory requirements. JPMorgan CEO Jamie Dimon, despite consistently surpassing the target, reiterates the 17% goal, possibly awaiting more definitive regulatory clarity on capital and liquidity requirements. Analysts speculate that if regulatory easing occurs, JPMorgan's actual ROTCE could climb even higher. However, the unexpected alignment of Wells Fargo's new ROTCE target with JPMorgan's long-standing benchmark has certainly captured attention within the financial industry. While JPMorgan's premium valuation is attributed to its diverse revenue streams, including credit card lending, investment banking, and a strong payments business, as well as Dimon's esteemed leadership, Wells Fargo's renewed vigor cannot be overlooked. The fact that Charles Scharf, a former protégé of Dimon, is now steering Wells Fargo toward comparable financial ambitions suggests a potentially evolving competitive dynamic between these two banking giants. The journey for Wells Fargo to close the valuation gap with JPMorgan will be arduous, but their aggressive new strategy signals a clear intent to vie for industry leadership.

This strategic move by Wells Fargo represents a significant moment in the banking sector. It highlights the profound impact of regulatory changes and effective leadership on a financial institution's trajectory. For investors, it underscores the importance of monitoring not just past performance, but also management's forward-looking strategies and their ability to execute. The potential for Wells Fargo to achieve these ambitious targets could lead to a re-evaluation of its stock and offer valuable insights into the broader health and competitiveness of the U.S. banking industry.