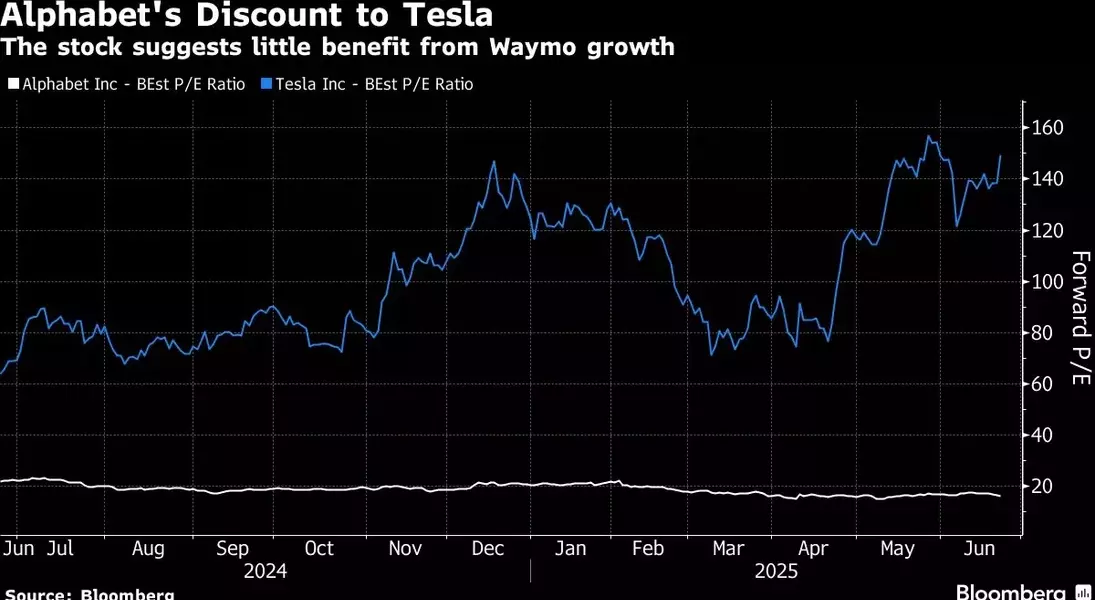

While excitement around autonomous vehicle technology is growing, Alphabet Inc.’s stock has not captured the same level of investor enthusiasm as Tesla, despite Waymo’s expanding robotaxi operations across multiple U.S. cities. Waymo has logged over 71 million miles driven without human intervention and is actively increasing its commercial footprint through partnerships and ride-hailing integrations. In contrast, Tesla recently launched a limited-scale rival service that saw mixed results but still managed to boost its share price. Alphabet’s heavy reliance on digital advertising has historically led to a lower valuation compared to other tech giants, with its current earnings multiple being a fraction of Tesla’s. Analysts argue that Waymo’s real-world deployment, established technology, and OEM partnerships are being overlooked, while Tesla’s unproven autonomous ambitions continue to drive its premium valuation.

Investors see a massive potential market for robotaxis, with projections reaching $325 billion annually in ride-hailing revenue by 2030. Within this space, up to $20 billion could come from fully autonomous services, according to recent analysis. Waymo is already offering paid rides in Los Angeles, Austin, Phoenix, and San Francisco, and has expanded into Atlanta via Uber’s platform, with plans to enter Miami and Washington next year. The company also filed for testing permits in New York City, causing ripples in the broader transportation sector. Despite these developments, Alphabet’s stock remains undervalued relative to its autonomous driving progress, with many analysts suggesting the market is assigning little to no value to Waymo’s current operations and future potential.

Waymo was valued at more than $45 billion in late 2024, placing it on par with major automotive manufacturers like Ford and General Motors. However, given Alphabet’s overall market capitalization exceeding $2 trillion, Waymo remains just one component of a much larger portfolio. Still, Morgan Stanley analysts have pointed out that Waymo’s growing presence offers significant long-term upside for shareholders. Unlike Tesla, whose valuation hinges heavily on the rapid adoption of its autonomous taxi service, Alphabet benefits from diversified revenue streams including search, YouTube, and Google Cloud. This diversification reduces exposure to risks associated with consumer acceptance of self-driving vehicles, making Alphabet a more balanced investment choice according to some market strategists.

Despite underperforming the Nasdaq 100 Index this year, Alphabet continues to gain traction in autonomous mobility. Waymo now serves over 250,000 paid rides weekly — a fivefold increase from the previous year — and is increasingly becoming a topic of discussion among investors during earnings calls. While Tesla faces backlash over CEO Elon Musk’s controversial public statements and declining sales, Alphabet maintains a strong foundation with tangible progress in driverless technology. Some experts believe that both companies can coexist and succeed in the expanding autonomous vehicle market, but Waymo currently holds the edge in commercial execution, while Tesla relies on manufacturing capacity to scale in the future.