Unlock Long-Term Wealth with Buffett's S&P 500 Blueprint

Embracing the Oracle's Wisdom: A Timeless Investment Principle for All

When an individual achieves immense financial success, accumulating a fortune exceeding $140 billion and fostering a multi-trillion dollar enterprise, their insights naturally command significant attention. This is precisely why Warren Buffett has maintained his status as a highly respected figure in the financial world. Despite his extraordinary achievements, he has consistently offered invaluable investment guidance accessible to everyday investors.

The Enduring Appeal of the S&P 500: A Foundation for Economic Participation

A central tenet of Buffett's advice throughout his career has been that ordinary investors are best served by regularly allocating capital to the S&P 500 as a reliable method for accumulating wealth over a lifetime. He has frequently stated, \"For most people, the optimal strategy is to hold an S&P 500 index fund.\" Consequently, for those seeking an investment strategy aligned with Buffett's principles, an S&P 500 Exchange Traded Fund (ETF), such as the Vanguard S&P 500 ETF (VOO), presents a clear path forward. It represents one of the most straightforward ways to implement his recommendation.

The Core Advantage: Broad Market Exposure and Simplified Diversification

The S&P 500 index comprises approximately 500 of the largest publicly traded companies in the United States, making investments in an S&P 500 fund a practical means of participating in the broader U.S. economy. While smaller businesses also contribute to the economic landscape, companies within the S&P 500 represent a substantial portion of the nation's Gross Domestic Product. The index's sector allocation, as of a recent measurement, demonstrates a wide, though concentrated, distribution:

- Technology: 34.8%

- Financial Services: 13.5%

- Consumer Discretionary: 10.5%

- Communication Services: 10.1%

- Healthcare: 8.9%

- Industrial Sector: 8.3%

- Consumer Staples: 4.9%

- Energy Sector: 2.9%

- Utilities: 2.3%

- Real Estate: 1.9%

- Basic Materials: 1.8%

Although the current emphasis on technology stocks might not perfectly align with Buffett's traditional preferences, he would likely still acknowledge the inherent benefit of an index encompassing businesses from virtually every major economic sector. While not as spread out as it once was, it still offers immediate portfolio diversification to investors. The ability to gain exposure to 500 of America's leading companies through a single investment significantly streamlines the investment process. There's no need to dedicate extensive hours to researching numerous individual companies; one simply invests in the S&P 500 and relies on its proven capacity for sustained long-term expansion.

Cost-Effectiveness: VOO as a Prudent Choice for Index Investing

Buffett also advocates for the affordability of S&P 500 funds, which is why VOO is often favored over alternatives like the SPDR S&P 500 ETF Trust (SPY). VOO's expense ratio of 0.03% is considerably lower, more than three times cheaper, than SPY's 0.0945% expense ratio. Both options are economical, and while a difference of 0.0645% might appear minor, it accumulates significantly over time. Given that both ETFs essentially track the same index, opting for the more cost-efficient choice is a logical decision. To illustrate, consider a scenario where you invest $500 monthly into both ETFs, assuming an average annual return of 10%. Over a 25-year period, the variance in fees between 0.03% and 0.0945% would result in an additional cost of over $5,600 for the higher-expense fund.

The Reward of Patience: Demonstrating Attractive Returns Through Simplicity

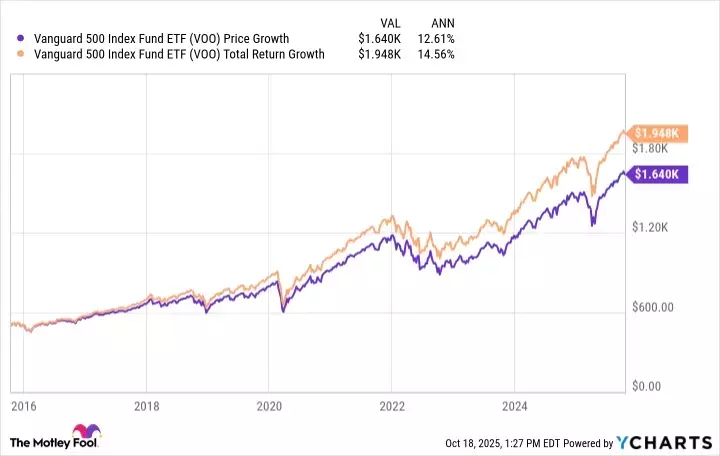

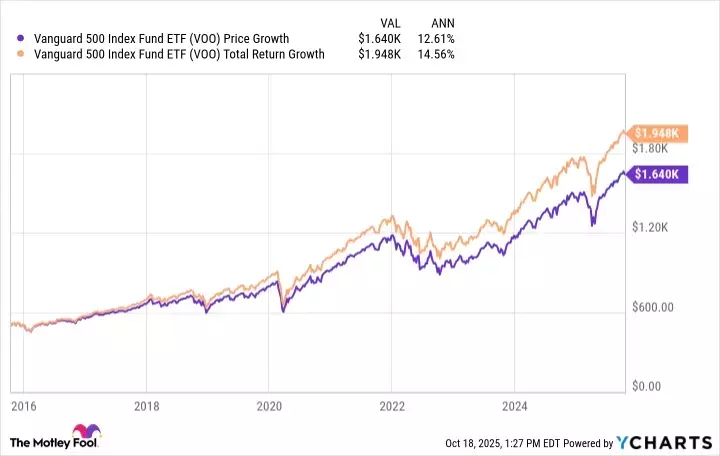

Opting for S&P 500 investing does not necessitate compromising on potential gains. A study conducted by MarketWatch revealed that approximately 65% of actively managed funds on Wall Street underperformed the S&P 500 in 2024. Over the past decade, VOO has generated an average annual return of approximately 12.6% (or 14.5% when including dividend reinvestment). This indicates that an initial investment of $500 made a decade ago would now be valued between $1,600 and $1,900. No individual, including Buffett or seasoned Wall Street professionals, can precisely predict the short-term performance of any stock. Nevertheless, the S&P 500 remains well-positioned to serve as an appealing long-term investment. While market fluctuations and challenges are inevitable, historical data consistently demonstrates that patient investors are ultimately rewarded