U.S. stock futures were falling back early Tuesday after the S&P 500 closed above 6,000 for the first time yesterday. The index is on course for its first back-to-back yearly gains of more than 20% for the first time since 1998.

Riding the Wave of Optimism: Investors Bullish on Trump's Policies

Dow Reaches Unprecedented Levels

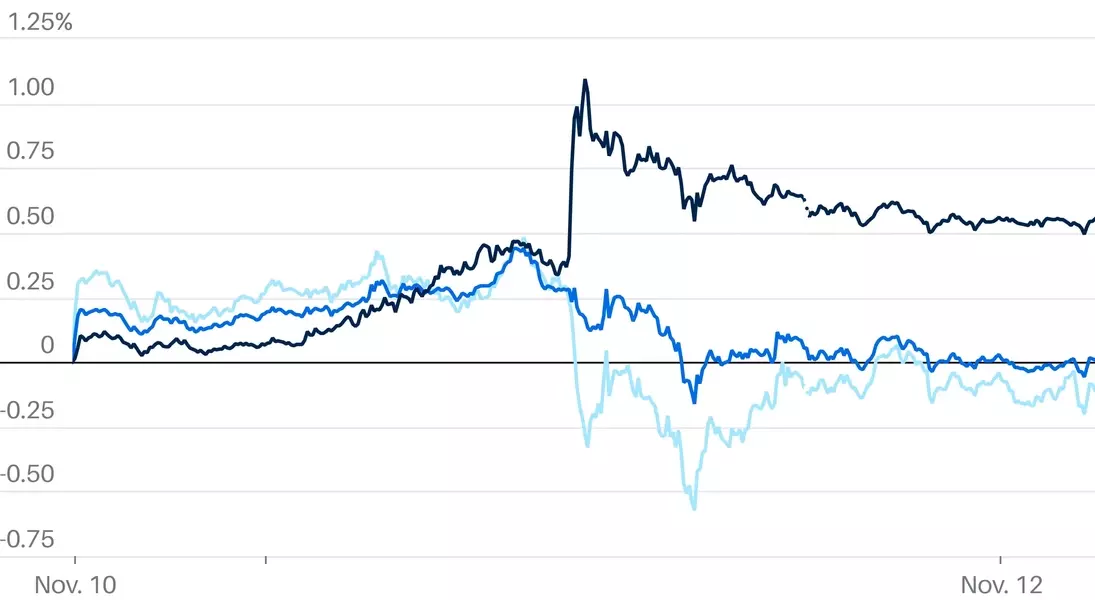

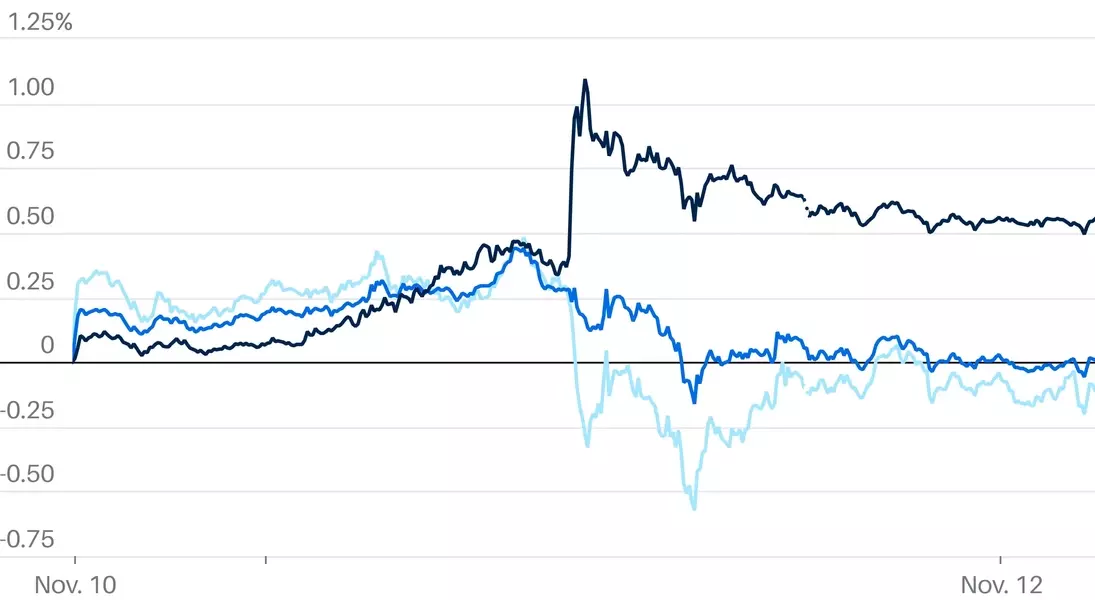

The Dow Jones Industrial Average futures were down 35 points, or 0.1%, after closing above 44,000 for the first time yesterday. This milestone reflects the broader market's confidence in the future economic landscape under the incoming Trump administration. Investors are betting that the president-elect's plans for lower taxes and reduced regulation will translate into higher corporate profits, driving the Dow to new heights.The S&P 500 futures also fell 0.1%, as did contracts tied to the technology-heavy Nasdaq 100. However, all three major indexes finished Monday's trading session in positive territory, indicating the market's resilience and optimism.Anticipating Trump's Economic Agenda

The election of Donald Trump to another term in the White House last week has ignited a rally in stocks, fueled by optimism that his policies will bolster company earnings over the next four years. While there are still two months before Trump takes office, the market is already pricing in his anticipated plans, as well as key economic data and earnings reports.Investors are closely watching the upcoming inflation figures and Home Depot's earnings, which could provide further insights into the health of the economy. Additionally, the potential for more interest-rate reductions from the Federal Reserve may also lift stocks over the coming months, further buoying the market's upward trajectory.Riding the Wave of Optimism

The market's surge in the wake of Trump's election victory reflects the widespread belief that his economic agenda will be a boon for businesses. Investors are betting that the combination of lower taxes and looser regulation will translate into higher corporate profits, driving the stock market to new heights.However, it's important to note that the market's reaction is based on anticipation and speculation, rather than concrete policy implementation. The true impact of Trump's policies will only become clear once they are enacted and their effects can be measured. Nonetheless, the current market enthusiasm suggests that investors are confident in the president-elect's ability to deliver on his promises and propel the economy forward.As the transition of power approaches, the market will continue to closely monitor the developments in Washington, eagerly awaiting the details of Trump's economic plan and its potential implications for the broader market. Investors will be closely watching for any signs of policy shifts or changes that could affect the market's trajectory in the months ahead.You May Like