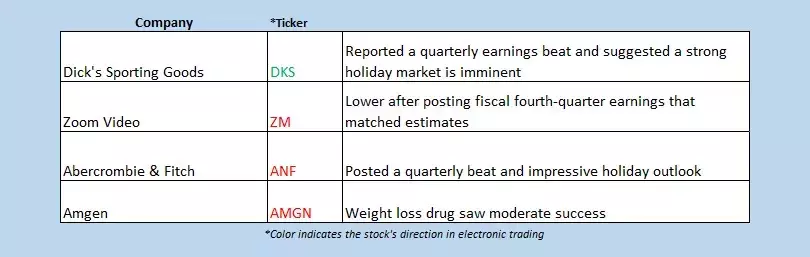

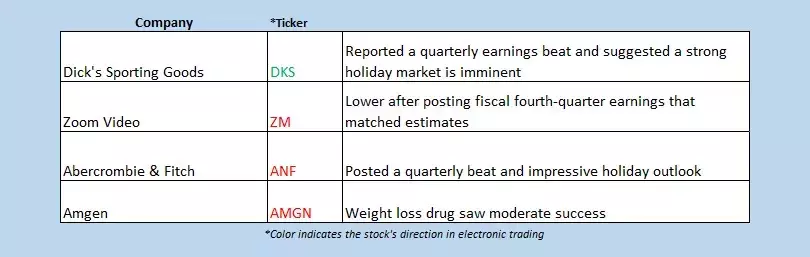

Stock futures are in a state of flux this morning as investors delve into the significant tariff proposals put forth by President-elect Donald Trump last night. The Dow Jones Industrial Average (DJI) futures are down by 168 points, with added pressure coming from Amgen's (AMGN) roughly 12% premarket drop due to its obesity drug trial results. In contrast, the S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) futures are showing a modest increase following yesterday's upward movement.

2 Risks for Bulls, per Schaeffer's V.P. of Research Todd Salamone

Investors need to be aware of two key risks for bulls as they navigate the current market. Todd Salamone, Schaeffer's V.P. of Research, has pointed out these risks. Firstly, the uncertainty surrounding the tariff proposals and their potential impact on various sectors could lead to increased market volatility. This volatility may cause investors to become more cautious and potentially sell off their holdings. Secondly, the global economic landscape is also a factor to consider. Any slowdown in global economic growth could further dampen market sentiment and pose a challenge for bulls.Secondly, the global economic landscape is also a factor to consider. Any slowdown in global economic growth could further dampen market sentiment and pose a challenge for bulls.How Options Traders Doubled Their Money with This Telehealth Stock

Options traders have been making some interesting moves with a particular telehealth stock. Through strategic trading strategies and a keen understanding of market trends, these traders have managed to double their money. This success story highlights the potential opportunities that exist in the options market and how astute traders can capitalize on them. By carefully analyzing market data and using various trading techniques, these traders have been able to generate significant profits. It serves as an example of the kind of returns that can be achieved through active trading in the stock market.Plus, 2 Retail Stocks Falling after Earnings

Two retail stocks have experienced a decline in value after reporting their earnings. Best Buy Co Inc (NYSE:BBY) stock is down 3.3% in premarket trading. The company announced worse-than-expected third-quarter results and lowered its full-year sales forecast due to the slowing demand for its electronics and appliances. This shows the impact that weak earnings can have on a stock's performance. Year to date, the equity is still up 18.8%, but the recent earnings announcement has caused some concern among investors.Another retail stock that has fallen is Kohl's Corp (NYSE:KSS). Shares of Kohl's are down 18.8% before the bell. The retailer's third-quarter earnings and revenue missed expectations. Additionally, Michaels CEO Ashley Buchanan is replacing the current CEO Tom Kingsbury, effective January 15. If the losses continue, KSS may drop to its lowest level since 2020. This highlights the challenges faced by retail companies in a changing market environment.EV Stock Surges on Government Funding

Rivian Automotive Inc (NASDAQ:RIVN) stock is seeing a significant increase in electronic trading. The electric vehicle (EV) name has received conditional approval for a loan of up to $6.6 billion from the U.S. government. This news has boosted investor confidence in the company and led to a surge in its stock price. Heading into today, RIVN is down 50.5% year to date, but the government funding could potentially turn things around for the company. It shows the importance of government support in the growth of the EV industry and how it can have a positive impact on individual companies.You May Like