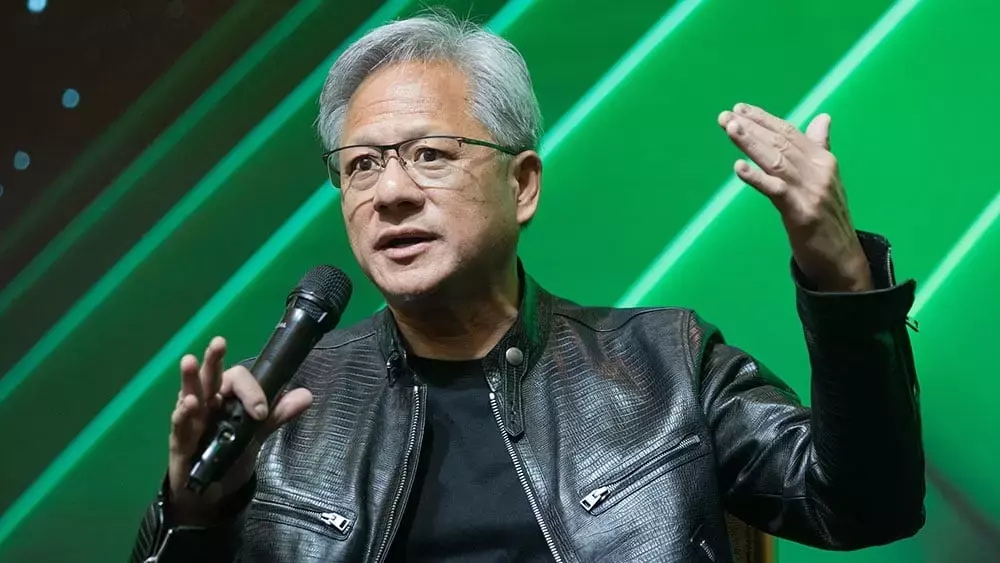

On Wednesday, the financial landscape was abuzz with anticipation as the Dow Jones Industrial Average and other major stock indexes showed an upward trend. Investors were keenly awaiting a critical earnings report from Nvidia (NVDA) and the insights from its Chief Executive Jensen Huang, which was set to be released after the market close. An early setback was witnessed by Target (TGT) in the stock market.

Early Market Indicators and Futures Movements

Before the opening bell, Dow Jones futures saw a modest 0.2% increase, while the S&P 500 futures edged up by 0.1%. In morning trading, the tech-heavy Nasdaq 100 futures traded with a less than 0.1% gain. The 10-year Treasury yield rose to 4.43%, and oil prices climbed, with West Texas Intermediate futures trading around $70.10 per barrel. Among exchange traded funds, the Invesco QQQ Trust (QQQ) and the SPDR S&P 500 ETF (SPY) both showed a slight increase ahead of the market open.Nvidia's Impact on the Market

Chip giant Nvidia had a significant impact on the market. On Tuesday, it rallied 4.9% after snapping back from two days of heavy losses. Its shares regained the recent 140.76 buy point and were close to reaching record highs. Nvidia stock added 0.4% in premarket trading on Wednesday. The company is scheduled to report earnings after the close, and Wall Street expects it to earn 75 cents a share, up 86%, on sales of $33.1 billion, up 83%, according to Investor’s Business Daily’s MarketSurge. Key earnings movers on Wednesday include Target, TJX (TJX), and Williams-Sonoma (WSM). Target stock plunged 16% as the company missed earnings and sales estimates and cut its full-year outlook. TJX stock dropped 2.4%, while Williams-Sonoma rocketed more than 26% in premarket trading.Dow Jones and Other Components' Movements

On Tuesday, the Dow Jones Industrial Average fell 0.3% for a fourth consecutive session of losses. However, the S&P 500 rose 0.4% and the Nasdaq composite advanced 1%. Among the best companies to watch on the stock market today are Broadcom (AVGO), Costco Wholesale (COST), Deckers Brands (DECK), FanDuel parent Flutter Entertainment (FLUT), and Tradeweb Markets (TW). Dow Jones components making notable moves are Amazon.com (AMZN), Apple (AAPL), Microsoft (MSFT), and Salesforce (CRM). Salesforce and Broadcom featured in the Stocks Near A Buy Zone column. There were no new stocks on IBD MarketSurge’s “Breaking Out Today” list due to the recent market weakness. Investors can check for potential breakouts on the “Near Pivot” list. To find additional stock ideas, they can refer to IBD Stock Lists like IBD 50, Big Cap 20, and Stocks Near A Buy Zone.Software Leaders and Their Positions

Dow Jones software leader Salesforce is testing a 318.71 buy point, according to MarketSurge pattern recognition. Shares rose 1% on Wednesday. Outside the Dow Jones index, artificial intelligence giant Broadcom is below support around its 50-day line as it continues to build a flat base with a 186.42 alternative entry. Broadcom shares edged lower on Wednesday. Heico is in buy range above its flat base’s 269.38 buy point and is a recent IBD Stock Of The Day. Shares rose 1% early Wednesday. Deckers stock is in buy range past a 172.57 buy point in a cup-with-handle base. Shares were down 0.4% on Wednesday. Shares of Flutter jumped past a 252.84 buy point in a flat base during last week’s jump to new highs and remained at the top of the buy range. The stock inched higher on Wednesday morning. Finally, Tradeweb moved within striking distance of a 136.13 entry in a flat base during Tuesday’s 3% rally. Aggressive investors could use a move above the high of 131.70 as a trendline early entry. Tradeweb stock rallied 1.5% in premarket action on Wednesday.Magnificent Seven Stocks and Their Performances

Among Magnificent Seven stocks, Alphabet (GOOGL) fell a fraction in premarket trading. Shares are again nearing a 182.02 buy point in a cup with handle following a short-lived breakout attempt. Meta Platforms (META) gave up its 50-day line last week but is still near a flat base’s 602.95 buy point. Shares rose 0.5% on Wednesday. Tesla (TSLA) lost 0.3% on Wednesday premarket after a three-day win streak. Shares of the electric-vehicle giant are back near new highs. Among Dow Jones components in the Magnificent Seven, Amazon stock rebounded 1.4% on Tuesday but dipped 0.4% in premarket trading on Wednesday. Amazon shares are just above a consolidation’s 201.20 buy point. Shares of Apple are vacillating above and below their 50-day line as they continue to consolidate after a new high on Oct. 15. The stock inched down on Wednesday morning. Microsoft shares rose 0.3% on Wednesday morning. The stock remains below its 50-day line, a key level to watch.Be sure to follow Scott Lehtonen on X at @IBD_SLehtonen for more on growth stocks, the Dow Jones Industrial Average, and the stock market today.