Driving the Future: Unlocking the Potential of Vehicle Periodic Maintenance

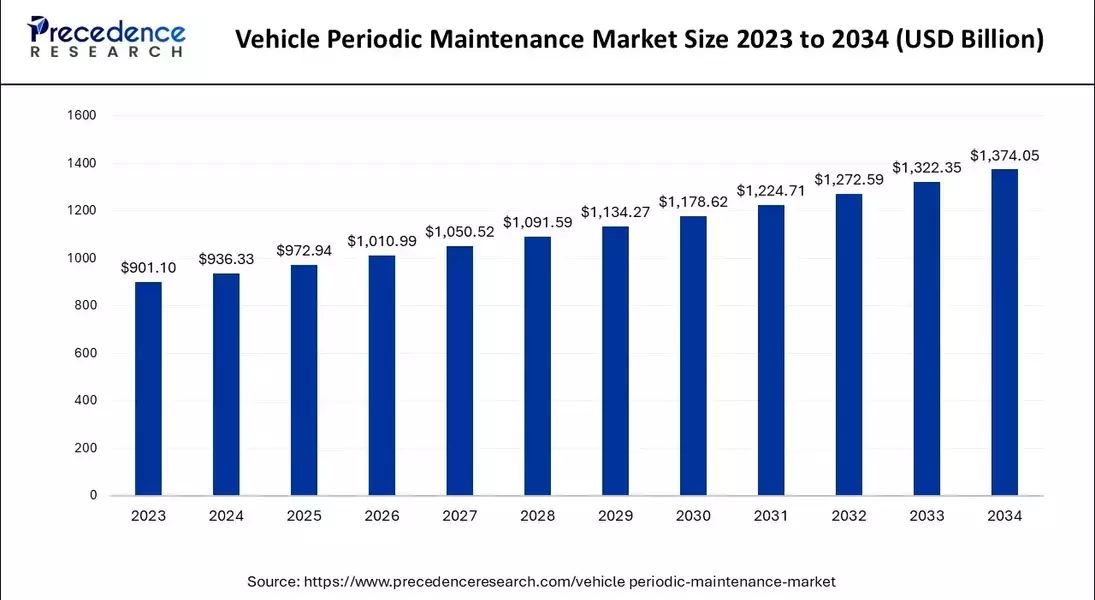

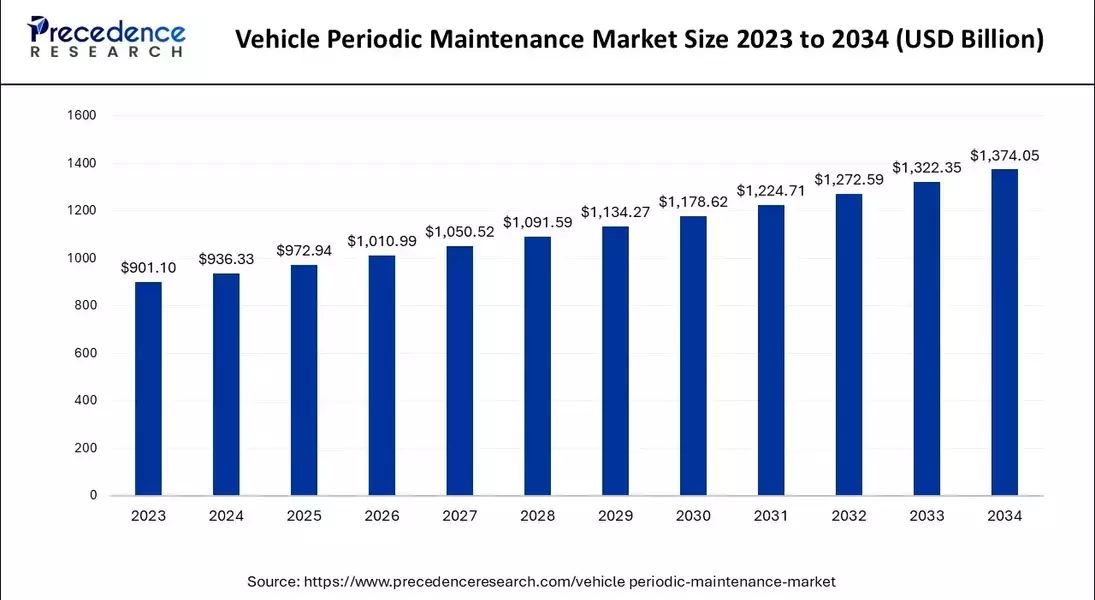

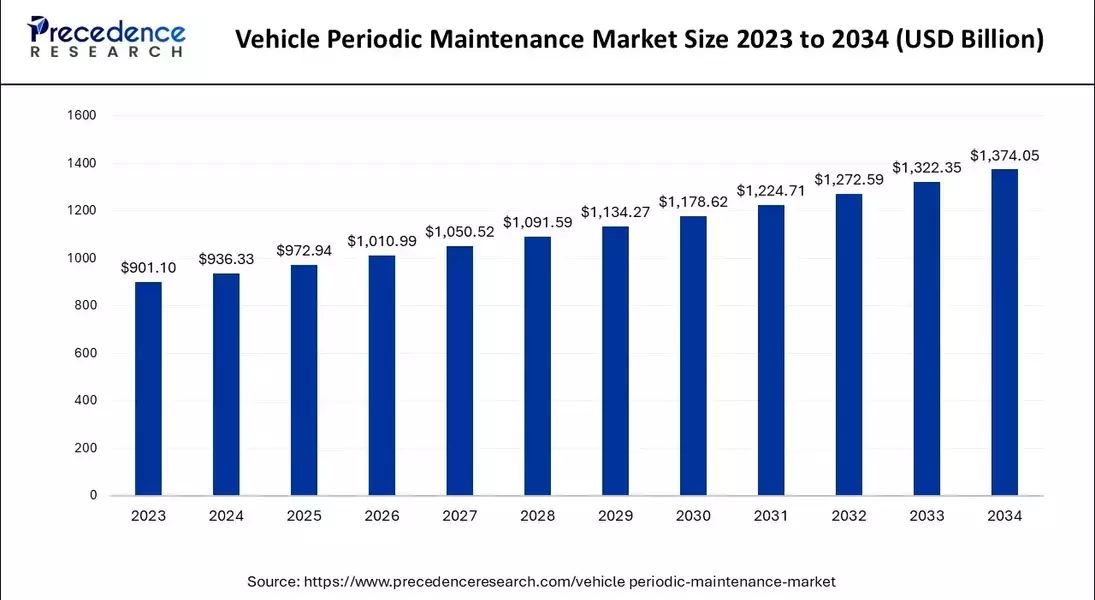

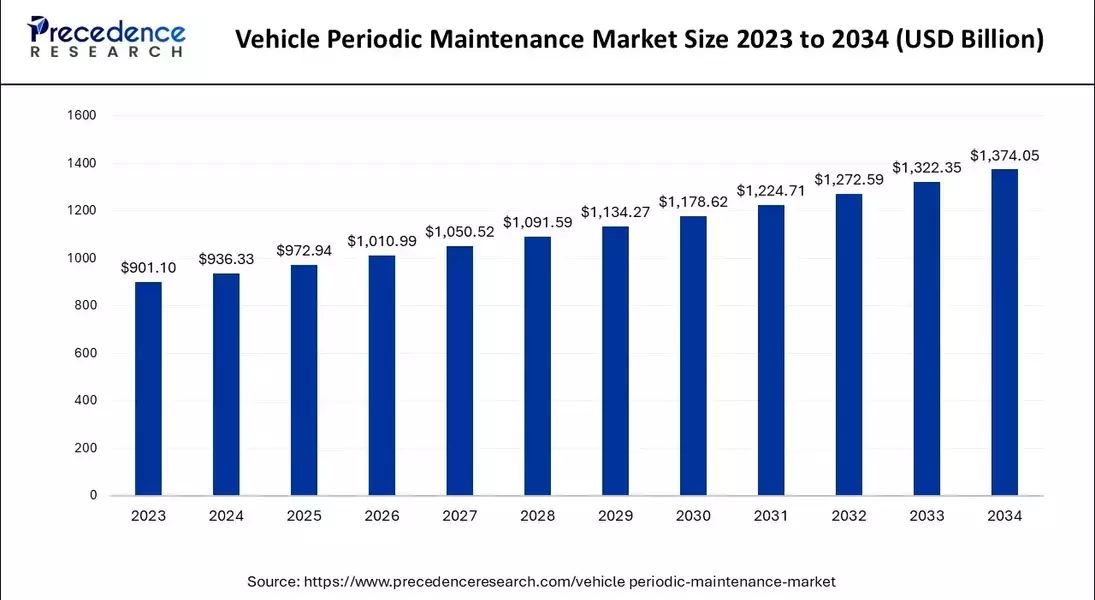

The global vehicle periodic maintenance market is poised for significant growth, with projections indicating a surge from $936.33 billion in 2024 to a staggering $1,374.05 billion by 2034, expanding at a CAGR of 3.91%. This remarkable trajectory is fueled by the increasing awareness among consumers about the necessity of regular vehicle maintenance, which not only enhances efficiency and cost-effectiveness but also instills a sense of safety and confidence in vehicle owners.Empowering Drivers, Transforming the Industry

Navigating the Evolving Landscape of Vehicle Periodic Maintenance

The vehicle periodic maintenance market is experiencing a surge in demand, driven by the exponential growth in global automotive sales. Consumers are increasingly recognizing the value of maintaining their vehicles to ensure smooth operation, reliability, and longevity. Periodic maintenance has become a comprehensive approach, encompassing regular inspections, repairs, and replacements to optimize the performance of vehicles.This comprehensive maintenance process involves refilling essential fluids, such as wiper fluid, radiator coolant, brake fluid, and power steering fluid, as well as oiling the motor to mitigate the risks of damage due to friction. Additionally, various automotive parts are meticulously cross-checked to ensure maximum efficiency, including brake pads, wipers, driving belts, spark plugs, air filters, and fluid filters.Embracing the Power of AI: Transforming Vehicle Periodic Maintenance

The vehicle periodic maintenance market is undergoing a transformative shift, driven by the integration of Artificial Intelligence (AI) technology. AI is revolutionizing the industry by enhancing accuracy, efficiency, and cost-effectiveness through the implementation of predictive maintenance strategies. By leveraging AI algorithms, real-time data monitoring, and advanced sensor technology, vehicle owners can now anticipate potential failures before they occur, mitigating the risk of unexpected breakdowns and minimizing maintenance costs.The integration of AI-powered solutions in the vehicle periodic maintenance market enables the optimization of scheduled maintenance and routine services. By analyzing patterns of vehicle usage, AI-powered systems can recommend customized maintenance schedules, ensuring that workshops have the necessary parts on hand and minimizing downtime. This seamless integration of technology and service has the potential to redefine the customer experience, providing greater convenience and flexibility.Navigating the Regional Dynamics: Insights into the Global Landscape

The vehicle periodic maintenance market exhibits distinct regional dynamics, with Asia Pacific emerging as the largest market in 2023. This dominance can be attributed to the rising awareness among consumers in the region about the importance of regular vehicle maintenance for safety, performance, and cost-effectiveness.Furthermore, the growing disposable incomes in countries like India, China, and Japan have fueled the demand for vehicle maintenance services. Stringent regulations regarding vehicle safety and carbon emissions have also contributed to the market's expansion in the Asia Pacific region.On the other hand, North America is expected to witness the fastest growth in the vehicle periodic maintenance market during the forecasted years. This can be attributed to the affluent consumer base, who tend to invest in luxury vehicles, as well as the increasing number of repair and maintenance centers in the region, particularly in the United States. The aging vehicle fleet in the U.S., with an average age exceeding 12 years, has also driven the demand for periodic maintenance services.Unlocking the Potential of Emerging Vehicle Technologies

The vehicle periodic maintenance market is poised to capitalize on the growing demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs). As these advanced vehicle technologies gain traction, the market is presented with a significant opportunity to cater to their specialized maintenance requirements.Maintaining EVs and HEVs involves specialized services, such as software updates, electrical system repairs, and battery diagnostics. These technologically advanced vehicles require a different approach to periodic maintenance, creating a surge in demand for specialized tools, training, and expertise. The integration of AI-based battery diagnostics and cloud-based service platforms further enhances the customer experience, providing greater convenience and flexibility.As consumers become increasingly conscious of environmental sustainability and the impact of their transportation choices, the demand for EVs and HEVs is expected to rise exponentially. This shift in consumer preferences presents a lucrative opportunity for the vehicle periodic maintenance market to adapt and capitalize on the growing need for specialized services tailored to these emerging vehicle technologies.Navigating the Competitive Landscape: Key Players Shaping the Future

The vehicle periodic maintenance market is characterized by the presence of a diverse array of players, each vying for a share of this rapidly growing industry. Prominent players in the market include ADNOC, Nippon Express Co., Car Parts.com Inc., Belron International Ltd., EUROPART Holding GmbH, Hance's European, Inter cars, LKQ Corporations, M& M Auto Repair, Mekonomen Group, Mobivia Groupe, My TVS, Sun Auto Service, USA Automotive, and Wrench, Inc.These market leaders are continuously exploring strategic initiatives to strengthen their market position and meet the evolving needs of consumers. Recent developments in the industry include the launch of innovative service offerings, such as Goodyear Tire and Rubber Company's tires-as-a-service program, and the introduction of mobile apps like Kiwi Fix Auto's platform, which provides a seamless and convenient way for car owners to manage their vehicle maintenance and emergencies.Furthermore, the industry has witnessed significant consolidation, with players like AutoNation, Inc. acquiring Repair Smith, a mobile solution for automotive repair and maintenance, to expand their footprint and enhance their service capabilities. These strategic moves underscore the competitive nature of the vehicle periodic maintenance market and the industry's commitment to delivering exceptional customer experiences.As the market continues to evolve, the key players in the vehicle periodic maintenance industry must remain agile, innovative, and customer-centric to capitalize on the growing demand and secure their position in this dynamic landscape.