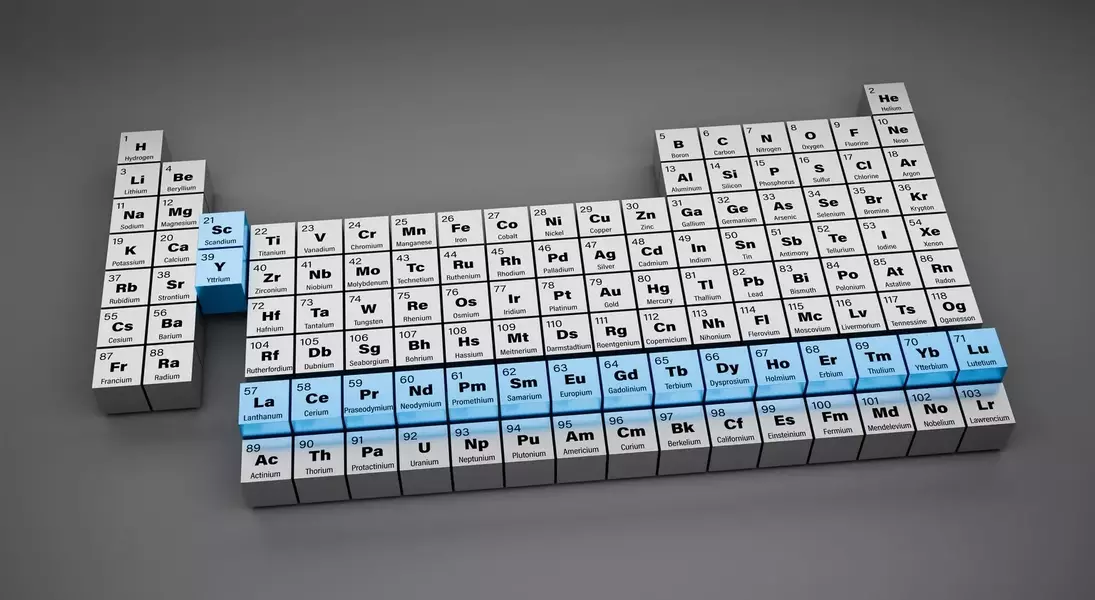

Strategic Investment: A New Chapter for USA Rare Earth

Navigating Market Volatility: A Recent History of USA Rare Earth Stock Performance

USA Rare Earth, Inc. has experienced a dynamic trajectory in the market over the past year. Initially, the former SPAC saw its stock price almost double by March 2025, reflecting significant investor interest. However, this period of rapid growth was followed by a downturn, with the stock eventually trading below its original offering price of $10.

Transformative Government Support: The Impact of New Investment

A crucial turning point for USA Rare Earth came in October with the announcement of a transformative investment from the U.S. government. This substantial backing fundamentally alters the company's financial landscape and strategic positioning. Such government involvement typically signifies a recognition of the company's importance to national interests and can provide a stable foundation for future growth and development.

Opportunities and Challenges: Balancing Government Backing with Market Risks

While the U.S. government's investment and USA Rare Earth's strong balance sheet provide distinct advantages, the company still faces certain challenges. Dilution risk, a common concern with new investments, could impact existing shareholders. Furthermore, the long-term demand for rare earth elements remains subject to the uncertainties of evolving trade policies, which could influence market stability and company performance. These factors require careful consideration despite the positive impact of government support.

Analyst's Outlook: Upgrading USAR Stock to a Hold Amidst Evolving Conditions

Considering the complex interplay of government backing, market volatility, and future uncertainties, the analyst has chosen to upgrade USA Rare Earth stock to a Hold rating. This decision reflects a recognition of the company's enhanced stability due to government support, while also acknowledging the inherent risks. The company's solid financial health, coupled with strategic government partnership, suggests a more secure, albeit still evolving, investment profile.