Navigating the Currents of Commerce: Economic Shifts and Corporate Strategies

Robust Job Growth Exceeds Forecasts, Boosting Market Sentiment

Stock futures saw an upward movement following the release of the U.S. employment report, which showed stronger-than-anticipated job creation. The Bureau of Labor Statistics reported that American businesses added 130,000 jobs in January, surpassing economists' predictions of 55,000 and December's 50,000 additions. This positive labor market news led to approximately a 0.4% increase in Nasdaq 100, Dow Jones Industrial Average, and S&P 500 futures. The unemployment rate also declined to 4.3% from 4.4% in December, defying expectations of it remaining constant.

Bond Yields React to Economic Data and Market Dynamics

The yield on the 10-year Treasury bond, a key indicator influencing various consumer loan rates, including mortgages, climbed above 4.20% from approximately 4.13% after the job report's release. This surge followed a decline of over 6 basis points the previous day, when the yield closed below 4.15% after an unexpectedly flat December U.S. retail sales report. These fluctuations underscore the bond market's sensitivity to economic data and its implications for interest rates.

Mixed Stock Market Performance Reflects Sectoral Disparities

Despite the positive jobs data, stock market performance was mixed. The Dow Jones Industrial Average achieved its third consecutive closing record, alongside a new intraday high, with a modest 0.1% increase. However, the technology-focused Nasdaq and the broader S&P 500 indices both ended the day lower by 0.6% and 0.3% respectively, breaking their two-session winning streaks. This divergence highlights a shift in investor focus, with technology stocks experiencing a pullback.

AI Concerns Impact Financial Sector, 'Magnificent Seven' See Varied Results

Worries surrounding artificial intelligence (AI) negatively affected financial stocks, particularly wealth management firms. S&P Global and Raymond James Financial saw declines of nearly 10% and 9% respectively. Recent AI-related announcements have caused volatility in these industries, though both firms' shares rebounded over 1% in premarket trading. Among the 'Magnificent Seven' stocks, all but Tesla experienced declines, with Tesla shares climbing nearly 2%. Early Wednesday trading showed mixed results for these major tech companies, with minimal significant movements.

Key Corporate Movements and Market Shifts

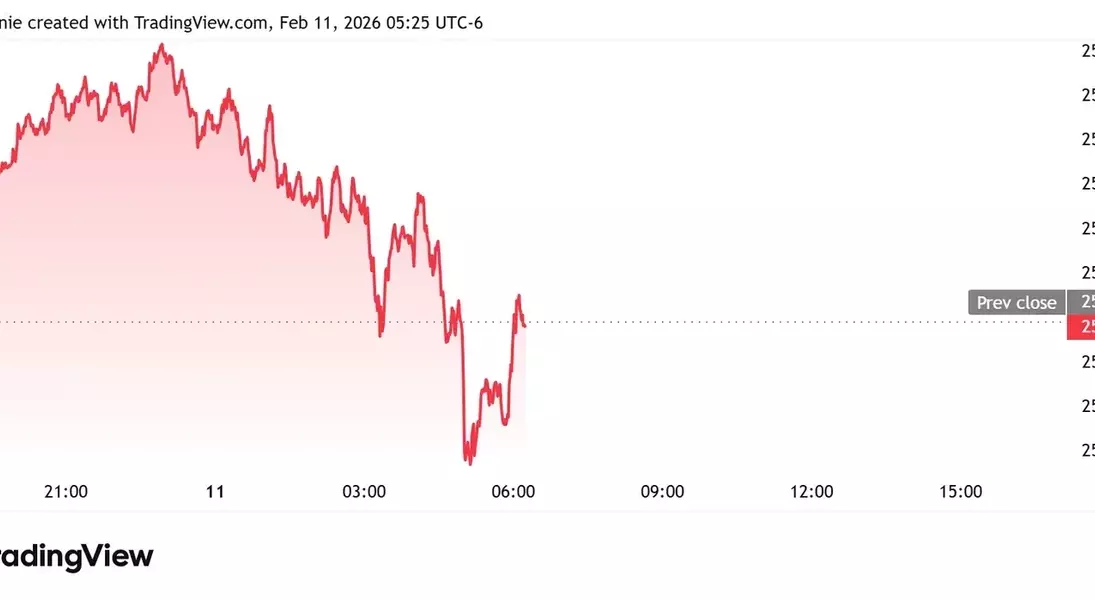

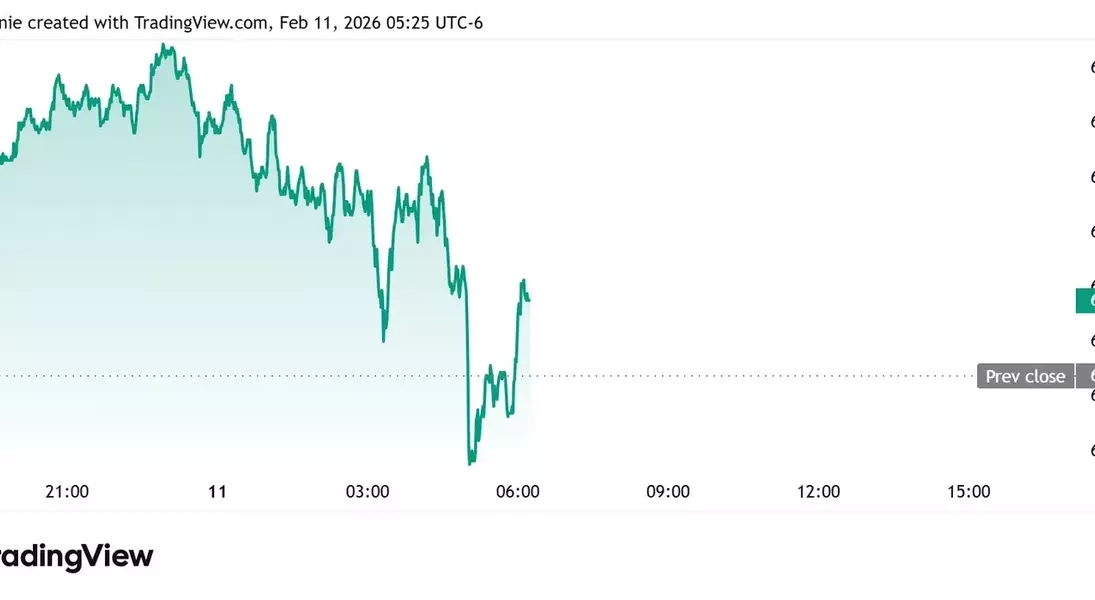

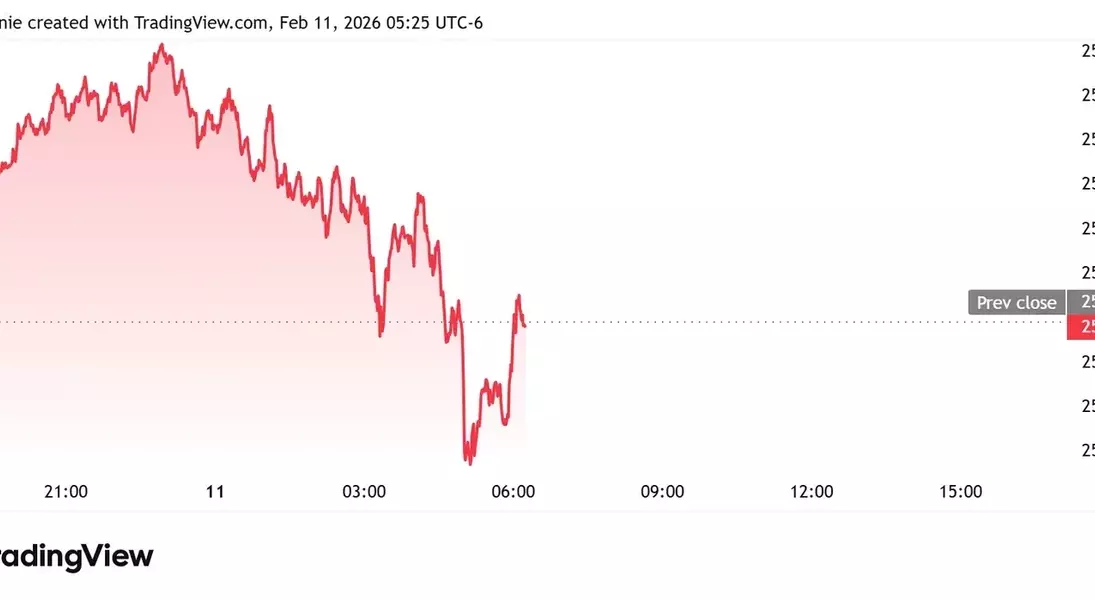

Several companies experienced significant stock movements. Mattel plummeted 27%, Lyft sank 17%, Moderna dropped 10%, Robinhood Markets retreated 8%, Humana fell 6.5%, Kraft Heinz declined 7%, and T-Mobile US pulled back 3.5%. Conversely, Cloudflare soared 15%, Shopify surged 11%, Hinge Health popped 11%, Ford Motor gained 1.5%, and Hilton Worldwide Holdings edged higher. McDonald's was also scheduled to release its earnings report. In the cryptocurrency market, Bitcoin traded near $66,700 after peaking around $69,200, while the U.S. dollar index slipped 0.2% to 96.57. Gold futures rose 1.3% to $5,095 per ounce, and silver futures surged over 5% to $84.65 per ounce. West Texas Intermediate crude futures increased by 1.4% to $64.85 per barrel.

Consumers Tighten Belts Amidst Economic Uncertainty

New data suggests that consumers might be scaling back their spending. Retail sales stagnated in December, falling short of expectations after a period of strong growth. This trend signals a potential slowdown in consumer spending for 2026, as a challenging job market prompts caution. Scott Hoyt of Moody's Analytics notes that the labor market's weakness is a key factor, with little expectation for significant improvement. Given that consumer spending accounts for roughly two-thirds of the U.S. economy, even minor reductions can have a substantial impact on overall economic activity.

Kraft Heinz Reconsiders Planned Separation Strategy

Kraft Heinz has put its plans for a two-way split on hold. The new CEO, Steve Cahillane, stated in the fiscal 2025 fourth-quarter earnings report that the company's challenges are manageable internally and that it is "prudent to pause work related to the separation." He added that this decision would avoid related dis-synergies this year. Cahillane, who assumed the CEO role on January 1, took over after Kellanova's acquisition by Mars in December. Kraft Heinz had initially announced plans to split in September, undoing a merger that was a decade old. The company's fourth-quarter net sales decreased by 3.4% year-over-year to $6.35 billion, slightly below analyst expectations, primarily due to a 4.7 percentage point drop in volume/mix across all segments, particularly in coffee, cold cuts, Indonesia, bacon, and Ore-Ida. Although adjusted earnings per share for Q4 were $0.67, exceeding estimates, the fiscal 2026 adjusted EPS guidance of $1.98 to $2.10 fell significantly below the consensus of $2.48. Kraft Heinz shares dropped 7% before the bell, having already fallen over 15% in the past year.

The Trump Family's Foray into Cryptocurrency: World Liberty Financial

The Trump family has expanded its business interests into the cryptocurrency sector with World Liberty Financial. This company operates a lending market called WLFI Markets and, through its subsidiary World Liberty Trust, has applied for a national banking charter. World Liberty Financial positions itself as a "decentralized finance" (DeFi) ecosystem, aiming to remove intermediaries from financial transactions. The company was founded by President Donald Trump, his sons, and Steve Witkoff (the president's special envoy) and his sons. Central to this venture is its USD1 stablecoin, designed to maintain a peg to the U.S. dollar, and its token WLFI, which recently traded at about 11 cents, a significant drop from its peak of around 33 cents since its launch in September. WLFI Markets enables users to borrow and lend against digital assets using USD1. While the app is not available in all U.S. regions, including New York, its growth could increase the circulating supply of USD1 and potentially boost the interest income from its backing assets.

Wage Growth Experiences a Notable Slowdown

Many workers experienced slower wage growth this year, a trend confirmed by new data. The Bureau of Labor Statistics reported that wages and salaries for private industry workers increased by 0.7% in the fourth quarter, marking the slowest pace since the second quarter of 2021. On an annual basis, wages grew by 3.4%, matching the first quarter's rate but decreasing from the third quarter. This slowdown signals a tightening job market for employees, as companies reduce hiring. Job openings have reached a post-pandemic low, with more unemployed individuals than available positions, and the unemployment rate has gradually risen since early 2025. Dante DeAntonio, an economist at Moody's Analytics, noted that the weak fourth-quarter growth in the Employment Cost Index aligns with other indicators of a softening labor market in the latter half of 2025. Employers are now under less pressure to raise wages compared to previous years.

Stock Futures Remain Steady Ahead of January Job Report Release

Futures contracts linked to the Dow Jones Industrial Average showed a slight increase of 0.1%. Similarly, S&P 500 futures also advanced by 0.1%. Nasdaq 100 futures, however, experienced a marginal decline. These movements occurred as markets awaited the official release of the January jobs report, with investors cautiously positioning themselves in anticipation of the key economic data.