The U.S. land market is navigating a challenging period, marked by a significant decline in buyer interest and an increase in failed transactions. This downturn is particularly notable following a robust two-year growth phase, indicating a shift in market dynamics where previous valuations no longer hold. The current environment presents a standoff between sellers, who are reluctant to lower prices, and cautious builders facing tighter profit margins. This imbalance is not only impacting immediate land deals but also foreshadows a potential slowdown in future residential construction, affecting the broader housing supply chain.

As the market adjusts, buyers are gaining negotiating power, leading to more flexible terms for land acquisition. This change allows for delayed purchases and renegotiated contracts, reflecting a more buyer-friendly landscape. Simultaneously, alternative strategies like land banking and the expansion of build-to-rent models are gaining traction, providing investors and developers with options to navigate the volatile market. These evolving trends underscore a critical period for the real estate sector, where adaptation and strategic planning will be key to success amidst shifting economic conditions and evolving buyer demands.

Shifting Tides: Demand Decline and Price Resilience in the Land Market

The U.S. land market is currently experiencing a notable contraction in demand, reaching levels not witnessed since late 2022. A recent report indicates that a mere 28% of land brokers now characterize demand as robust, a stark contrast to the 76% recorded just a year prior. This represents a significant and abrupt reversal from a period of intense competition over the past two years. The market's shift is further evidenced by a sharp increase in transaction cancellations and renegotiations, with almost 80% of brokers reporting such occurrences. Deals that were financially sound six months ago are reportedly no longer viable, creating a challenging environment for both buyers and sellers.

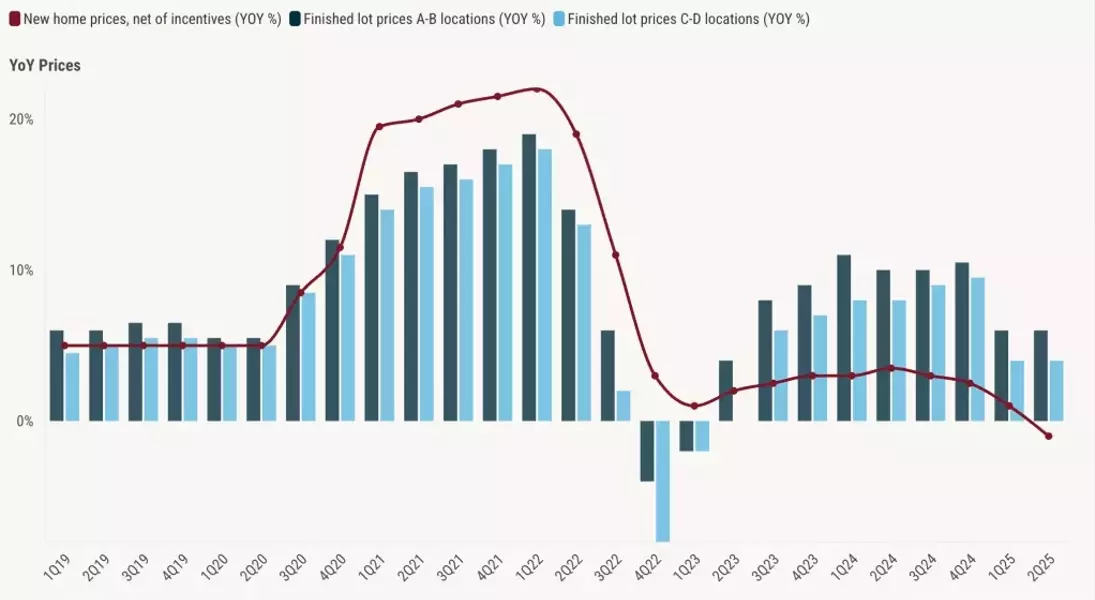

Despite this marked weakening in demand, land prices have paradoxically demonstrated a degree of resilience, particularly for prime locations. While national new home prices experienced a modest 1% decrease in the second quarter, lot prices, especially in desirable 'A-B' locations, saw an increase of 6% year-over-year. Even in 'C-D' areas, prices rose by 4%. This resilience in land pricing is attributed to reduced construction costs, which enable builders to allocate more capital towards land acquisition, even as their overall profitability tightens. Furthermore, a persistent scarcity of developed lots continues to exert upward pressure on prices, preventing a more substantial decline in line with falling demand. This dynamic has created a disconnect between seller expectations and what builders are prepared to pay, leading to a market standoff and protracted transaction times.

Buyer Advantage and Market Adaptation Amidst Uncertainty

The current cooling trend in the land market is empowering buyers, who are now in a stronger position to negotiate more favorable terms. This newfound leverage allows for the securing of concessions such as delayed lot purchases and the restructuring of contracts to better suit current market realities. However, despite this shift, identifying bulk acquisitions that align with builders' profit requirements remains challenging, as many raw land sellers are steadfast in their pricing expectations. The market is thus characterized by a delicate balance where buyers have more influence over terms, yet significant price reductions on raw land are still uncommon, leading to an environment where strategic negotiation is paramount.

In response to the evolving market conditions, alternative investment strategies are gaining prominence. Land banking, a practice where investors acquire and hold land without immediate development, continues to expand, offering a way to manage market risk. Concurrently, build-to-rent operators are significantly increasing their presence, with their share of finished lot purchases rising from 5% to 8% within a year. This growth is partly fueled by some traditional builders stepping back from deals, creating opportunities for build-to-rent ventures. The overall slowdown in land transactions signals a potential decrease in future homebuilding activity, as builders scale back on housing starts due to elevated new-home inventories and sluggish sales. This slowdown is also anticipated to have a cascading effect on suppliers of building materials, who face a bleaker outlook as construction volumes decline.