Crude Oil Futures Surge: A Detailed Analysis of the Latest Market Trends

The oil market has been a topic of intense interest in recent times, with fluctuations in crude oil prices having a significant impact on global economies. In the latest development, crude oil futures have settled at $70.10, marking a notable increase of $0.27 or 0.39%. This article delves into the intricacies of the current market dynamics, providing a comprehensive analysis of the key factors driving the price movements and the potential implications for various stakeholders.Unlocking the Potential of the Crude Oil Market

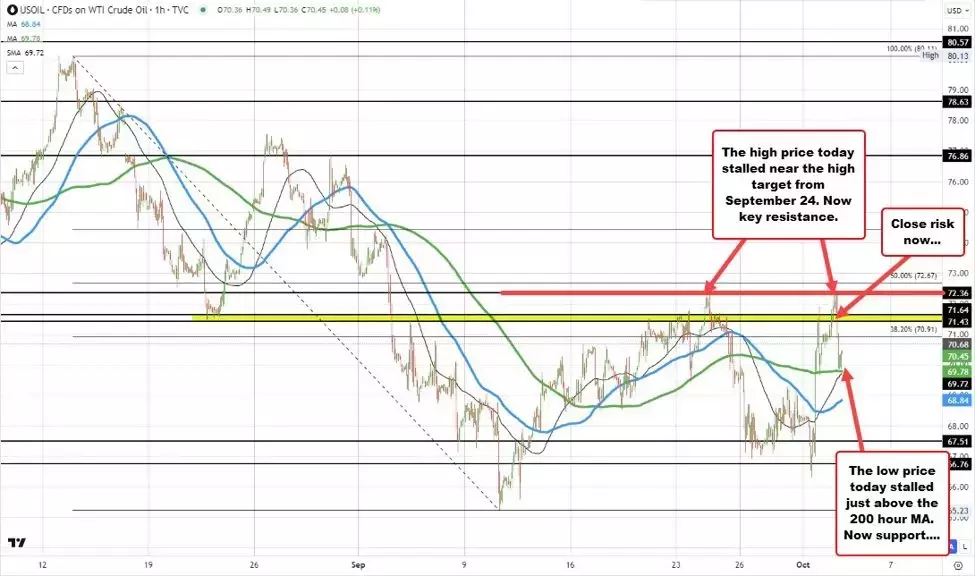

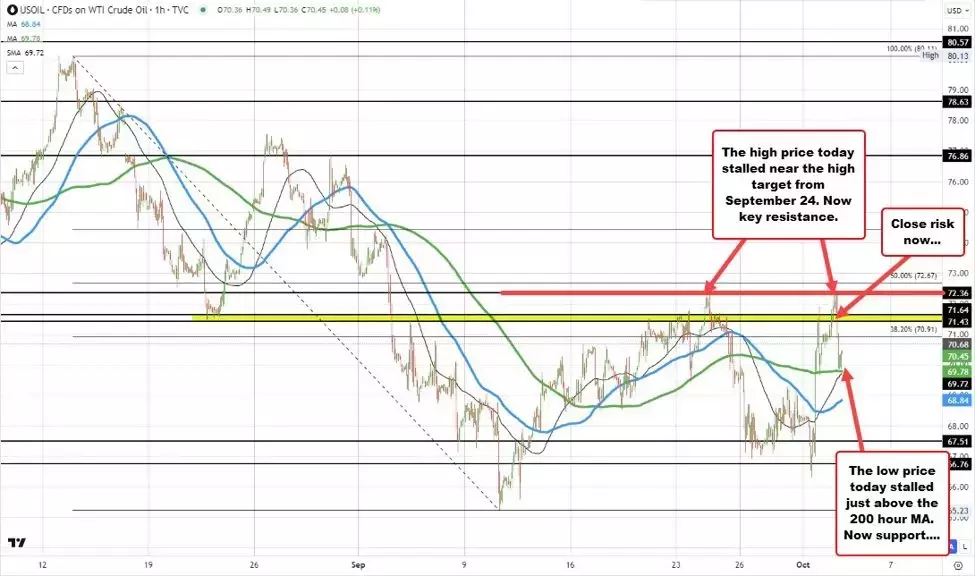

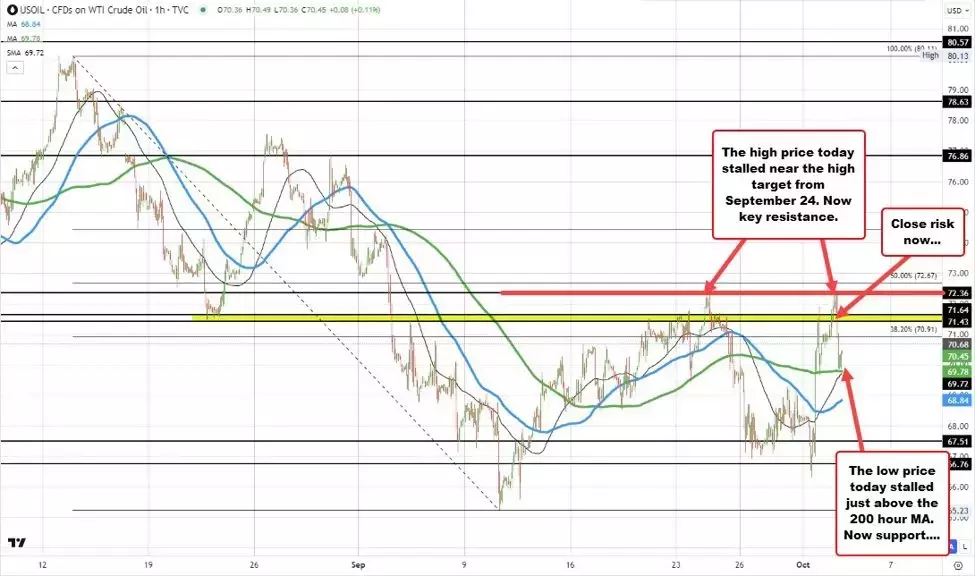

Navigating the Hourly Price Movements

The hourly chart of crude oil futures reveals an intriguing pattern. The price reached a high of $72.45 during the trading session, testing the previous high recorded on September 24th. However, the market subsequently rotated back to the downside, indicating that the previous high has now become a key resistance level. This technical observation suggests that the market is facing a critical juncture, with the potential for further price fluctuations in the near future.On the downside, the low price of $69.90 stalled just ahead of the 200-hour moving average, which is currently at $69.78. This level has now emerged as a crucial support, as the market seeks to maintain its upward momentum. The swing area between $71.43 and $71.64 also presents an important zone of interest, as it represents a potential area of consolidation or further price movements.Analyzing the Broader Market Dynamics

The current price action in the crude oil futures market must be viewed within the broader context of the global energy landscape. The 38.2% retracement of the move down from the August high comes in at $70.91, which could serve as an additional reference point for market participants. This level may act as a potential support or resistance, depending on the overall market sentiment and the interplay of various fundamental factors.It is crucial to consider the impact of geopolitical tensions, supply and demand dynamics, and the ongoing efforts to transition towards renewable energy sources. These factors can significantly influence the trajectory of crude oil prices, and market participants must remain vigilant in monitoring the evolving landscape.Implications for Stakeholders

The fluctuations in crude oil prices have far-reaching implications for various stakeholders, including consumers, producers, policymakers, and investors. Consumers may face changes in the prices of fuel and energy-related products, which can impact their overall cost of living. Producers, on the other hand, must navigate the complexities of supply and demand, adjusting their strategies to optimize profitability.Policymakers play a crucial role in shaping the energy landscape, as they must balance the need for energy security, environmental sustainability, and economic growth. Investors, both institutional and individual, closely monitor the crude oil market, as it can have a significant impact on their portfolios and investment strategies.The Road Ahead: Navigating Uncertainty and Opportunity

The crude oil market is a dynamic and ever-evolving landscape, with a multitude of factors influencing its trajectory. As the market continues to navigate the current price movements, it is essential for all stakeholders to remain vigilant, analyze the data, and make informed decisions. By understanding the technical and fundamental drivers of the market, market participants can better position themselves to capitalize on the opportunities and mitigate the risks that may arise in the future.In conclusion, the latest developments in the crude oil futures market highlight the need for a comprehensive understanding of the underlying dynamics. As the global energy landscape continues to evolve, the ability to adapt and respond to these changes will be crucial for the success of all stakeholders involved.