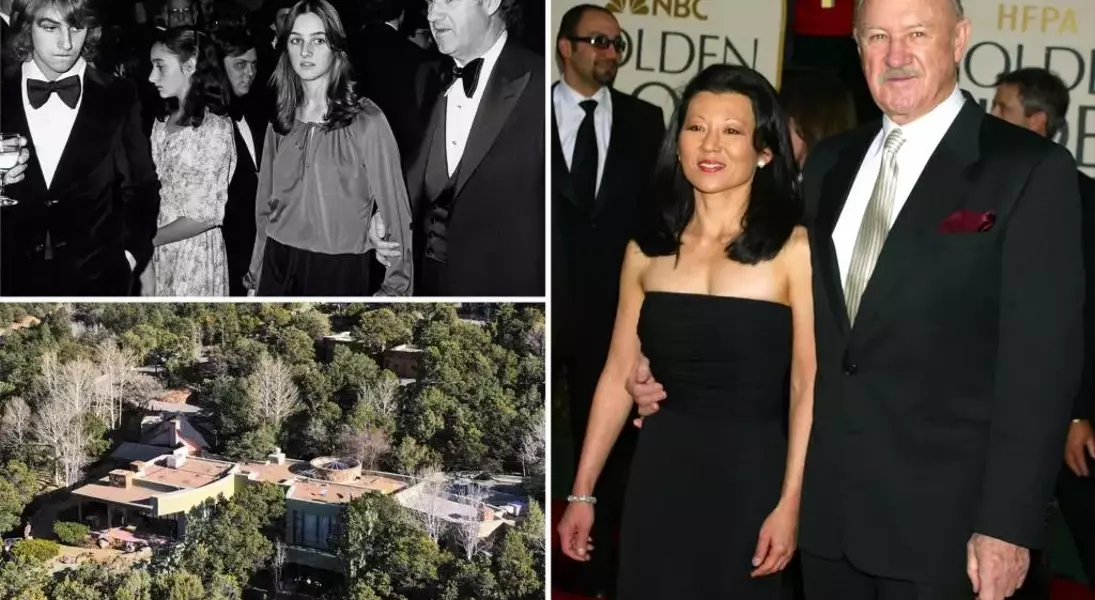

Following the unexpected demise of legendary actor Gene Hackman and his wife Betsy Arakawa, questions have arisen about the distribution of his substantial estate. Despite not being directly mentioned in his will, Hackman’s three children might still inherit his fortune through a living trust established decades ago. The terms of this trust remain undisclosed, leaving room for speculation regarding its beneficiaries. Should all named benefactors be deceased, or if certain legal conditions are met, the fortune could default to his offspring. Furthermore, an old New Mexico supreme-court ruling may provide grounds for challenging the legitimacy of the trust under specific circumstances.

The uncertainty surrounding Hackman's estate stems from both the private nature of the trust and potential legal avenues that his children could pursue. If they can demonstrate suspicious circumstances indicative of undue influence over the creation of the trust, they might succeed in having it invalidated. This involves proving factors such as weakened mental capacity at the time of drafting, lack of consideration for the bequest, unnatural dispositions, beneficiary involvement in procuring the gift, domination by the beneficiary, or secrecy concerning the document.

Potential Inheritance Through Trust Beneficiaries

Gene Hackman’s estate planning appears centered around a living trust rather than a traditional will. Established many years ago and last updated in 2005, this trust holds all his assets. Although the identities of the beneficiaries remain confidential, there is a possibility that his children—Christopher, Elizabeth, and Leslie—could benefit from it indirectly. If no other designated recipients survive, the wealth might revert to them by default.

This situation arises because trusts typically include provisions for alternative beneficiaries should primary ones predecease the settlor. While Hackman's will does not explicitly mention his children, their inclusion within these fallback clauses cannot be ruled out. Moreover, given the privacy afforded to trust agreements, details about who stands to gain remain speculative. Legal experts like Thomas Banner suggest that without public disclosure, understanding the exact distribution becomes nearly impossible. However, if all named beneficiaries are deceased, the likelihood increases that Hackman's offspring would receive portions of the $80 million.

Legal Challenges Based on Suspicious Circumstances

Beyond relying on default beneficiary structures, another avenue exists for Hackman’s children to contest the trust. A landmark New Mexico court case, Chapman v. Varela, offers precedent allowing challenges based on undue influence during the creation of testamentary documents. If evidence suggests manipulation influenced the terms of the trust, particularly involving weakened physical or mental states, random bequests, unjust property divisions, significant beneficiary participation, control exerted over the testator, or extreme secrecy, the presumption shifts toward invalidity until proven otherwise.

In applying this precedent, several elements must align for a successful challenge. For instance, demonstrating that Hackman suffered from Alzheimer’s disease at relevant times could indicate impaired judgment. Similarly, showing stark deviations from prior wills or concealment of the trust’s existence might bolster claims of improper influence. With Christopher Hackman reportedly engaging a prominent probate attorney, indications point towards potential litigation aimed at ensuring equitable treatment of the family legacy. Ultimately, resolving these disputes hinges upon thorough investigation into the facts surrounding the trust's formation and adherence to legal standards designed to protect against coercion and exploitation.