Why Transparency in Monetary Policy is Essential for Economic Stability

The Federal Reserve’s handling of tariff-related monetary policy has become a focal point of scrutiny. Despite predictions of inflationary pressures due to tariffs, empirical evidence paints a different picture. With consumer price index (CPI) figures easing down to 1.4% annually, far below the targeted 2%, one must question the validity of the Fed's assumptions. This disparity highlights an urgent need for clarity in their economic models.

Fed Leadership Under Scrutiny: A Closer Look at Powell's Influence

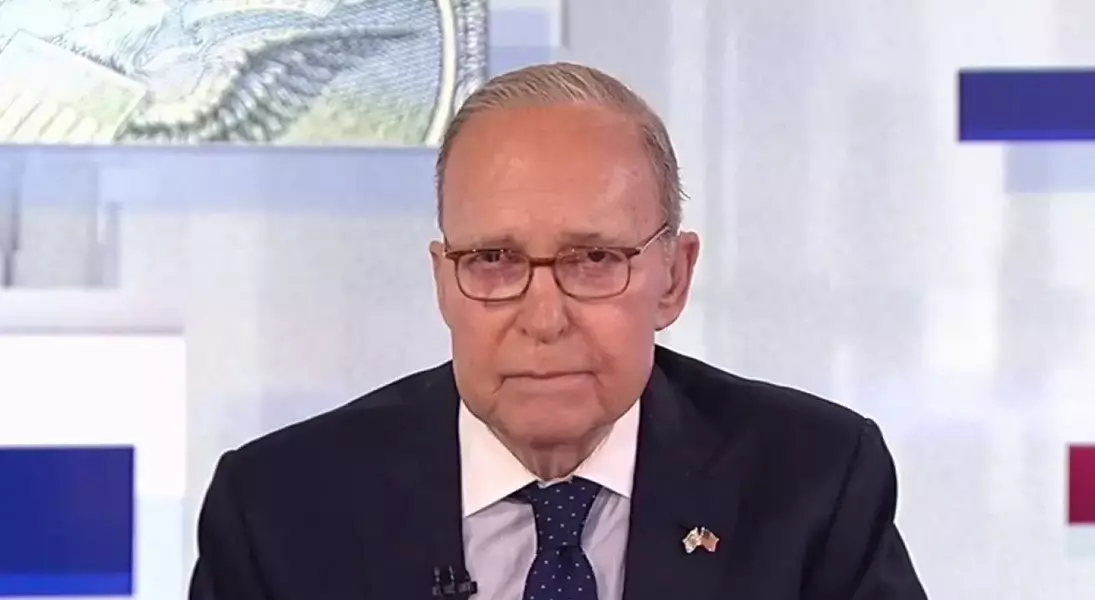

Jay Powell, while not an economist by training, wields significant influence over the Federal Reserve's direction. His decisions appear guided by a staff of economists whose models remain undisclosed. This lack of transparency fosters groupthink within the institution. President Trump's critique underscores this issue, pointing out the absence of dissenting voices among board members like Miki Bowman and Chris Waller. The absence of diverse perspectives weakens the Fed's ability to adapt effectively to changing economic conditions.

A deeper examination reveals how entrenched bureaucratic processes stifle innovation. In situations requiring nuanced approaches, such as assessing the impact of tariffs, a singular perspective can misguide policy formulation. By failing to incorporate varied viewpoints, the Fed risks undermining its credibility and effectiveness.

Economic Models: Beyond the Single Variable Approach

Historical data from President Trump's first term offers valuable insights into the multifaceted nature of economic modeling. During this period, despite imposing substantial tariffs on various goods, including steel, aluminum, solar panels, and washing machines, inflation remained remarkably stable at or below 2%. This stability was largely attributed to complementary measures like tax cuts and deregulation efforts, which stimulated business investment and productivity. These factors collectively contributed to a supply-side growth that mitigated inflationary pressures.

An academic study published by the National Bureau of Economic Research further supports this argument. It highlights how long-term capital investments, facilitated through permanent immediate cash expensing, could drive robust economic expansion without sparking inflation. Yet, there is no indication that these considerations have been integrated into the Fed's models, leaving their forecasts suspect.

Reevaluating Tariff Impacts: A Broader Perspective

Tariffs are often misunderstood as purely inflationary tools. However, when viewed holistically, they can serve strategic purposes such as reducing trade barriers and enhancing market access for domestic companies. Such measures have the potential to foster competitive environments that suppress prices rather than inflate them. Moreover, regulatory reforms introduced during the Trump administration acted as counter-inflationary forces, contributing positively to economic health.

Powell's public statements reflect a narrow understanding of tariff dynamics. Assertions like "someone has to pay" oversimplify complex economic interactions. For instance, shifts in money supply growth rates from 30% to 4% indicate reduced liquidity, countering inflationary tendencies. Additionally, consumer behavior adjustments ensure price indices remain stable even if individual item costs fluctuate. These nuances warrant comprehensive analysis absent in current Fed discourse.

Monetary Policy Oversight: Bridging the Gap Between Theory and Reality

In light of these observations, it becomes imperative to redefine the scope of monetary policy oversight. Jay Powell's role should focus exclusively on managing monetary aspects rather than venturing into trade policy realms. Clear communication regarding mortgage rates, credit card interest, and car loan impacts would restore public confidence in the Fed's stewardship.

Ultimately, fostering transparency and encouraging diverse thought within the Federal Reserve will enhance its capacity to respond adeptly to evolving economic landscapes. By integrating comprehensive models and embracing innovative perspectives, the Fed can better navigate challenges posed by tariffs and other fiscal instruments.

FEDERAL RESERVE TARIFF IMPACTS MONETARY POLICY INFLATION MODELS JAY POWELLFed Stance on TariffsLeadership Dynamics at the FedEconomic Modeling ComplexityBroader Implications of TariffsMonetary Policy Reevaluation